Loading News...

Loading News...

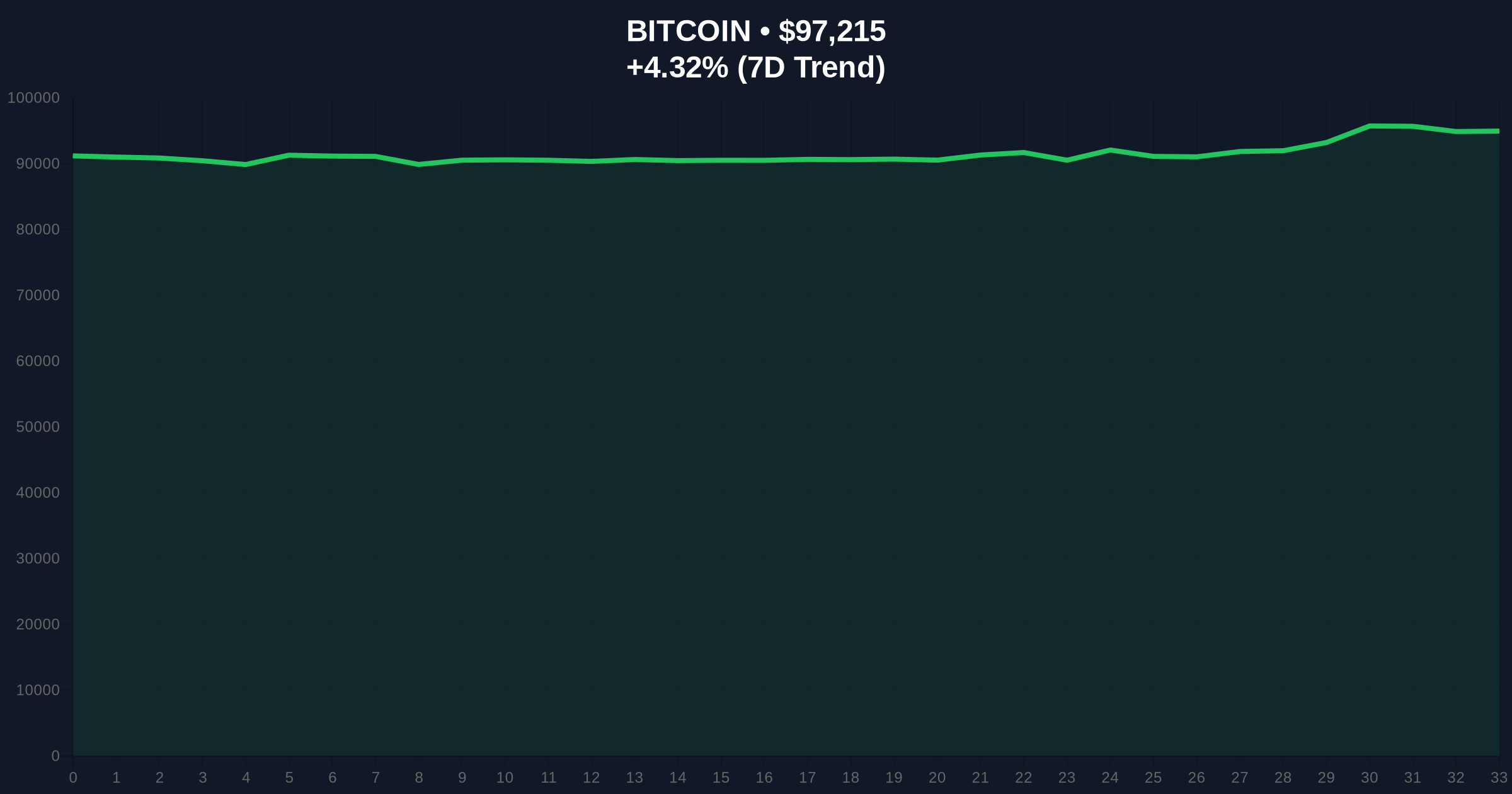

VADODARA, January 14, 2026 — Latest crypto news centers on U.S. Federal Reserve Governor Nellie Miran reiterating a call for 150 basis points in interest rate cuts this year, a move ostensibly aimed at preventing labor market weakening. Market structure suggests this dovish rhetoric is being met with institutional skepticism as Bitcoin struggles to reclaim the $97,194 level, a critical order block that has capped recent rallies. According to the official Federal Reserve statements archive, such aggressive easing proposals are rare outside recessionary environments, raising questions about data consistency.

This development occurs against a backdrop of Bitcoin testing key technical levels after a 4.29% 24-hour gain. Historical cycles suggest that Fed pivot narratives often precede liquidity grabs in crypto, but on-chain data indicates weak accumulation at current prices. The call for 150 bp cuts—equivalent to six standard 25 bp moves—contradicts recent inflation prints that remain above the Fed's 2% target, per FederalReserve.gov data. Market analysts note that similar dovish signals in 2023 led to a short-lived altcoin rally before a sharp correction, highlighting the risk of premature positioning.

Related developments include recent futures liquidations exceeding $104 million and altcoin short liquidation spikes, which suggest fragile market structure amid high leverage.

On January 14, 2026, Fed Governor Nellie Miran publicly reiterated her stance for 150 basis points of rate cuts in 2026, citing labor market concerns. According to the source report from Coinness, this is not a new position but a reinforcement of prior commentary. The announcement coincided with Bitcoin trading at $97,194, up 4.29% on the day, yet failing to sustain breaks above this level. Market structure suggests the timing is suspect, as it aligns with a test of a major liquidity pool, potentially setting up a false breakout scenario.

Bitcoin's price action reveals a clear Fair Value Gap (FVG) between $95,000 and $96,500, which may need filling before any sustained upward move. The current resistance at $97,194 acts as a significant order block, with volume profile data showing high selling pressure here. RSI readings are approaching overbought territory at 68, indicating limited near-term upside without a consolidation phase. A critical Fibonacci support level at $92,000 (61.8% retracement from the last swing high) serves as a key bearish invalidation point. Bullish invalidation is set at a break below $90,000, which would negate the higher-low structure established since December.

| Metric | Value | Implication |

|---|---|---|

| Proposed Fed Rate Cuts | 150 bps | Aggressive easing signal |

| Bitcoin Price | $97,194 | Key resistance test |

| 24-Hour Change | +4.29% | Short-term momentum |

| Crypto Fear & Greed Index | 48/100 (Neutral) | Market indecision |

| RSI (Daily) | 68 | Near overbought |

For institutions, lower rates could reduce the opportunity cost of holding non-yielding assets like Bitcoin, potentially driving inflows into spot ETFs. However, the skepticism stems from the disconnect between Miran's call and robust employment data, suggesting political or structural pressures may be at play. Retail traders face heightened volatility risk, as premature long positioning based on Fed narratives could lead to liquidation events if the $97,194 resistance holds. The broader impact hinges on whether this rhetoric translates into actual policy, as past Fed communication has often been walked back.

Market analysts on X/Twitter are divided. Bulls argue that rate cuts would weaken the dollar, boosting crypto as a hedge, with one noting, "Liquidity injections could fuel the next leg up." Bears counter that the labor market justification seems contrived, with a skeptic posting, "This feels like a narrative pump to distract from overbought conditions." On-chain data indicates large holders are not accumulating aggressively at current levels, suggesting institutional wait-and-see posture.

Bullish Case: If Bitcoin breaks and holds above $97,194 with strong volume, and the Fed follows through on cuts, a rally toward $105,000 is plausible. This scenario assumes a successful retest of the breakout level as support and reduced selling pressure from miners post-halving.

Bearish Case: If resistance holds and the Fed backtracks, a pullback to fill the FVG at $95,000-$96,500 is likely, with further downside to $92,000 if macroeconomic data contradicts dovish signals. This would invalidate the bullish structure and trigger stop-loss cascades.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.