Loading News...

Loading News...

VADODARA, January 12, 2026 — The latest crypto news reveals a significant distribution event as a whale who accumulated 101,000 Ethereum (ETH) five years ago at an average price of $660 has deposited the final 26,000 tokens to Bitstamp exchange, according to on-chain data reported by AmberCN. This transaction, worth $80.88 million, completes the transfer of the entire original holding to exchanges, realizing a total profit of approximately $269 million. Market structure suggests this systematic liquidation coincides with deteriorating market conditions and raises questions about institutional positioning ahead of potential macroeconomic shifts.

This whale's exit pattern mirrors distribution phases observed during previous market cycles, particularly the 2021-2022 correction when long-term holders began profit-taking near all-time highs. The timing is notable given current macroeconomic uncertainty, including the Federal Reserve Chair Powell investigation that has injected volatility into risk assets. According to Ethereum's official documentation on network upgrades, the transition to proof-of-stake via The Merge was designed to reduce sell pressure from miners, yet on-chain data indicates persistent distribution from early accumulators. The complete transfer of 101,000 ETH to exchanges represents a liquidity grab that could absorb buy-side orders and create downward pressure on price action.

Four hours prior to this analysis, the whale deposited 26,000 ETH to Bitstamp, as confirmed by AmberCN's on-chain intelligence. This follows a pattern of gradual transfers over recent weeks, culminating in the full 101,000 ETH position being moved to exchange wallets. The original accumulation occurred approximately five years ago at an average entry of $660, representing a cost basis of roughly $66.66 million. With Ethereum currently trading at $3,101.29, the unrealized gain was approximately $246.5 million before transfers began. The realized profit of $269 million suggests some trading activity occurred during the holding period. This behavior contrasts with recent staking activity by Bitmine-linked addresses, indicating divergent institutional strategies.

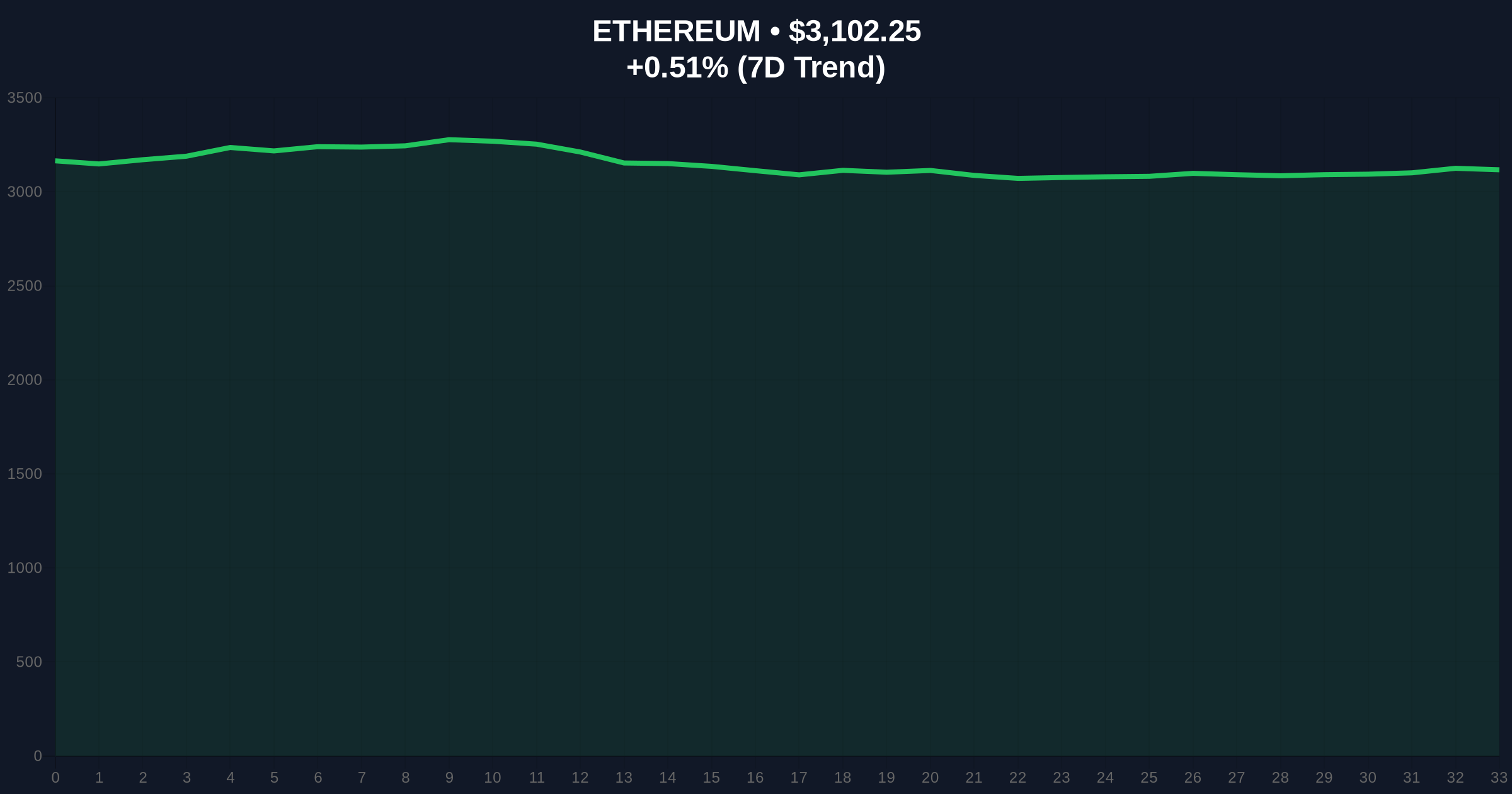

Ethereum's price action shows a clear fair value gap (FVG) between $3,050 and $3,150 that formed during last week's volatility. The current price of $3,101.29 sits within this zone, suggesting potential for a fill. The volume profile indicates weak support below $3,000, with significant liquidity pools forming around $2,950 (the 0.618 Fibonacci retracement level from the 2024 low). The 50-day moving average at $3,210 acts as dynamic resistance, while the 200-day moving average at $2,890 provides longer-term support. RSI readings at 42 suggest neutral momentum with bearish bias. Bullish invalidation occurs if price breaks and closes below the $2,950 Fibonacci support. Bearish invalidation requires a sustained break above the $3,350 order block that formed in December 2025.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) |

| Ethereum Current Price | $3,101.29 |

| 24-Hour Price Change | +0.56% |

| Whale Deposit Amount | 26,000 ETH ($80.88M) |

| Total Whale Profit Realized | $269 million |

| Original Accumulation Price | $660 (avg) |

For institutional portfolios, this exit signals potential distribution from sophisticated capital that entered during the 2020-2021 accumulation phase. The complete transfer to exchanges increases available supply during a period of market structure weakness, potentially exacerbating downward pressure. Retail investors face increased volatility as large sell orders can trigger stop-loss cascades. The timing aligns with broader macroeconomic uncertainty, including potential shifts in Federal Reserve policy that could impact risk asset correlations. According to historical cycles, whale distribution at these levels often precedes corrective phases of 20-30% in Ethereum's price over subsequent months.

Market analysts on X/Twitter express concern about the systematic nature of this exit. One quantitative trader noted, "Complete distribution of a five-year position during fear sentiment suggests this whale sees limited upside in the near term." Others point to the Powell investigation creating market structure uncertainty that may be driving risk-off behavior. Bulls counter that Ethereum's fundamental improvements, including EIP-4844 proto-danksharding implementation, create long-term value regardless of short-term whale activity. However, the prevailing sentiment remains cautious, with many awaiting confirmation of support holds before establishing new positions.

Bullish Case: If Ethereum holds the $2,950 Fibonacci support and absorbs the whale's selling pressure, a rebound toward $3,500 is possible by Q2 2026. This scenario requires sustained network activity growth and resolution of macroeconomic uncertainties. Reduced sell pressure from other long-term holders would confirm accumulation at current levels.

Bearish Case: Failure to hold $2,950 support could trigger a liquidation cascade toward the $2,600 region (the 0.786 Fibonacci level). Continued whale distribution combined with worsening Federal Reserve monetary policy conditions could extend the correction through mid-2026. This would invalidate the current bullish market structure and require reassessment of long-term trend assumptions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.