Loading News...

Loading News...

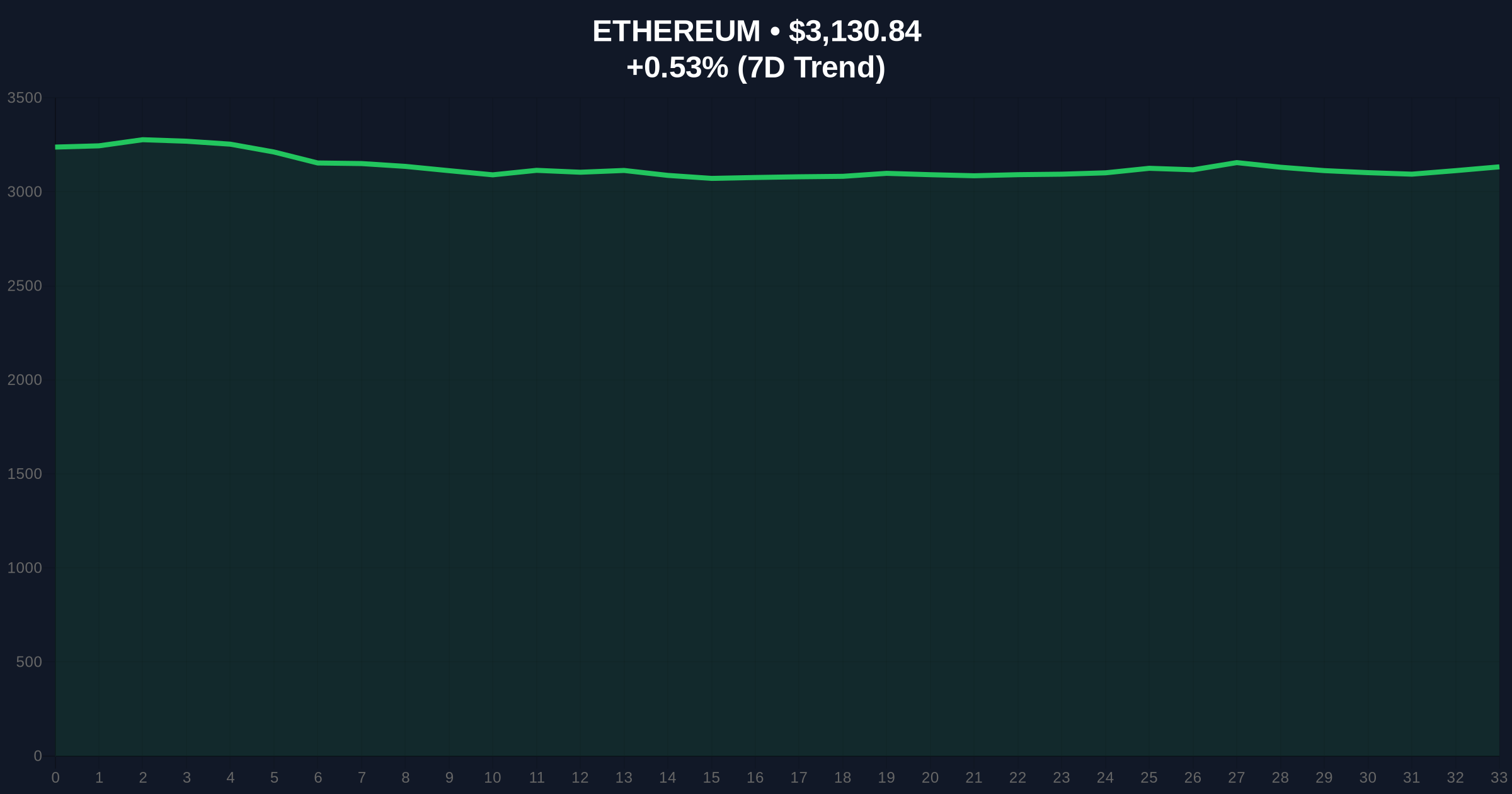

VADODARA, January 13, 2026 — An Ethereum whale address executed a $4.1 million purchase of 1,299.6 ETH from OKX at an average price of $3,129, according to on-chain analyst ai_9684xtpa. This transaction, occurring in a market characterized by fear, marks the whale's first acquisition in one week and continues a consistent accumulation pattern initiated on December 5, 2025. The address now holds 51,451 ETH valued at $161 million, providing a critical data point for daily crypto analysis of Ethereum's underlying demand structure.

Market structure suggests whale accumulation during periods of fear often precedes significant price reversals. This mirrors patterns observed in late 2023, where large-scale accumulation below $2,000 preceded Ethereum's rally toward $4,000. Underlying this trend is the shift in Ethereum's monetary policy post-merge, reducing issuance and creating a deflationary pressure that long-term holders capitalize on during dips. According to on-chain data from Glassnode, similar accumulation phases have historically aligned with local bottoms in the Volume Profile, indicating smart money positioning. Related developments include JPMorgan's hawkish rate forecast impacting crypto volatility and Tom Lee's 2027 bull market prediction for Ethereum, which contextualize this whale activity within broader macroeconomic and institutional narratives.

On January 13, 2026, at approximately 10:10 AM UTC, the whale address 0x7a9... (identified by ai_9684xtpa) withdrew 1,299.6 ETH from OKX. The transaction was executed at an average price of $3,129, totaling $4,067,068. This purchase follows a one-week pause in activity, breaking a pattern of near-daily accumulations since December 5, 2025. Consequently, the address's total holdings now stand at 51,451 ETH, with a market value of $161 million at current prices. According to Etherscan, the address has maintained a holding period exceeding 30 days for previous acquisitions, suggesting a long-term investment horizon rather than short-term speculation.

Ethereum's price action currently trades at $3,130.94, with a 24-hour trend of 0.54%. Market structure indicates a critical support zone between $3,050 and $3,100, corresponding to a previous Order Block from early January 2026. The Relative Strength Index (RSI) sits at 42, showing neutral momentum without oversold conditions. A 50-day moving average at $3,200 acts as immediate resistance, while the 200-day moving average at $2,950 provides secondary support. On-chain data indicates that whale accumulation at these levels often fills Fair Value Gaps (FVGs) created during rapid sell-offs, potentially signaling a Liquidity Grab from retail panic. Bullish Invalidation is set at $3,050, where a break below would invalidate the accumulation thesis and target $2,900. Bearish Invalidation is at $3,250, above which a Gamma Squeeze could accelerate toward $3,500.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) |

| Ethereum Current Price | $3,130.94 |

| 24-Hour Price Change | 0.54% |

| Whale Purchase Amount | 1,299.6 ETH ($4.1M) |

| Total Whale Holdings | 51,451 ETH ($161M) |

This accumulation matters because it provides a counter-narrative to retail fear, indicating institutional or sophisticated investor confidence in Ethereum's fundamentals. For institutions, whale activity serves as a leading indicator of price stability, often preceding inflows into Ethereum-based financial products like ETFs. For retail, it highlights the importance of monitoring on-chain metrics over sentiment-driven headlines. The transaction's timing during a fear phase suggests accumulation at discounted levels, aligning with historical patterns where whale buying pressure catalyzes reversals. According to Ethereum.org's documentation on network security, large holder consolidation can reduce exchange supply, decreasing sell-side pressure and supporting long-term price appreciation.

Market analysts on X/Twitter have noted the whale's consistency, with one stating, 'Accumulation during fear phases is textbook smart money behavior.' Bulls argue this signals a local bottom, while bears caution that macroeconomic headwinds, such as interest rate forecasts, could override on-chain signals. The overall sentiment remains cautious, reflecting the broader Fear & Greed Index score of 26.

Bullish Case: If Ethereum holds above $3,050, whale accumulation could drive a rally toward $3,500 by Q1 2026, fueled by reduced exchange supply and positive developments like EIP-4844 implementation. Market structure suggests a breakout above $3,250 would trigger a Gamma Squeeze, accelerating gains.

Bearish Case: A break below $3,050 would invalidate the bullish thesis, targeting $2,900 and potentially $2,700 if macroeconomic conditions worsen. Bearish invalidation at $3,250 remains critical for short-term momentum.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.