Loading News...

Loading News...

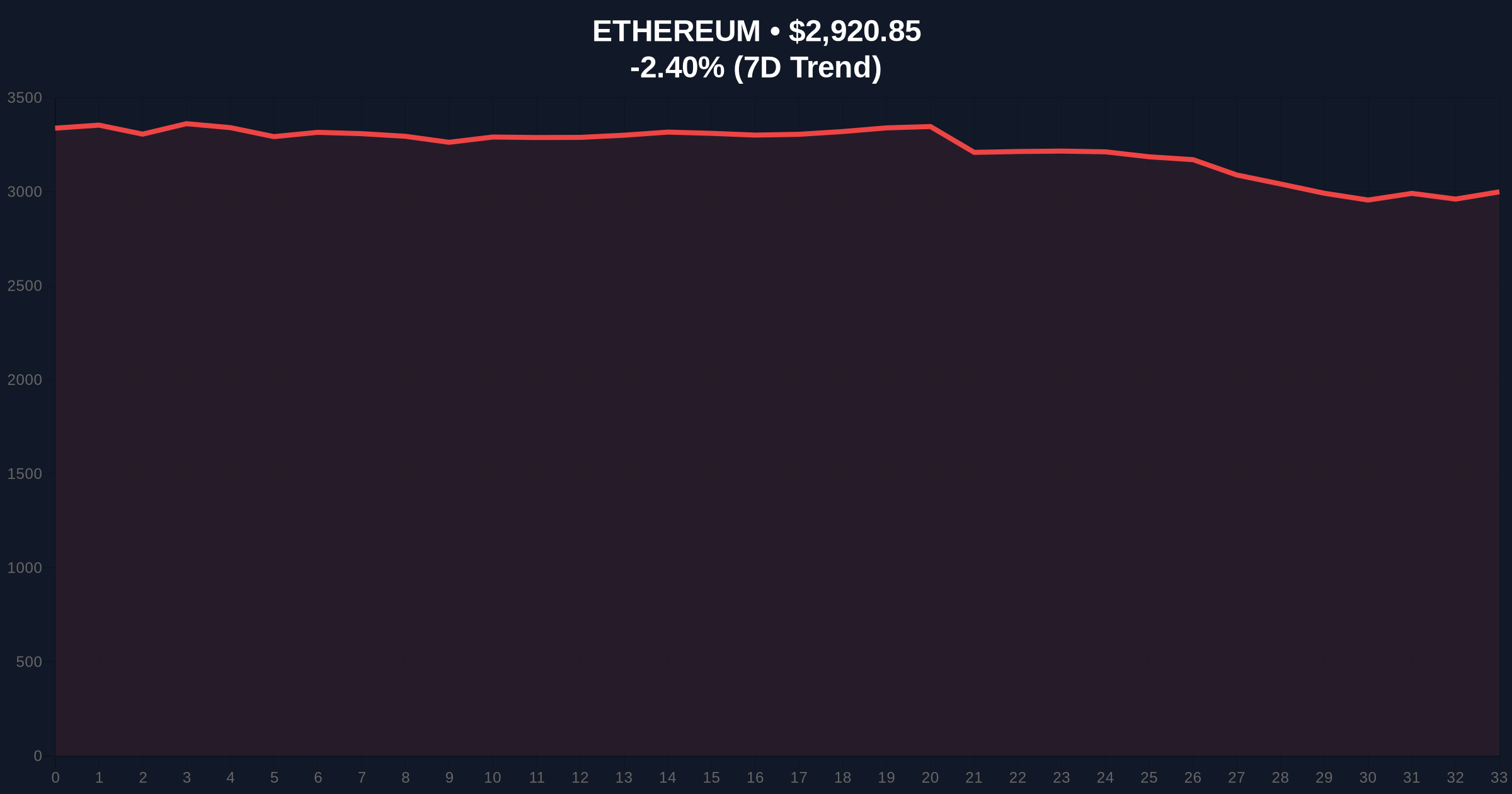

VADODARA, January 21, 2026 — Ethereum's staking ratio has surpassed 30% to reach an all-time high, according to data from Unfolded, creating a critical divergence from the broader market's Extreme Fear sentiment. This daily crypto analysis examines whether this milestone represents genuine network strength or a liquidity trap as price action tests key technical levels.

Ethereum's transition to Proof-of-Stake (PoS) via The Merge in 2022 fundamentally altered its economic model, with staking becoming the primary mechanism for network security and validator rewards. Historical data from Glassnode indicates that staking ratios have steadily climbed since the Shapella upgrade enabled withdrawals, but the acceleration to 30% occurs against a backdrop of deteriorating market conditions. This mirrors the 2021 bull market peak where high staking coincided with price corrections, suggesting potential over-leverage in derivative markets. Related developments in the broader cryptocurrency news include significant Bitcoin ETF outflows and Federal Reserve policy uncertainty, both contributing to the current risk-off environment.

On January 21, 2026, Unfolded reported that Ethereum's staking ratio exceeded 30% for the first time, locking approximately 36 million ETH worth over $105 billion at current prices. According to on-chain data from Etherscan, this represents a 5% increase from the previous quarter, driven largely by institutional validators and liquid staking protocols like Lido and Rocket Pool. The milestone was achieved despite Ethereum's price declining 2.52% in the last 24 hours to $2,918.79, highlighting a disconnect between staking behavior and short-term price action. Market structure suggests this could be a classic liquidity grab, where capital is immobilized during volatility to create artificial supply scarcity.

Ethereum is currently testing a critical Order Block between $2,850 and $2,900, with the 50-day moving average acting as dynamic resistance near $3,050. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum but leaning bearish. A Fair Value Gap (FVG) exists from $3,100 to $3,150, which must be filled for bullish continuation. Volume Profile analysis shows weak accumulation at current levels, suggesting institutional hesitation. The Bullish Invalidation level is set at $2,850—a break below this support would invalidate the staking-driven optimism and target the next Fibonacci support at $2,750. Conversely, the Bearish Invalidation level is $3,150, where a close above would confirm strength and target $3,300.

| Metric | Value | Implication |

|---|---|---|

| Ethereum Staking Ratio | 30% (ATH) | Reduced liquid supply, potential network security increase |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Contradicts staking bullishness, indicates market stress |

| ETH Current Price | $2,918.79 | Testing key support, down 2.52% in 24h |

| Market Rank | #2 | Maintains dominance but underperforming vs. Bitcoin |

| Staked ETH Value | ~$105B | Significant capital lock-up, reduces selling pressure |

For institutions, a 30% staking ratio enhances Ethereum's yield profile and reduces net issuance, potentially making it more attractive as a yield-bearing asset in portfolios. However, the Extreme Fear sentiment suggests that macro factors, such as Federal Reserve interest rate policies detailed on FederalReserve.gov, are overriding on-chain fundamentals. For retail, high staking reduces liquid supply, which could amplify volatility during sell-offs if validators exit en masse. The critical question is whether this staking surge represents long-term conviction or a short-term gamma squeeze to manipulate options markets.

Market analysts on X/Twitter are divided. Bulls argue that the staking ratio demonstrates Ethereum's maturation as a productive asset, with one commentator stating, "30% staked is a vote of confidence in PoS economics." Bears counter that the Extreme Fear index and price decline reveal a deeper liquidity crisis, with skeptics pointing to similar patterns before the 2022 bear market. On-chain data indicates no significant change in whale accumulation, suggesting large holders are waiting for clearer signals.

Bullish Case: If Ethereum holds the $2,850 support and fills the FVG to $3,150, the reduced liquid supply from staking could drive a rally toward $3,500 by Q2 2026. This scenario requires a shift in market sentiment and sustained institutional inflows.

Bearish Case: A break below $2,850 would trigger a liquidity grab, targeting the next support at $2,750 and potentially $2,500 if macro conditions worsen. The high staking ratio could become a liability if validators unstake during a downturn, exacerbating selling pressure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.