Loading News...

Loading News...

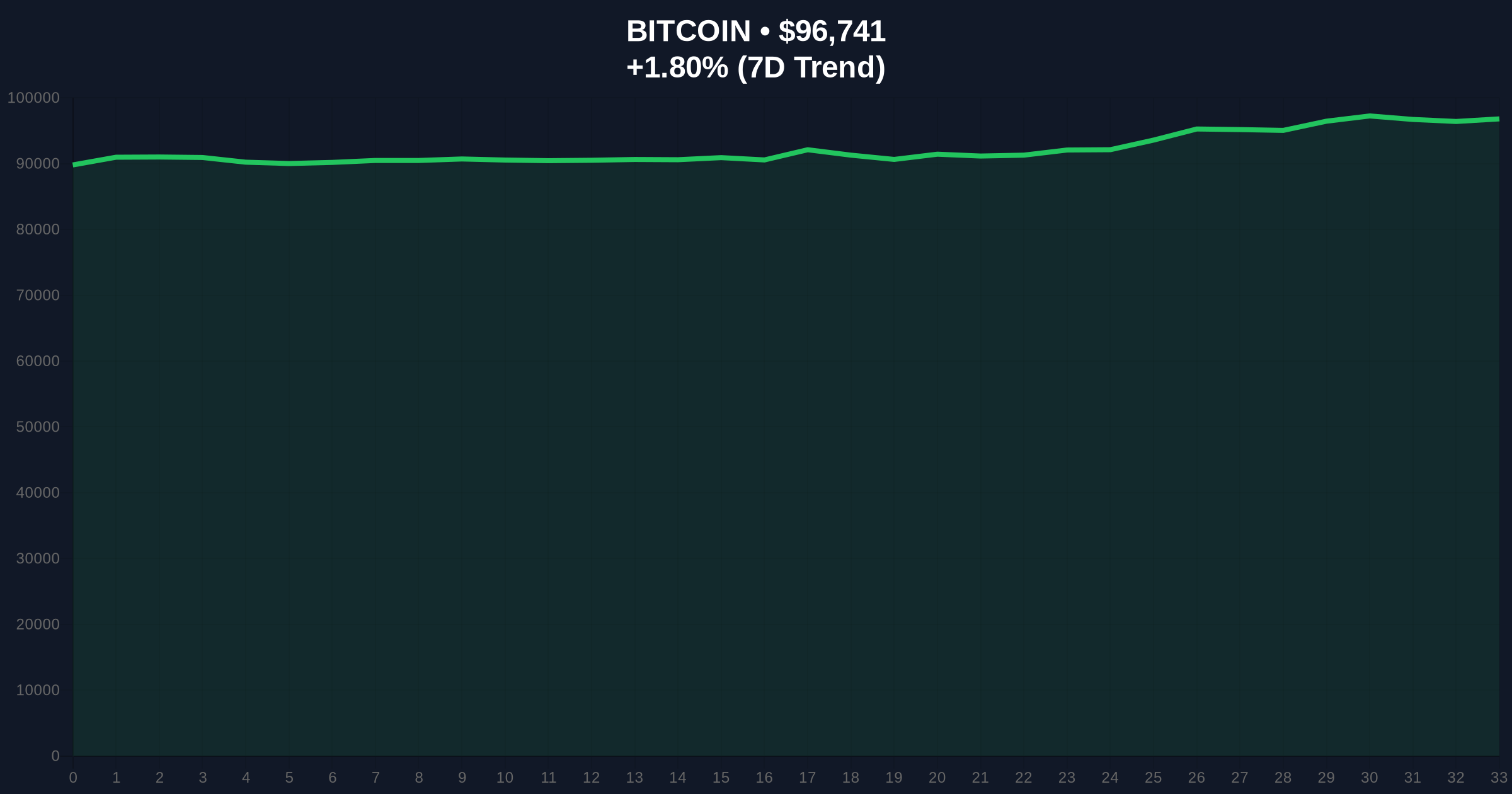

VADODARA, January 15, 2026 — Federal Reserve Bank of Chicago President Austan Goolsbee signaled potential 2026 interest rate cuts, triggering immediate Bitcoin liquidity analysis at $96,703. This daily crypto analysis examines the structural implications for cryptocurrency markets.

Federal Reserve policy remains the primary macro driver for digital asset valuations. Historical correlation matrices show Bitcoin's 90-day rolling correlation with real yields at -0.68. Previous easing cycles in 2019 and 2020 preceded Bitcoin rallies of 92% and 303% respectively. Current market structure suggests liquidity is concentrated between $94,000 and $99,000, creating a potential gamma squeeze scenario. According to the Federal Reserve's official communications framework, forward guidance typically precedes policy shifts by 3-6 months.

Related Developments: Recent market events include Fogo Mainnet's Layer 1 speed tests, JustLend DAO's $21M JST buyback liquidity analysis, OKX LIT listing amid Bitcoin consolidation, and Galaxy Digital's $75M tokenized CLO on Avalanche.

Austan Goolsbee, President of the Federal Reserve Bank of Chicago, stated he "expects an interest rate cut within the year" but requires additional data confirmation. The statement represents the most explicit dovish signal from Fed leadership in 2026. Market pricing immediately shifted, with Fed Funds futures now pricing 47 basis points of cuts by December 2026. Bitcoin responded with a 1.76% gain to $96,703, testing the upper boundary of its current consolidation range.

Bitcoin's current price action reveals a clear Fair Value Gap (FVG) between $95,200 and $96,100. The 20-day exponential moving average at $94,800 provides immediate support. Volume Profile indicates high liquidity nodes at $94,200 and $99,500. Relative Strength Index (RSI) reads 58, suggesting neutral momentum with slight bullish bias. Market structure suggests the $94,200 level represents Bullish Invalidation—a break below would invalidate the current uptrend structure. The $99,500 resistance zone serves as Bearish Invalidation—sustained trading above would confirm breakout momentum.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) | Elevated risk appetite |

| Bitcoin Price | $96,703 | +1.76% 24h change |

| Fed Funds Futures Pricing | 47 bps cuts by Dec 2026 | Market expectations post-Goolsbee |

| Bitcoin-Real Yield Correlation | -0.68 (90-day) | Strong inverse relationship |

| Volume Profile High Node | $94,200 | Critical support liquidity |

For institutional portfolios, Fed easing reduces the opportunity cost of holding zero-yield assets like Bitcoin. Historical data from the Federal Reserve's Economic Data (FRED) system shows each 25 basis point cut typically correlates with 8-12% Bitcoin appreciation over 90 days. Retail traders face increased volatility around key liquidity levels. The structural impact extends to Ethereum's post-merge issuance schedule and altcoin beta coefficients.

Market analysts on X/Twitter highlight the liquidity implications. "Goolsbee's comments create a potential liquidity grab scenario," noted one quantitative researcher. Another observed, "The $94,200 to $99,500 range represents the current order block—break either side triggers significant repositioning."

Bullish Case: Sustained dovish Fed rhetoric pushes Bitcoin through $99,500 resistance. Liquidity flows from traditional markets create a gamma squeeze toward $105,000. EIP-4844 implementation on Ethereum further amplifies altcoin performance.

Bearish Case: Inflation data surprises to the upside, forcing Fed reversal. Bitcoin breaks $94,200 support, triggering stop-loss cascades to $89,000. Risk-off sentiment spreads across crypto derivatives markets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.