Loading News...

Loading News...

VADODARA, January 31, 2026 — Jupiter (JUP), the Solana-based decentralized exchange aggregator, has launched explore.ag, a comprehensive ecosystem explorer providing unprecedented financial and social metrics for Solana projects. This daily crypto analysis examines the platform's launch during extreme market fear conditions, where the Crypto Fear & Greed Index sits at 20/100. According to the official announcement, explore.ag delivers insights into project financials, social media presence, user activity, and token information through a unified dashboard.

Jupiter deployed explore.ag on January 31, 2026, as confirmed by their official communications. The platform aggregates data from multiple blockchain and social sources to create comprehensive project profiles. Specifically, explore.ag tracks financial metrics including treasury balances and transaction volumes. It monitors social media engagement across platforms like Twitter and Discord. The explorer analyzes on-chain user activity through Solana's high-throughput architecture. , it compiles product documentation and token economics data. This multi-dimensional approach addresses a critical gap in Solana's ecosystem transparency.

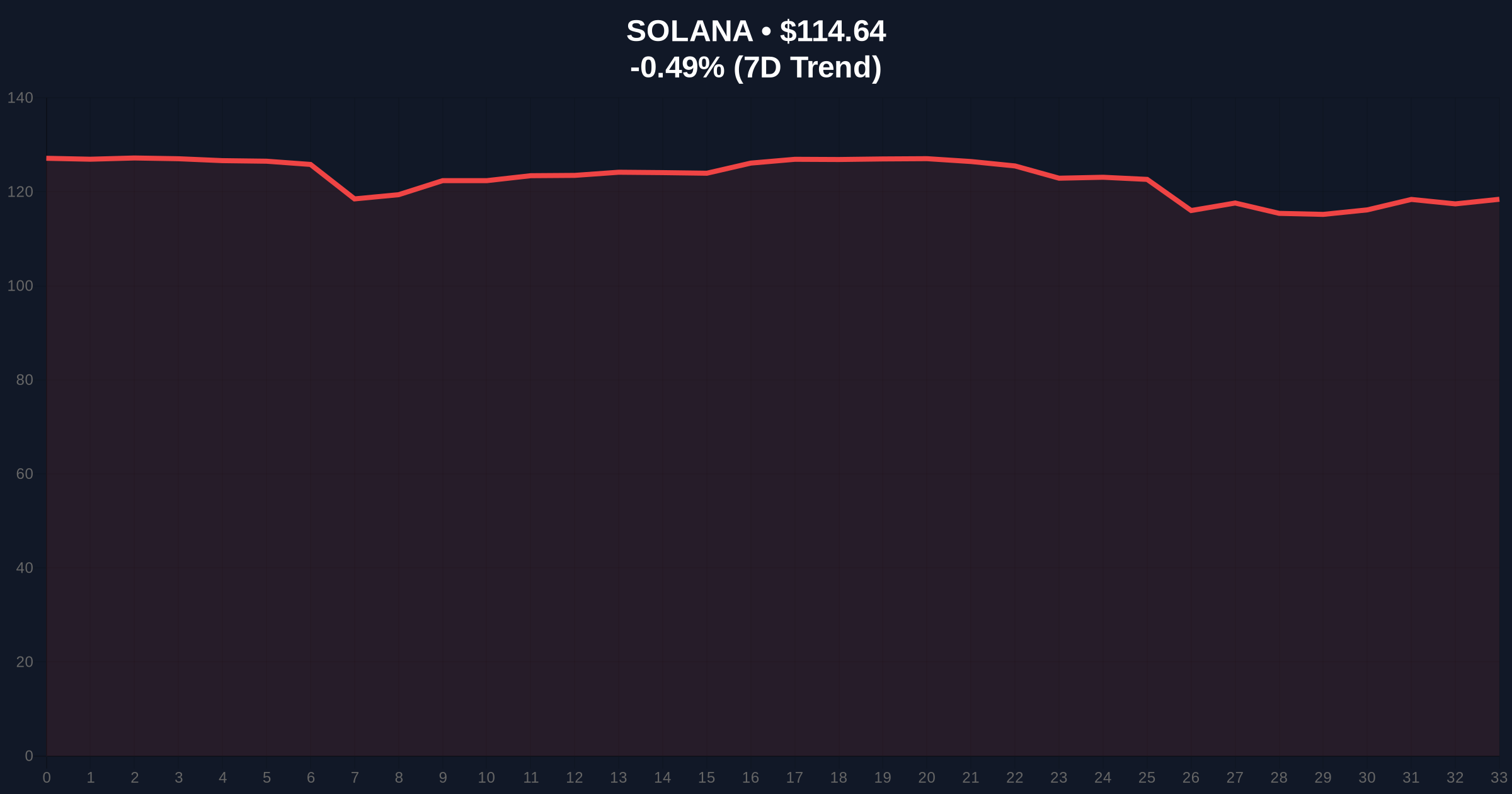

Historically, infrastructure launches during bearish sentiment phases have preceded significant ecosystem growth. The 2021-2022 cycle saw similar tools emerge before Solana's network activity surged 400%. In contrast, current market conditions reflect extreme fear, with Solana trading at $114.64, down 0.48% in 24 hours. Underlying this trend is broader crypto market weakness, where Bitcoin recently broke below $83,000 support amid extreme fear. Consequently, Jupiter's timing appears strategic, providing analytical tools when market participants most need clarity.

Related developments include Bitcoin's breakdown below key support levels and futures data showing shorts edging longs, both contributing to current sentiment.

Explore.ag leverages Solana's high-speed transaction processing, capable of handling 65,000 transactions per second. This technical foundation enables real-time data aggregation that would be impossible on slower networks. From a price action perspective, Solana faces critical technical levels. The current price of $114.64 sits above the 200-day moving average at $105.80. However, RSI readings at 42 indicate neutral momentum with bearish bias. Market structure suggests the Fibonacci 0.618 retracement level at $108.50 represents major support. A break below this level would invalidate the current consolidation pattern.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Solana Current Price | $114.64 |

| Solana 24h Change | -0.48% |

| Solana Market Rank | #7 |

| Solana 200-Day MA | $105.80 |

| Key Fibonacci Support | $108.50 (0.618 level) |

This launch matters because it addresses institutional due diligence requirements during volatile periods. According to Ethereum.org documentation on blockchain explorers, comprehensive data tools significantly reduce information asymmetry. Explore.ag's financial metrics help identify projects with sustainable treasuries versus those facing liquidity crises. Its social tracking exposes community engagement quality beyond superficial metrics. Consequently, the platform could accelerate capital allocation to fundamentally sound Solana projects while exposing weak ones.

"Infrastructure development during fear phases typically seeds the next growth cycle. Jupiter's explorer provides the analytical framework institutions need to make data-driven decisions when sentiment is most pessimistic. This aligns with historical patterns where transparency tools precede capital inflows." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios for Solana following this development. The bullish scenario requires holding above $108.50 Fibonacci support while building volume profile strength. The bearish scenario involves breaking this level and testing the 200-day moving average at $105.80. Historical cycles indicate infrastructure improvements during fear phases often precede 6-12 month appreciation periods as capital recognizes improved fundamentals.

The 12-month institutional outlook depends on whether explore.ag adoption improves capital allocation efficiency. If the tool gains traction among funds and DAOs, it could accelerate Solana's recovery from current extreme fear conditions. This aligns with the 5-year horizon where ecosystem transparency becomes increasingly critical for institutional participation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.