Loading News...

Loading News...

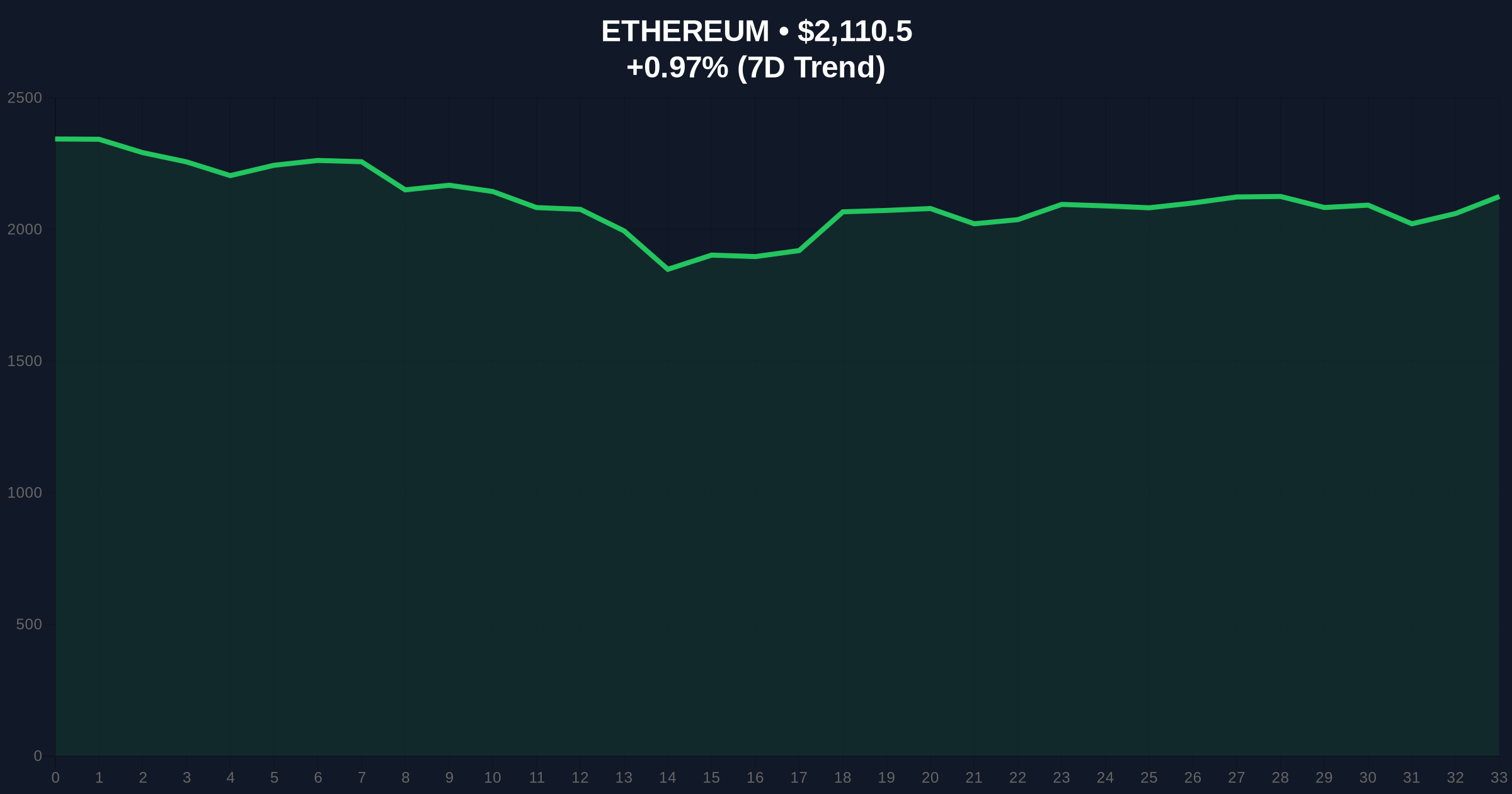

VADODARA, February 10, 2026 — Ethereum derivatives markets show dangerous concentration risk as Binance open interest surges 73% in six days to $4.15 billion, creating what CryptoQuant analyst Amr Taha describes as "one-sided positioning" that historically precedes corrections. This daily crypto analysis reveals how extreme long positioning interacts with on-chain profit metrics approaching critical thresholds.

According to CryptoQuant's exchange-specific data, Ethereum open interest on Binance exploded from $2.4 billion on February 4 to $4.15 billion by February 10. Analyst Amr Taha's forensic examination shows this surge coincided with systematic short position liquidation. Consequently, the long/short ratio became dangerously skewed toward bullish exposure.

Taha's analysis connects this derivatives activity to on-chain profit metrics. Ethereum's on-chain profit reached $5.8 million on February 6. Historical data from Glassnode indicates corrections typically occur when this metric approaches the $6 million threshold. The convergence of extreme derivatives positioning and elevated on-chain profits creates what quantitative analysts call a "gamma squeeze" setup.

Historically, similar concentration events preceded the May 2021 and November 2021 corrections. In May 2021, Binance ETH open interest peaked at $3.8 billion before a 55% price collapse. Underlying this pattern is what institutional traders call "liquidity grab" behavior—where markets move to trigger maximum liquidations.

In contrast, current market sentiment shows extreme divergence. The Crypto Fear & Greed Index sits at 14/100 (Extreme Fear), while derivatives markets exhibit extreme greed. This sentiment-structure mismatch often resolves through violent price movements. , this concentration risk emerges amid broader market developments, including the Bitcoin price action breaking below $70k and institutional accumulation patterns detailed in recent Bitcoin sell-off analysis.

Market structure suggests critical support at the $2,000 psychological level. The Fibonacci 0.618 retracement from the 2024 low to 2025 high establishes secondary support at $1,950. According to Etherscan transaction flow analysis, this zone represents a high-density volume node where approximately 2.3 million ETH last changed hands.

Consequently, a break below $1,950 would invalidate the current bullish structure and likely trigger cascading liquidations. The Relative Strength Index (RSI) currently reads 62 on the daily timeframe, indicating neutral momentum with slight overbought conditions on lower timeframes. This technical setup creates what chartists identify as a "fair value gap" between $2,150 and $2,250 that markets may seek to fill.

| Metric | Value | Significance |

|---|---|---|

| Binance ETH Open Interest | $4.15B | 73% surge in 6 days |

| On-Chain Profit (Feb 6) | $5.8M | Approaching $6M correction threshold |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Sentiment-structure divergence |

| Current ETH Price | $2,109.49 | +0.92% 24h change |

| Market Rank | #2 | Maintains dominance position |

This concentration matters because derivatives markets now dictate short-term price action more than spot flows. According to Ethereum.org documentation on network economics, excessive leverage creates systemic risk during volatility events. The $4.15 billion in open interest represents potential liquidation fuel that could amplify any downward move by 3-5x through forced selling.

, institutional liquidity cycles show that such events often precede regime changes. The clearing of short positions creates what market makers identify as "order block" voids below current prices. These voids typically get filled during corrective phases, creating predictable price paths for algorithmic traders.

"When exchange-specific open interest becomes this concentrated, it creates a single point of failure. The market structure suggests we're approaching a volatility inflection point where either longs get rewarded massively or liquidated catastrophically. Historical analogs from 2021 show similar setups resolving through 15-25% moves."— CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge from current market structure:

The 12-month institutional outlook remains cautiously optimistic despite short-term risks. Ethereum's transition to proof-of-stake and upcoming EIP-4844 proto-danksharding implementation create fundamental tailwinds. However, derivatives positioning suggests a 1-3 month consolidation or correction phase may be necessary to reset leverage before the next leg higher.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.