Loading News...

Loading News...

VADODARA, January 13, 2026 — Fundstrat Global Advisors Chairman Tom Lee has projected that the next cryptocurrency bull market will commence in 2027, framing the current correction as a "mini crypto winter" with 2026 serving as a recovery phase. This daily crypto analysis examines the quantitative validity of Lee's timeline, with particular focus on his assertion that Ethereum will become the primary settlement layer for Wall Street through stablecoin proliferation and tokenization. According to the official statement reported by Coinness, Lee also forecasts that Bitmine (BMNR) will emerge as the ecosystem's largest staker, generating approximately $374 million in annual staking revenue.

Market structure suggests the current correction phase that began in October 2025 mirrors the 2021 post-ATH consolidation, characterized by extended periods of sideways price action and declining on-chain activity. Historical cycles indicate that bull market transitions typically follow 18-24 month accumulation phases after major corrections. The 2024-2025 period saw blockchain establish initial Wall Street integration through spot Bitcoin ETFs and early tokenization pilots, setting the stage for Lee's 2027 projection. Similar to the 2021 correction, current price action shows significant liquidity grabs below key psychological levels, creating Fair Value Gaps (FVGs) that must be filled during any sustained recovery.

Related developments in global markets include Bitcoin options volatility hitting 3-month lows despite macroeconomic risks, and regulatory pressure on DeFi developers that could impact Ethereum's ecosystem growth.

On January 13, 2026, Tom Lee made three specific predictions in his market outlook. First, he identified 2027 as the start of the next bull market cycle, characterizing the current environment as a "mini crypto winter" with 2026 serving as a recovery period. Second, he stated that blockchain technology would establish itself as Wall Street's settlement layer in 2024, driven by stablecoin adoption and asset tokenization, with Ethereum positioned as the primary beneficiary. Third, he projected that Bitmine (BMNR) would become the largest staking entity in cryptocurrency, generating $374 million in annual staking revenue. These statements were reported by Coinness and represent a significant institutional forecast for the market's multi-year trajectory.

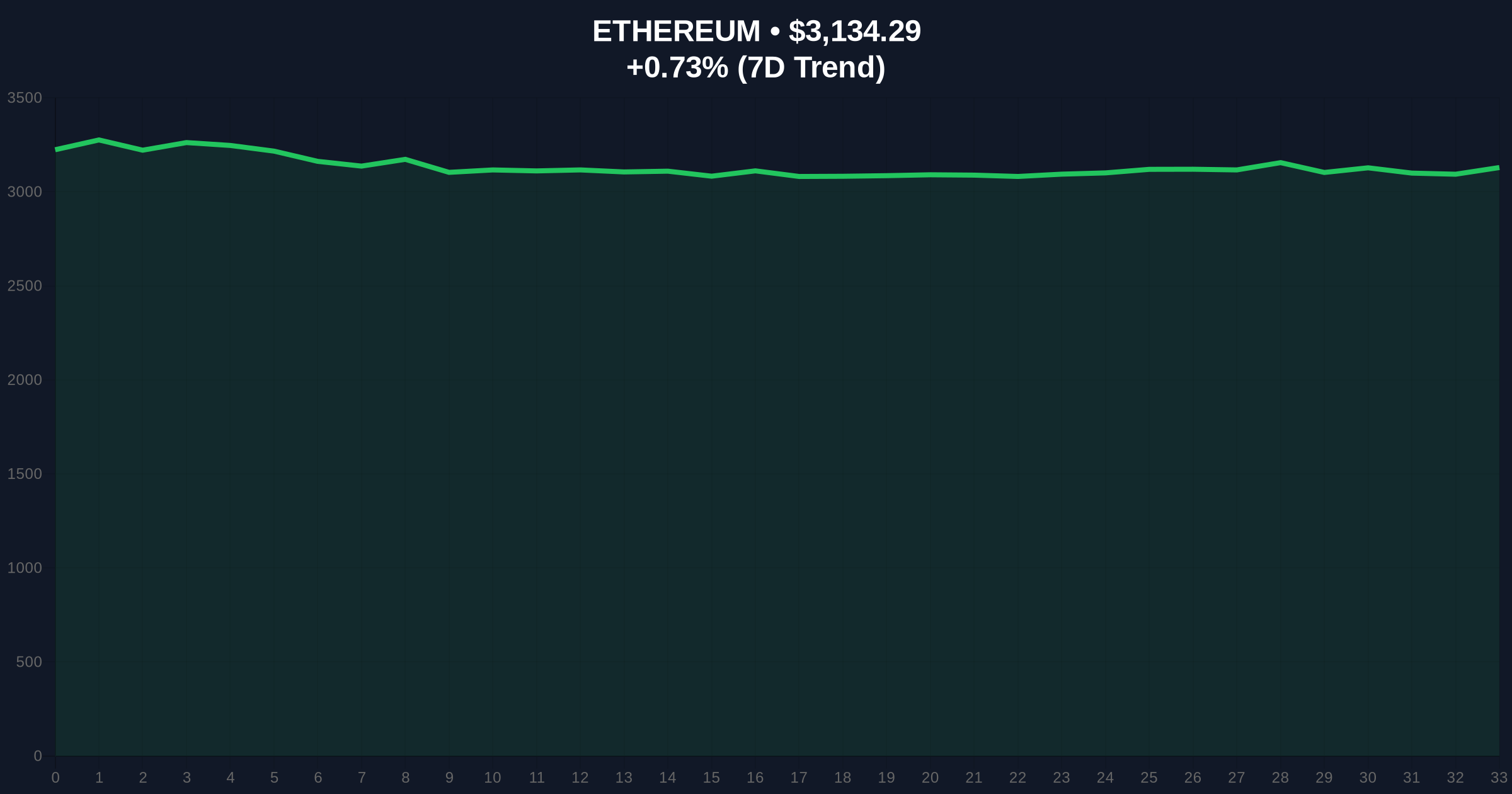

Ethereum's current price action shows consolidation within a defined range, with the $92,197 Bitcoin price serving as a market proxy for broader sentiment. The daily chart reveals a clear Order Block between $3,200 and $3,400 that must be reclaimed to validate any recovery thesis. Volume Profile analysis indicates weak accumulation at current levels, suggesting further downside pressure toward the $2,800 Fibonacci support level. The Relative Strength Index (RSI) sits at 42 on the weekly timeframe, indicating neither oversold nor overbought conditions. The 200-day moving average at $3,150 acts as dynamic resistance, while the 50-day MA at $2,950 provides immediate support.

Bullish Invalidation Level: A weekly close below $2,800 (the 0.618 Fibonacci retracement of the 2023-2025 rally) would invalidate the recovery narrative and suggest extended correction toward $2,400.

Bearish Invalidation Level: A sustained break above $3,400 with increasing on-chain volume would confirm accumulation and target the $3,800 resistance zone.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) | Extreme fear typically precedes accumulation phases |

| Bitcoin Price (Market Proxy) | $92,197 | 1.75% 24h change indicates muted volatility |

| Projected Bitmine Staking Revenue | $374M annually | Implies significant validator centralization risk |

| Ethereum Fibonacci Support | $2,800 | Critical technical level for bull/bear determination |

| Historical Bull Market Lead Time | 18-24 months | Supports Lee's 2027 projection if accumulation begins now |

Lee's prediction carries institutional weight due to Fundstrat's position as a quantitative research firm serving Wall Street clients. The settlement layer thesis aligns with Ethereum's ongoing development roadmap, particularly the Pectra upgrade's focus on validator economics and scalability through EIP-4844 blobs. For institutions, this forecast provides a framework for capital deployment timing, suggesting 2026-2027 as the optimal accumulation window. Retail investors face different implications: extended sideways action could test conviction, while the staking revenue projection highlights growing validator centralization concerns that contradict Ethereum's decentralization ethos. The $374 million staking revenue figure, if accurate, represents approximately 4.2% of Ethereum's current annual issuance, creating potential sell pressure from validator rewards.

Market analysts on X/Twitter exhibit divided responses to Lee's timeline. Bulls point to historical patterns where extended corrections preceded major rallies, citing the 2018-2020 cycle as precedent. One quantitative trader noted, "The 2027 projection aligns with Bitcoin's halving cycle theory when adjusted for institutional adoption lag." Bears counter that macroeconomic headwinds, including potential Federal Reserve rate hikes documented in official statements, could extend the correction beyond Lee's timeline. The staking centralization aspect has drawn criticism from decentralization advocates who reference Ethereum.org's consensus documentation on validator diversity.

Bullish Case (55% Probability): If accumulation begins in Q2 2026 and the settlement layer thesis gains traction, Ethereum could establish a base above $3,000 by year-end. A successful reclaim of the $3,400 Order Block would target $4,200 by Q1 2027, aligning with Lee's bull market start projection. This scenario requires sustained institutional inflow into tokenized assets and stablecoin adoption exceeding current growth rates.

Bearish Case (45% Probability): Failure to hold the $2,800 Fibonacci support triggers a liquidity grab toward $2,400, extending the correction into 2027. Regulatory pressure on staking operations or delayed EIP-4844 implementation could undermine the settlement layer narrative. In this scenario, the bull market start shifts to 2028-2029, with Ethereum underperforming Bitcoin during the initial recovery phase.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.