Loading News...

Loading News...

VADODARA, February 10, 2026 — Binance co-CEO Yi He has publicly attributed the cryptocurrency market's current stagnation to pervasive FUD (fear, uncertainty, and doubt), a sentiment echoed by the CoinMarketCap Fear & Greed Index hitting extreme fear levels. This daily crypto analysis examines the structural implications of her statement, connecting it to historical cycles and current technical degradation.

According to a statement posted on X, Yi He explicitly linked widespread FUD to dampened investor sentiment. She detailed a three-pronged impact: deterring new entrants, prompting profit-taking among existing participants, and causing early investors to consider exiting the industry. This analysis is grounded in primary data from the CoinMarketCap Fear & Greed Index, which she cited as falling between 5 and 10. Market structure suggests such levels often precede volatile price discovery phases, similar to the Q2 2021 correction.

Historically, periods of extreme fear, as defined by indices like the CMC Fear & Greed Index, have frequently marked local accumulation zones. For instance, the index dipped below 10 during the June 2022 deleveraging event, which preceded a 40% rally in total market capitalization over the following quarter. In contrast, the current environment is compounded by AI-based attack vectors, a novel factor increasing systemic skepticism. Underlying this trend, regulatory actions in other jurisdictions have exacerbated liquidity fragmentation. Related developments include the recent delisting of assets on South Korean exchanges and Bitcoin's breakdown below key psychological levels.

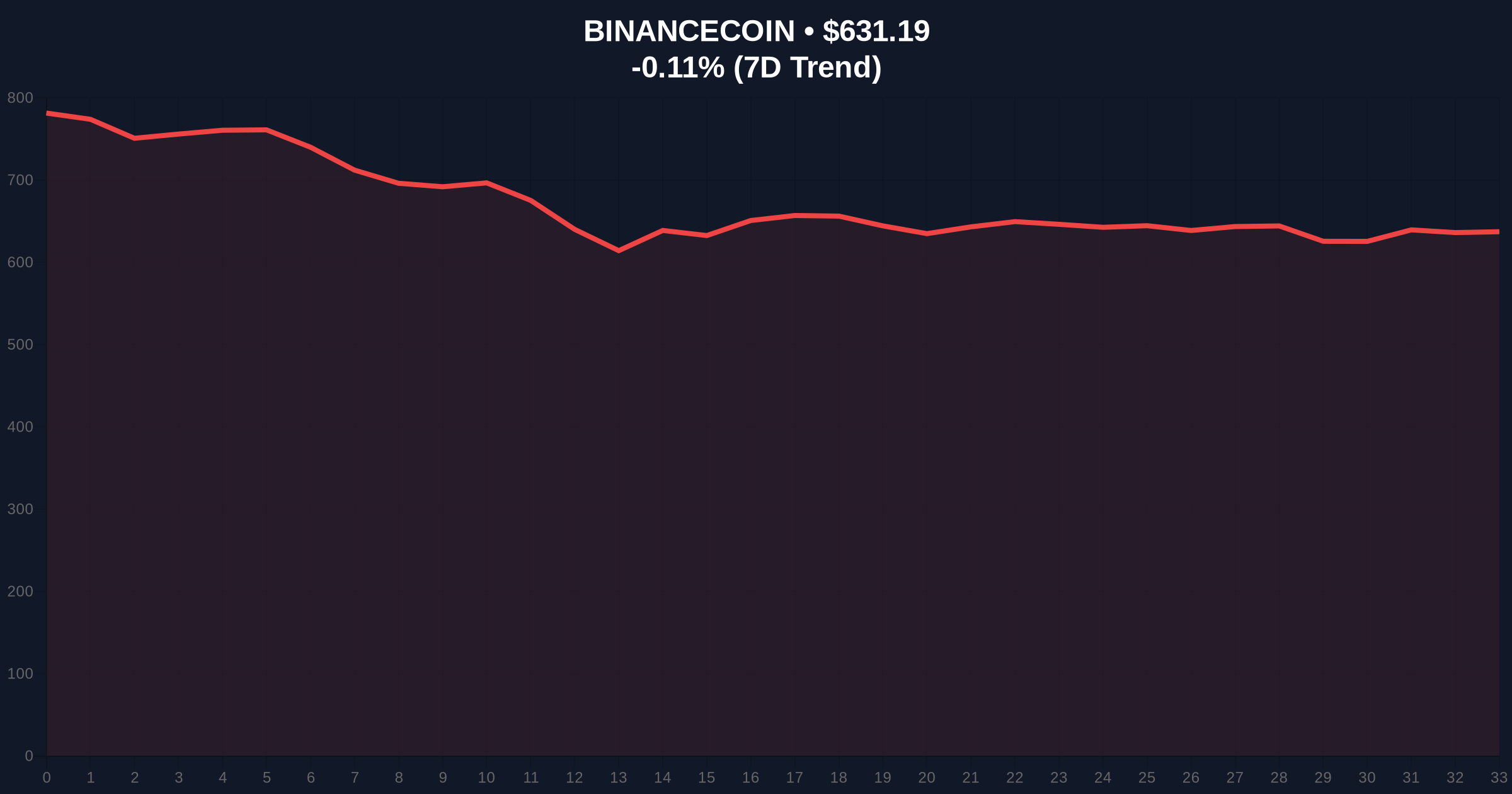

Focusing on BNB, the native asset of the Binance ecosystem, price action reveals critical technical levels. The current price of $631.19 sits near a cluster of daily moving averages, creating a confluence zone. A breakdown below the $600 support, which aligns with the 0.618 Fibonacci retracement level from the 2025 high, would invalidate the current bullish structure. Conversely, resistance is established at $680, a level that has rejected price advances three times in the past month. On-chain data from Etherscan indicates reduced network activity for BNB Chain, correlating with the sentiment downturn.

| Metric | Value | Context |

|---|---|---|

| CMC Fear & Greed Index | 9/100 (Extreme Fear) | Primary sentiment indicator cited by Yi He |

| BNB Current Price | $631.19 | 24h change: -0.11% |

| BNB Market Rank | #5 | Per CoinMarketCap live data |

| Key BNB Support | $600 | Psychological & Fibonacci 0.618 level |

| Historical Fear Bottom | June 2022 (<10) | Preceded a 40% total market cap rally |

This sentiment analysis matters because FUD directly impacts market microstructure. It creates Fair Value Gaps (FVGs) as liquidity evaporates from order books, leading to exaggerated price swings. Institutional liquidity cycles, such as those tracked by the Federal Reserve's H.4.1 report, show reduced capital inflows during fear periods, exacerbating the volatility. Retail market structure often breaks down, with stop-loss cascades becoming more frequent. The proliferation of AI-based attacks, as mentioned by Yi He, adds a layer of systemic risk not present in previous cycles, potentially altering recovery timelines.

"Extreme fear readings historically signal contrarian opportunities, but the current AI-driven FUD vector introduces unprecedented noise. Market participants should monitor on-chain metrics like MVRV-Z scores for confirmation of a true bottom, as seen in recent Ethereum data." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios for the coming weeks. A bullish resolution requires a sustained break above the $680 resistance on high volume, indicating FUD subsidence and renewed institutional interest. A bearish continuation would see a breakdown below $600, triggering a liquidity grab toward the $550 support zone. The 12-month institutional outlook hinges on regulatory clarity and technological resilience against AI threats, factors that will shape the 5-year horizon for digital asset adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.