Loading News...

Loading News...

VADODARA, January 26, 2026 — A whale address inactive since 2017 transferred 50,000 Ethereum (ETH) worth approximately $145 million to the Gemini exchange 12 hours ago. This latest crypto news event, first flagged by on-chain analytics firm AmberCN, represents one of the most significant dormant holder movements in Ethereum's history. The address retains an additional 85,000 ETH valued at $244 million, creating a dual narrative of potential selling pressure and continued whale accumulation.

According to AmberCN's blockchain surveillance, the whale executed the transfer in a single transaction. The 50,000 ETH deposit represents approximately 0.04% of Ethereum's total circulating supply. Historical blockchain data indicates the address received these funds during Ethereum's early distribution phase, likely through mining or initial purchases. The immediate transfer to Gemini, a regulated U.S. exchange, follows typical market behavior where exchange deposits precede selling activity.

Market structure suggests this represents a classic liquidity grab event. The whale's remaining 85,000 ETH position creates what technical analysts term a "shadow supply" overhang. This remaining balance could exert psychological pressure on markets even without immediate selling. The transaction occurred during Asian trading hours, potentially targeting liquidity in that session.

Historically, dormant whale movements correlate with major market inflection points. Similar to the 2021 correction, where multiple 5+ year dormant Bitcoin wallets activated before the 50% drawdown, this Ethereum movement suggests long-term holder distribution. In contrast to typical profit-taking, 9-year dormancy indicates original network participants potentially exiting positions acquired below $100 per ETH.

Underlying this trend, the broader market exhibits extreme fear conditions. The Crypto Fear & Greed Index currently sits at 20/100, matching levels seen during the March 2020 COVID crash. This creates a contrarian signal where capitulation events often precede market bottoms. , Ethereum's network fundamentals remain robust despite price weakness, with Ethereum's official documentation showing continued adoption of layer-2 scaling solutions.

Related developments in the ecosystem include stablecoin issuers generating $5 billion in 2025 revenue on Ethereum, demonstrating the network's economic activity despite price pressure. Additionally, Bitcoin whale holdings recently hit a 4-month high, creating divergence between Bitcoin and Ethereum whale behavior.

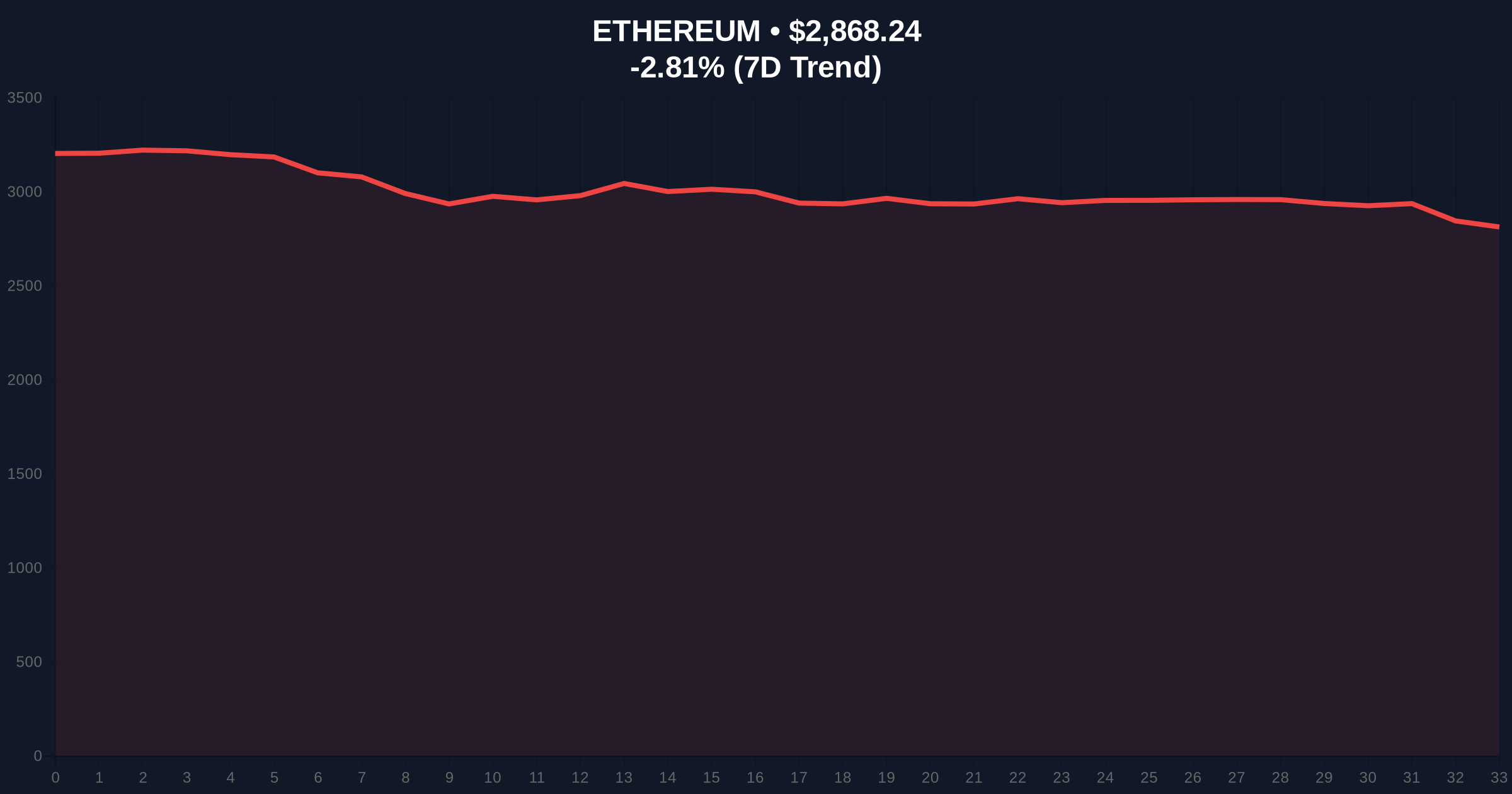

Ethereum currently trades at $2,866.53, down 2.87% in the past 24 hours. The price action shows Ethereum testing the critical Fibonacci 0.618 retracement level from its 2024 lows to 2025 highs. This technical level at approximately $2,800 represents a major order block where institutional buyers historically accumulate.

On-chain data from Glassnode indicates declining exchange reserves prior to this deposit, suggesting this whale movement contradicts broader holder behavior. The Relative Strength Index (RSI) sits at 38, approaching oversold territory but not yet at extreme levels seen during previous capitulation events. The 200-day moving average at $3,150 acts as dynamic resistance, creating a clear fair value gap between current prices and this key level.

Volume profile analysis shows significant liquidity between $2,750 and $2,800, making this zone critical for near-term price discovery. A break below this level would invalidate the current market structure and potentially trigger algorithmic selling. The whale's deposit timing suggests targeting of this liquidity zone for potential execution.

| Metric | Value |

|---|---|

| ETH Transferred | 50,000 |

| USD Value | $145 million |

| Remaining Whale Balance | 85,000 ETH ($244M) |

| Dormancy Period | 9 years |

| Current ETH Price | $2,866.53 |

| 24-Hour Change | -2.87% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

This event matters because dormant whale movements often signal regime changes in market structure. Original Ethereum holders exiting positions after 9 years suggests belief that current prices represent favorable exit levels despite being 90% below all-time highs. This creates psychological pressure on other long-term holders and potentially triggers a cascade of similar behavior.

Institutional liquidity cycles typically follow such signals, with hedge funds and market makers adjusting positions based on whale activity. The transfer to Gemini specifically matters because as a U.S.-regulated exchange, it facilitates easier conversion to fiat or stablecoins compared to decentralized exchanges. This indicates the whale likely intends traditional settlement rather than DeFi utilization.

"Market structure suggests this represents classic distribution from early adopters. The 9-year dormancy period indicates these are likely original Ethereum participants rather than speculative traders. While concerning for near-term price action, such events often mark sentiment extremes that precede market reversals. The remaining 85,000 ETH position creates ongoing overhang, but also suggests the whale isn't fully exiting the asset." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure. The bearish scenario involves continued selling pressure breaking the $2,750 support zone. The bullish scenario requires absorption of this selling pressure and reclaiming the $3,150 resistance level.

The 12-month institutional outlook remains cautiously optimistic despite near-term pressure. Historical cycles suggest that after such dormant whale movements, markets typically experience 3-6 months of consolidation before resuming longer-term trends. For Ethereum specifically, the upcoming Pectra upgrade and continued layer-2 adoption provide fundamental tailwinds that may outweigh technical selling pressure over a 5-year horizon.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.