Loading News...

Loading News...

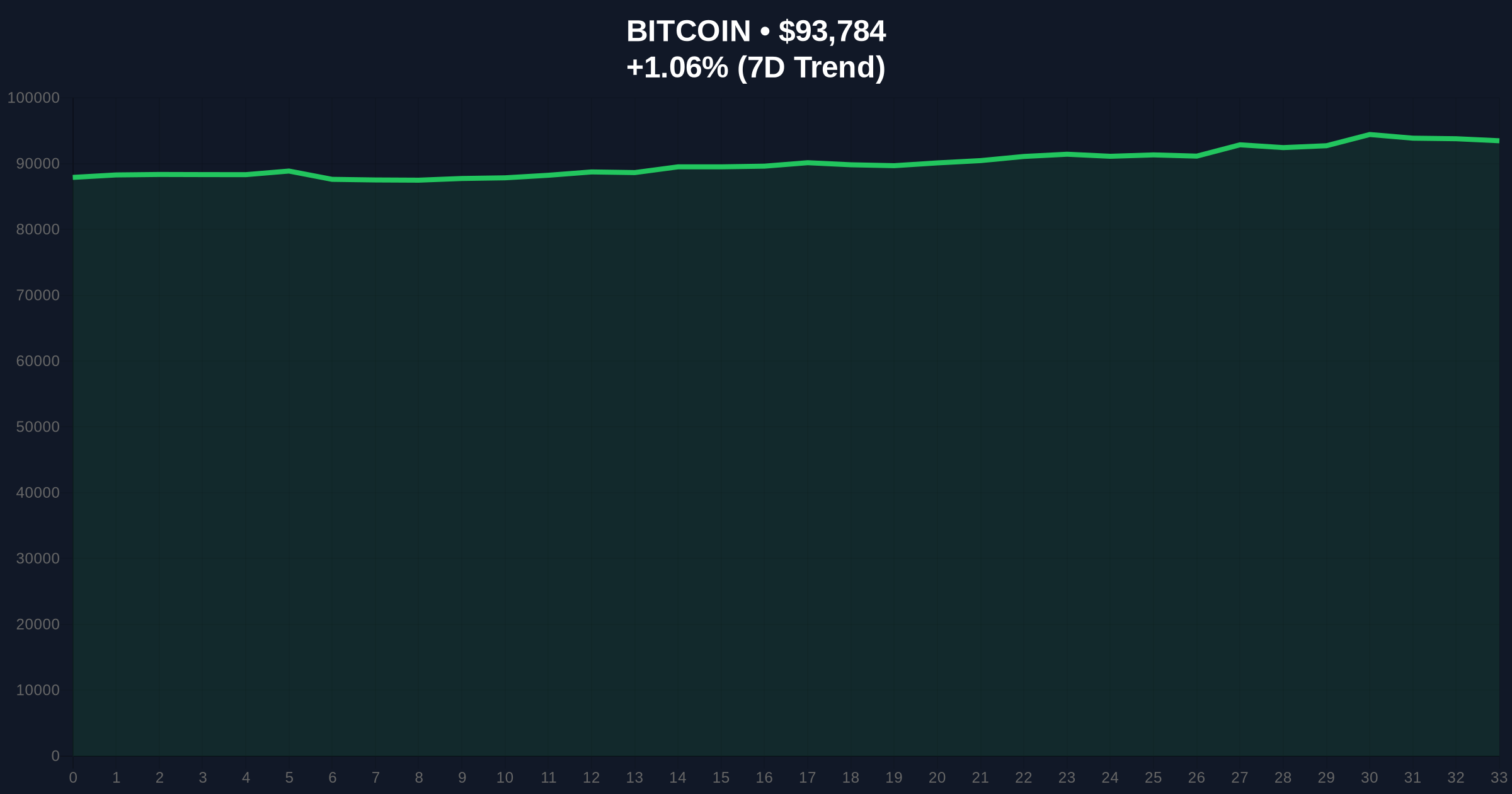

VADODARA, January 6, 2026 — According to a PR Newswire report, New York Stock Exchange-listed Hyperscale Data (GPUS) increased its Bitcoin holdings to 524.7 BTC as of January 4, marking a 16% rise of 72.7 BTC from the previous month's 452 BTC. This latest crypto news highlights continued institutional accumulation despite prevailing market fear, with Bitcoin trading at $93,810 and the Crypto Fear & Greed Index at 44/100. Market structure suggests this move aligns with the company's stated goal to accumulate BTC equivalent to 100% of its market capitalization, potentially creating a liquidity grab in the $90,000-$95,000 range.

Institutional Bitcoin adoption has accelerated since 2020, with public companies like MicroStrategy pioneering treasury reserve strategies. According to on-chain data from Glassnode, corporate Bitcoin holdings now exceed 1.5% of the total supply, creating a structural bid in the market. Hyperscale Data's accumulation mirrors this trend, occurring amid a broader market correction from all-time highs near $100,000. Underlying this trend is the increasing convergence of traditional equity and crypto markets, as seen in developments like the BitMEX Equity Perps launch. Consequently, such institutional moves often precede retail FOMO cycles, though current sentiment data indicates caution.

Per the PR Newswire report, Hyperscale Data disclosed holding 524.7 BTC as of January 4, 2026, a precise increase of 72.7 BTC from 452 BTC held in December 2025. This represents a 16% monthly accumulation rate. The company, listed on the NYSE under ticker GPUS, has publicly stated its objective to accumulate Bitcoin equivalent to 100% of its market capitalization. Market analysts interpret this as a strategic hedge against fiat inflation and a bet on Bitcoin's long-term store of value proposition. The timing coincides with Bitcoin's price consolidation between $90,000 and $95,000, suggesting accumulation during a period of relative price stability or minor dips.

Bitcoin's current price of $93,810 places it within a critical order block established during the Q4 2025 rally. The 50-day moving average at $91,500 provides immediate support, while resistance clusters near $95,000 based on volume profile analysis. RSI readings at 52 indicate neutral momentum, avoiding overbought or oversold extremes. A Fair Value Gap (FVG) exists between $88,000 and $90,000, which may attract price action if selling pressure intensifies. Bullish Invalidation is set at $90,000; a sustained break below this level would invalidate the current accumulation thesis and target the FVG. Bearish Invalidation rests at $95,500, where a breakout could trigger a gamma squeeze toward $98,000. This technical setup is complicated by broader market concerns, as highlighted in recent Glassnode data questioning bullish reversal signals.

| Metric | Value |

|---|---|

| Hyperscale Data BTC Holdings (Jan 4) | 524.7 BTC |

| Monthly Increase | 72.7 BTC (16%) |

| Bitcoin Current Price | $93,810 |

| 24-Hour Trend | +1.09% |

| Crypto Fear & Greed Index | 44/100 (Fear) |

Institutionally, this accumulation reinforces Bitcoin's role as a corporate treasury asset, similar to strategies endorsed by entities like Tesla and Square. According to the U.S. Securities and Exchange Commission (SEC) filings, public companies must disclose such holdings, increasing transparency and potentially encouraging further adoption. For retail investors, it provides a sentiment counterweight to current fear, suggesting smart money is accumulating during dips. However, the impact is nuanced: large-scale buying can create supply shocks, but it also concentrates ownership, raising questions about network decentralization. This dynamic is part of a larger trend of crypto-stock convergence, where traditional equity mechanisms increasingly interact with digital asset markets.

Market analysts on X/Twitter are divided. Bulls highlight the accumulation as a bullish signal, noting that "institutional buying during fear phases often precedes rallies." Bears caution that concentrated buying may not offset broader macroeconomic headwinds, such as potential interest rate hikes by the Federal Reserve. Some point to related risks, like the quantum computing threats to Bitcoin's supply as a long-term concern. Overall, sentiment leans cautiously optimistic, with many watching for follow-through from other institutions.

Bullish Case: If institutional accumulation continues and Bitcoin holds above $90,000, a breakout above $95,500 could target $98,000 and retest all-time highs. This scenario assumes no major regulatory shocks and sustained demand from entities like Hyperscale Data. Market structure suggests a liquidity grab above $95,000 could accelerate momentum.

Bearish Case: A break below $90,000 would invalidate the bullish thesis, potentially filling the FVG down to $88,000. This could occur if macroeconomic conditions worsen or if on-chain data, such as declining network activity, signals weakening fundamentals. In such a scenario, Bitcoin might retrace toward $85,000, aligning with the 200-day moving average.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.