Loading News...

Loading News...

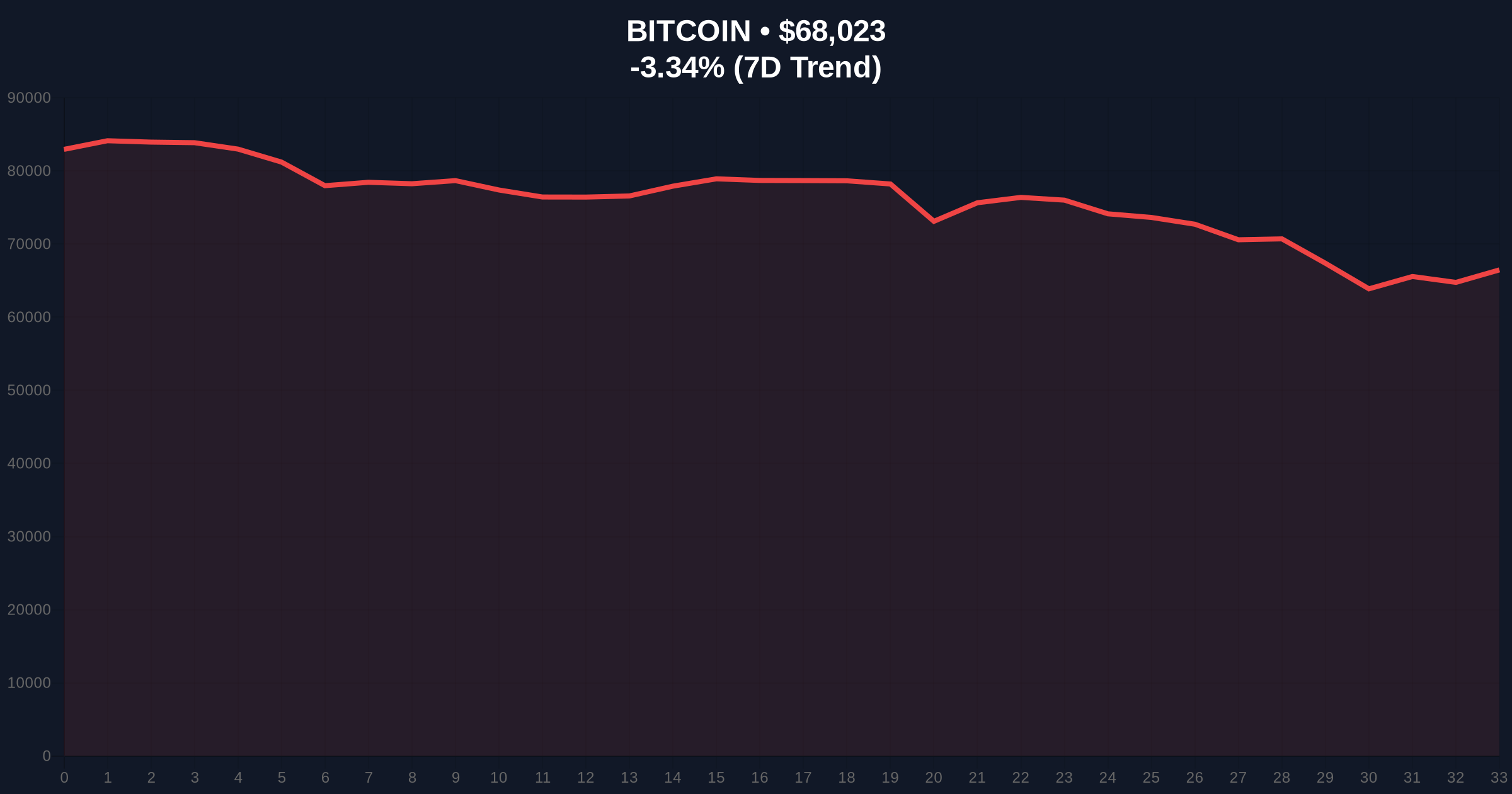

VADODARA, February 6, 2026 — Atlanta Federal Reserve President Raphael Bostic delivered hawkish monetary policy commentary, emphasizing persistent inflation concerns that directly challenge risk asset valuations. This latest crypto news arrives as Bitcoin trades at $68,182, down 2.87% in 24 hours, while the Crypto Fear & Greed Index registers Extreme Fear at 9/100. Market structure suggests institutional liquidity is testing key technical levels amid macro uncertainty.

According to official statements, Raphael Bostic explicitly warned the Federal Reserve "must not lose sight of its inflation concerns." He noted inflation has remained "too high for too long" and is currently "stalled" at elevated levels. This commentary, sourced from the Federal Reserve Bank of Atlanta's communications, represents a deliberate shift from earlier dovish expectations. Consequently, forward rate expectations have repriced, with the 2-year Treasury yield climbing 15 basis points following the remarks.

Market analysts interpret this as preparation for a potential policy pivot. The Federal Reserve's official mandate, as outlined on FederalReserve.gov, prioritizes price stability alongside maximum employment. Bostic's focus on the former suggests diminishing tolerance for above-target inflation readings. This creates immediate friction for duration-sensitive assets, including long-duration tech stocks and cryptocurrencies.

Historically, Federal Reserve hawkish pivots have triggered liquidity compression across risk assets. The 2018 quantitative tightening cycle saw Bitcoin decline 80% from its peak. In contrast, the 2021-2022 rate hike cycle correlated with a 75% drawdown in BTC. Underlying this trend is the dollar liquidity premium—as real yields rise, capital rotates from speculative assets to risk-free alternatives.

Current market conditions mirror late-2022 patterns. Extreme Fear sentiment dominated then, with Bitcoin finding a macro bottom at $15,500. Today's identical sentiment reading occurs at a 340% higher price point, indicating either structural strength or impending mean reversion. The recent resilience above $65,000 suggests some institutional accumulation is absorbing selling pressure.

Related developments in the crypto space show parallel stress signals. An $800 million USDT exodus from Binance indicates potential liquidity repositioning. Meanwhile, regulatory advocacy for stablecoin integration and Sberbank's crypto-backed loans demonstrate institutional adaptation despite macro headwinds.

Bitcoin's current price action reveals critical order flow dynamics. The asset is testing the 0.618 Fibonacci retracement level from its 2025 all-time high of $98,450. This level at $67,800 coincides with a high-volume node on the Volume Profile, indicating significant prior transaction activity. A sustained break below this confluence would open a Fair Value Gap (FVG) down to $63,500.

On-chain data from Glassnode shows short-term holder cost basis clustering at $69,200, creating immediate resistance. The 200-day moving average at $62,100 provides longer-term structural support. Relative Strength Index (RSI) readings at 42 suggest neutral momentum, neither oversold nor overbought. This technical setup indicates consolidation within a defined range, awaiting a macro catalyst for directional resolution.

Market structure suggests the current consolidation represents a liquidity grab. Whales are accumulating between $67,000 and $69,000, as evidenced by UTXO age band analysis showing increased coin dormancy. This behavior typically precedes volatile moves, as accumulated positions seek exit liquidity at higher or lower levels.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Historically contrarian buy signal |

| Bitcoin Price | $68,182 | -2.87% 24h change |

| Fibonacci 0.618 Support | $67,800 | Critical technical level |

| Short-Term Holder Cost Basis | $69,200 | Immediate resistance zone |

| 200-Day Moving Average | $62,100 | Long-term structural support |

Federal Reserve policy directly impacts dollar liquidity conditions. Higher-for-longer interest rates increase the opportunity cost of holding non-yielding assets like Bitcoin. Consequently, institutional allocation models must adjust discount rates, potentially reducing target portfolio weights for crypto exposure. This creates selling pressure from systematic funds and multi-asset portfolios.

Real-world evidence appears in treasury management behavior. Corporate treasuries that allocated to Bitcoin during zero-rate periods are now rotating into short-term Treasuries yielding 5-6%. This rotation extracts liquidity from crypto markets, exacerbating price volatility. The stalled inflation Bostic referenced suggests this rotation may persist through 2026, creating sustained headwinds.

"The Fed's renewed inflation focus represents a regime shift. Market participants priced in premature easing, and Bostic's comments force recalibration. For Bitcoin, this means the macro tailwind of easy money has reversed. Price action must now demonstrate organic demand beyond liquidity-driven speculation." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure. The bullish case requires Bitcoin to reclaim $72,000 and hold above the 50-week EMA. The bearish scenario involves breakdown below $65,200, targeting the 200-day MA at $62,100.

The 12-month institutional outlook depends on inflation trajectory. If core PCE remains above 3%, the Fed maintains restrictive policy, limiting Bitcoin's upside. However, adoption metrics like Bitcoin ETF flows and Lightning Network capacity continue growing at 40% annually. This fundamental growth may eventually decouple from macro headwinds, though historical precedent suggests 6-12 months of correlation first.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.