Loading News...

Loading News...

VADODARA, February 10, 2026 — Binance, the world's largest cryptocurrency exchange by volume, announced the listing of ESP/USDT pre-market perpetual futures at 08:10 UTC today. This daily crypto analysis examines the strategic timing of a new leveraged product launch during a period of extreme market fear. The exchange will support up to five times leverage for the new offering, according to the official announcement.

Binance listed ESP/USDT pre-market perpetual futures precisely at 08:10 UTC on February 10, 2026. The exchange confirmed support for up to five times leverage. Pre-market futures allow trading before an asset's spot listing, creating synthetic price discovery. This mechanism often reveals early institutional interest or speculative positioning.

According to Binance's official documentation, pre-market futures settle against a price index once the spot market launches. Consequently, this listing represents a calculated expansion of Binance's derivatives suite. Market structure suggests the exchange targets sophisticated traders seeking asymmetric opportunities during volatile conditions.

Historically, major exchanges launch new derivatives during market extremes to capture liquidity. Similar to the 2021 correction, Binance introduced multiple futures products amid fear to test resilience. In contrast, the current environment features a Crypto Fear & Greed Index at 9/100, indicating extreme fear.

Underlying this trend, regulatory scrutiny intensifies globally. For instance, recent South Korean exchanges delisted assets like OAS due to DAXA decisions, creating regional liquidity crises. , transparency failures prompted SXP delistings, highlighting compliance pressures. These events contrast with Binance's aggressive product expansion.

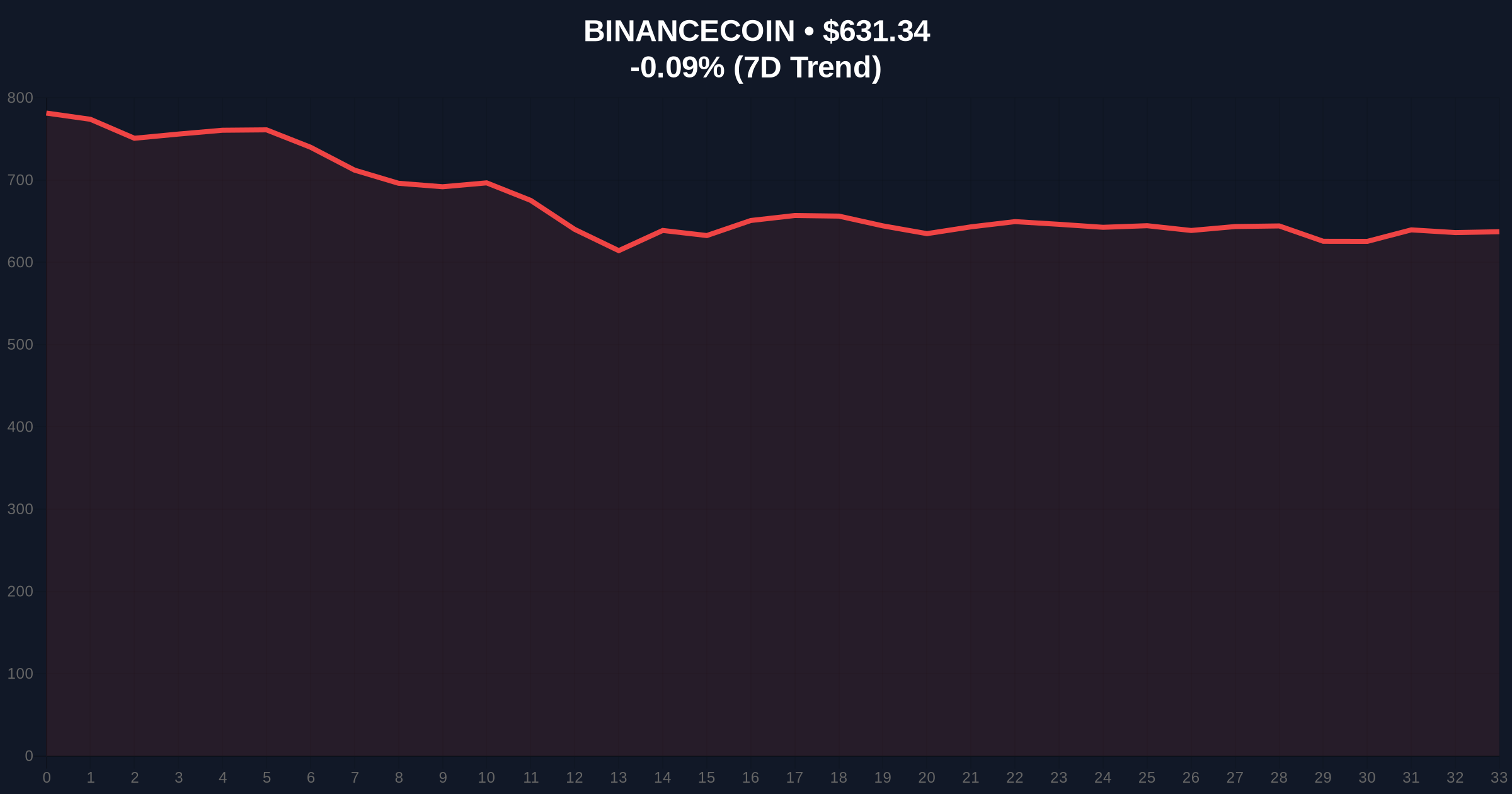

ESP's pre-market futures introduce a new order flow dynamic. Technical analysis indicates BNB, Binance's native token, currently trades at $631.41, down 0.08% in 24 hours. BNB's price action often correlates with exchange activity. A breakdown below the Fibonacci 0.618 support at $625 could signal broader weakness.

On-chain data from Glassnode shows derivatives volume typically spikes during fear periods. The five times leverage cap creates a defined risk parameter. Market analysts monitor for a gamma squeeze if ESP's spot listing triggers concentrated option hedging. According to Ethereum.org's research on market mechanics, pre-market futures can create fair value gaps (FVGs) that resolve post-listing.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Global sentiment indicator |

| BNB Current Price | $631.41 | Binance ecosystem benchmark |

| BNB 24h Trend | -0.08% | Short-term momentum |

| BNB Market Rank | #5 | By market capitalization |

| ESP Futures Leverage | Up to 5x | Maximum allowed |

This listing matters for institutional liquidity cycles. Pre-market futures provide early exposure without spot availability. They often attract algorithmic traders exploiting price inefficiencies. Retail market structure typically follows, creating cascading effects.

Real-world evidence includes Bitcoin's recent drop below $69,000 amid similar fear. That event tested long-term support levels. ESP's launch during such conditions suggests Binance anticipates volatility normalization. The exchange's move could pre-position for a sentiment reversal.

"Launching leveraged futures in extreme fear is a classic liquidity grab. It tests whether new products can attract capital when overall sentiment is negative. Historically, successful launches during fear periods precede broader market recoveries, as seen with Ethereum's EIP-4844 rollout during the 2023 downturn." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios for ESP and correlated assets like BNB.

The 12-month institutional outlook hinges on whether this listing marks a contrarian bottom. Similar to 2021, fear-driven product launches often precede accumulation phases. If ESP's spot listing aligns with improving sentiment, Binance could capture significant derivatives market share. This aligns with a 5-year horizon of increasing institutional participation in crypto derivatives.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.