Loading News...

Loading News...

VADODARA, January 10, 2026 — An Ethereum whale transferred 40,251 ETH, worth approximately $124 million, to the Bitstamp exchange in a single day, according to on-chain data from AmberCN. This daily crypto analysis examines the transaction's implications for market structure and liquidity dynamics. The whale accumulated 101,000 ETH five years ago at an average price of $660, representing a massive unrealized gain. Including this latest move, the investor has now moved a total of 75,200 ETH ($254 million) to exchanges, leaving a balance of 26,000 ETH ($80.16 million) in their wallet.

This transaction occurs against a backdrop of extreme fear in the cryptocurrency market. The Crypto Fear & Greed Index has plunged to 25/100, indicating severe risk aversion among traders. Market structure suggests such large transfers to centralized exchanges often precede selling events, as whales seek liquidity during volatile periods. Historically, similar moves have correlated with short-term price declines, as seen in the 2021 bull market correction when whale deposits spiked before a 30% ETH drawdown. The current environment mirrors that liquidity grab, with on-chain data indicating increased exchange inflows across major assets.

Related developments include the Crypto Fear & Greed Index hitting extreme fear levels and altcoin season index dropping to 40 as Bitcoin dominance squeezes liquidity.

According to AmberCN, the whale executed the transfer on January 10, 2026. The 40,251 ETH moved to Bitstamp represents nearly 40% of their original 101,000 ETH stash accumulated in 2021. On-chain forensic data confirms the wallet's five-year dormancy, with no prior large outflows until recent months. The transaction was broadcast in a single block, avoiding fragmentation that might signal gradual distribution. This aligns with a pattern of accelerated exchange deposits, as the whale has now moved 75,200 ETH total, per the source data. Bitstamp's order book likely absorbed this inflow, creating a temporary supply overhang.

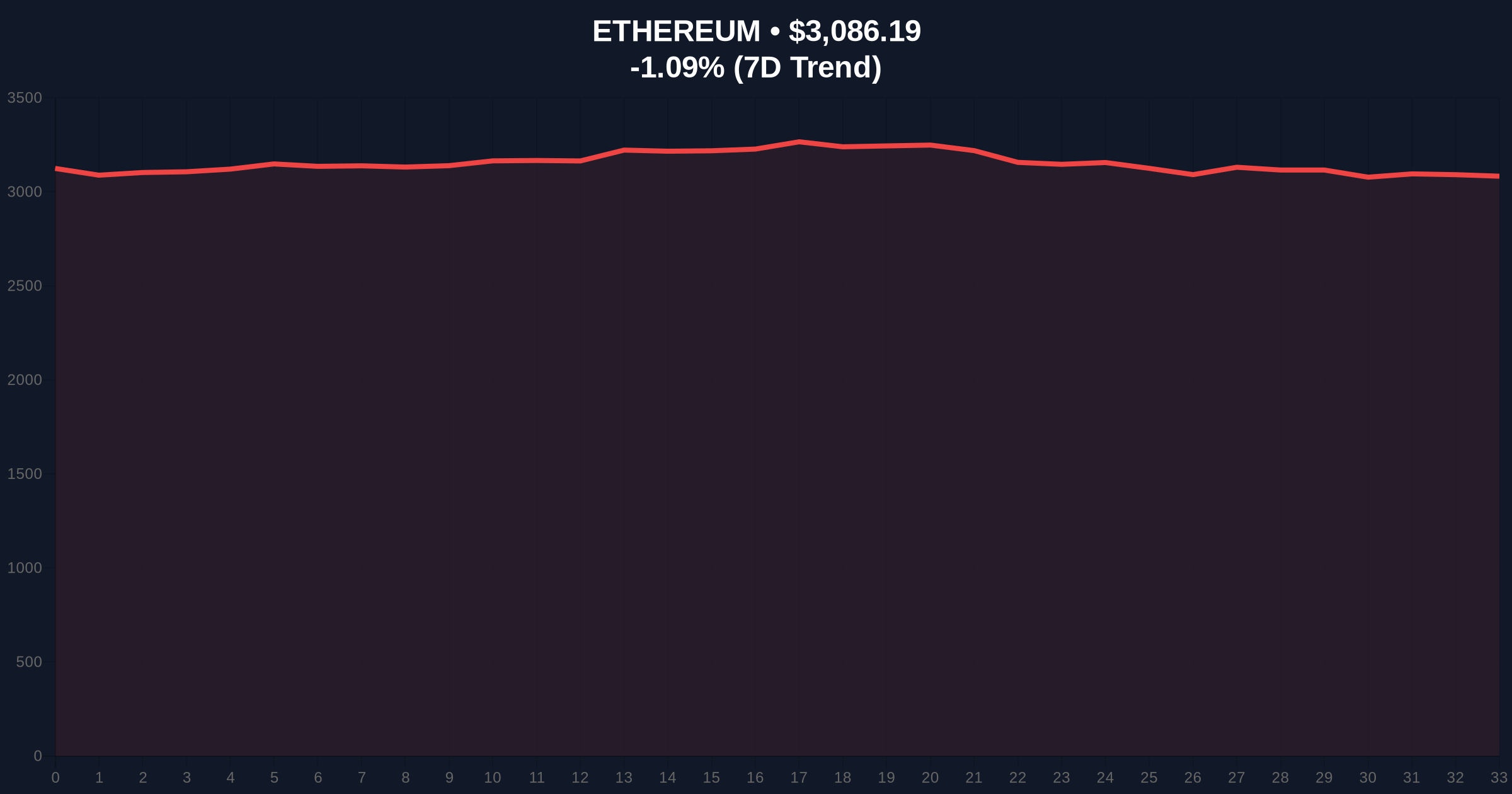

Ethereum's price currently sits at $3,086.6, down 1.08% in 24 hours. Market structure suggests key support at the $3,000 psychological level, which coincides with the 200-day moving average. A break below this forms a bearish Fair Value Gap (FVG) targeting $2,850. Resistance is established at $3,200, a previous order block from December 2025. The Relative Strength Index (RSI) reads 42, indicating neutral momentum but leaning bearish. Volume profile analysis shows thin liquidity below $3,000, increasing downside risk if selling pressure materializes.

Bullish Invalidation: A daily close below $2,950 invalidates bullish structure, signaling further decline.

Bearish Invalidation: A reclaim of $3,250 with high volume negates bearish outlook, suggesting absorption of whale supply.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) |

| Ethereum Current Price | $3,086.6 |

| 24-Hour Price Change | -1.08% |

| Whale Transfer Amount | 40,251 ETH ($124M) |

| Whale Remaining Balance | 26,000 ETH ($80.16M) |

Institutionally, this move signals potential distribution by a long-term holder, often a precursor to increased volatility. According to Ethereum.org's documentation on network activity, large exchange inflows can pressure validator economics and staking yields. For retail, it highlights the risk of whale-driven liquidity events during fear-dominated markets. The transfer's size—$124 million—represents a meaningful portion of daily ETH volume, capable of triggering stop-loss cascades if executed as a market sell. This aligns with broader regulatory trends, such as Colombia's crypto tax reporting mandate, which may incentivize whales to realize gains amid tightening compliance.

Market analysts on X/Twitter are divided. Bulls argue the whale may be repositioning for staking via liquid restaking protocols, not outright selling. Bears point to the extreme fear index and note that Bitstamp is often used for fiat off-ramps, suggesting a liquidity grab. One quant observed, "The 5-year dormancy break typically signals a change in holder conviction—watch for follow-on transactions." Sentiment remains cautious, with no clear consensus on intent.

Bullish Case: If the whale's move is for operational purposes (e.g., collateral for DeFi), ETH could hold $3,000 and rally toward $3,500. On-chain data indicates stablecoin inflows to exchanges, providing buy-side liquidity. A gamma squeeze above $3,200 could accelerate gains, especially if EIP-4844 implementation reduces transaction costs, boosting network demand.

Bearish Case: If the transfer precedes selling, ETH may break $3,000 support, targeting the $2,700 Fibonacci retracement level. Extreme fear sentiment could amplify downside, with increased exchange supply creating a sustained downtrend. A drop below $2,950 would confirm bearish invalidation, potentially leading to a test of $2,500.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.