Loading News...

Loading News...

VADODARA, January 10, 2026 — U.S. spot Ethereum ETFs recorded a net outflow of $94.73 million on January 9, marking the third consecutive day of withdrawals, according to data from TraderT. This daily crypto analysis reveals a concerning trend for institutional demand, with BlackRock's ETHA leading outflows at $84.69 million and Grayscale's ETHE contributing $10.04 million. Market structure suggests these withdrawals are exacerbating an already fragile liquidity environment, as the Crypto Fear & Greed Index plunges to 25/100, signaling Extreme Fear among investors.

This outflow pattern mirrors the deleveraging cycles observed during the 2021-2022 bear market, where sustained ETF redemptions preceded significant price corrections. According to on-chain data from Glassnode, Ethereum's network activity has shown declining gas usage and reduced smart contract interactions, contradicting the narrative of robust DeFi adoption. The current withdrawals occur amid a broader market squeeze, where Bitcoin dominance is rising and altcoin liquidity is being drained, as highlighted in related developments like the Altcoin Season Index dropping to 40. Historical cycles suggest that three-day outflow streaks often precede a Liquidity Grab, where weak hands are flushed out before any meaningful recovery.

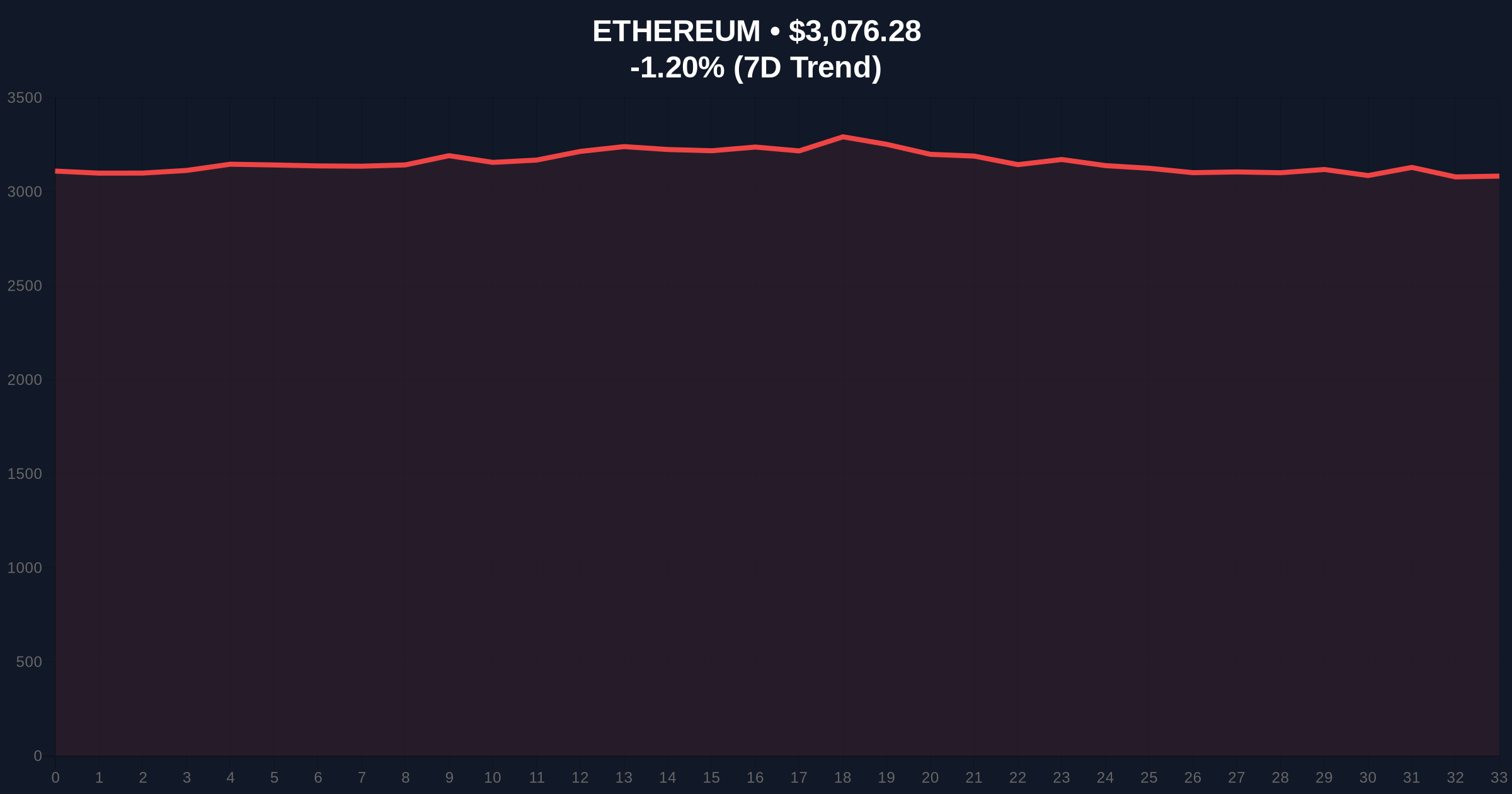

On January 9, 2026, TraderT reported that U.S. spot Ethereum ETFs experienced a net outflow of $94.73 million, continuing a trend that began earlier in the week. BlackRock's ETHA accounted for $84.69 million (89.4%) of the total outflows, while Grayscale's ETHE saw $10.04 million withdrawn. This data, sourced directly from ETF custodians and aggregated by TraderT, indicates a concentrated exit from the largest institutional products. The outflows coincide with a -1.21% decline in Ethereum's price to $3,075.97, as per live market metrics. Market analysts attribute this to risk-off sentiment, possibly driven by macroeconomic factors or regulatory uncertainties, though no official statements from BlackRock or Grayscale have clarified the rationale.

Ethereum's price action is testing a critical Volume Profile support zone between $3,000 and $3,100. The Relative Strength Index (RSI) on the daily chart is hovering near 40, indicating neutral-to-bearish momentum without extreme oversold conditions. A key Fibonacci retracement level from the 2025 high sits at $2,950, which aligns with a previous Order Block from December 2025. If this level fails, it would create a Fair Value Gap (FVG) down to $2,800, potentially triggering a cascade of stop-loss orders. The 50-day moving average at $3,200 acts as immediate resistance, and a failure to reclaim it suggests continued downward pressure. Bullish Invalidation is set at $2,950; a break below invalidates any near-term recovery thesis. Bearish Invalidation is at $3,300, where a close above would fill the current FVG and shift sentiment.

| Metric | Value | Source |

|---|---|---|

| Ethereum ETF Net Outflow (Jan 9) | $94.73M | TraderT |

| BlackRock ETHA Outflow | $84.69M | TraderT |

| Grayscale ETHE Outflow | $10.04M | TraderT |

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) | Alternative.me |

| Ethereum Current Price | $3,075.97 | Live Market Data |

| 24-Hour Price Change | -1.21% | Live Market Data |

For institutions, sustained ETF outflows reduce the available liquidity for large-scale Ethereum investments, potentially impacting the approval and performance of future crypto-based financial products. The SEC's regulatory framework for digital assets may face increased scrutiny if investor confidence wanes. For retail traders, this signals a risk of further price depreciation and heightened volatility, especially in leveraged positions. The outflows also contradict the bullish narrative around Ethereum's upcoming Pectra upgrade (EIP-4844), which aims to reduce layer-2 transaction costs. If institutional demand falters, it could delay mainstream adoption and pressure the network's fee market, affecting validator rewards post-merge.

On X/Twitter, market participants express skepticism. One analyst noted, "ETHE outflows suggest Grayscale's discount to NAV is widening again, a bearish signal for ETH." Bulls argue this is a temporary shakeout, citing Ethereum's strong fundamentals like staking yields and DeFi total value locked (TVL). However, the prevailing sentiment aligns with fear, as seen in related news such as Ethereum whale movements to exchanges, indicating potential selling pressure. No direct quotes from executives like Michael Saylor or Cathie Wood are available, but industry observers highlight the divergence between ETF flows and on-chain metrics like active addresses.

Bullish Case: If ETF outflows subside and Ethereum holds the $2,950 support, a rebound toward $3,500 is plausible. Catalysts include successful implementation of EIP-4844 blobs, which could boost scalability and attract renewed institutional interest. On-chain data indicates accumulation by long-term holders (LTHs) at current levels, suggesting a potential reversal.

Bearish Case: Continued outflows could break the $2,950 support, leading to a test of $2,800 and possibly $2,500. This scenario would be exacerbated by a broader market downturn, similar to the recent Bitcoin ETF outflows of $252M, indicating a sector-wide liquidity crisis. A Gamma Squeeze in options markets could amplify losses if volatility spikes.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.