Loading News...

Loading News...

- US Q3 GDP grew at 4.3% annualized rate, beating 3.3% forecasts, signaling economic resilience

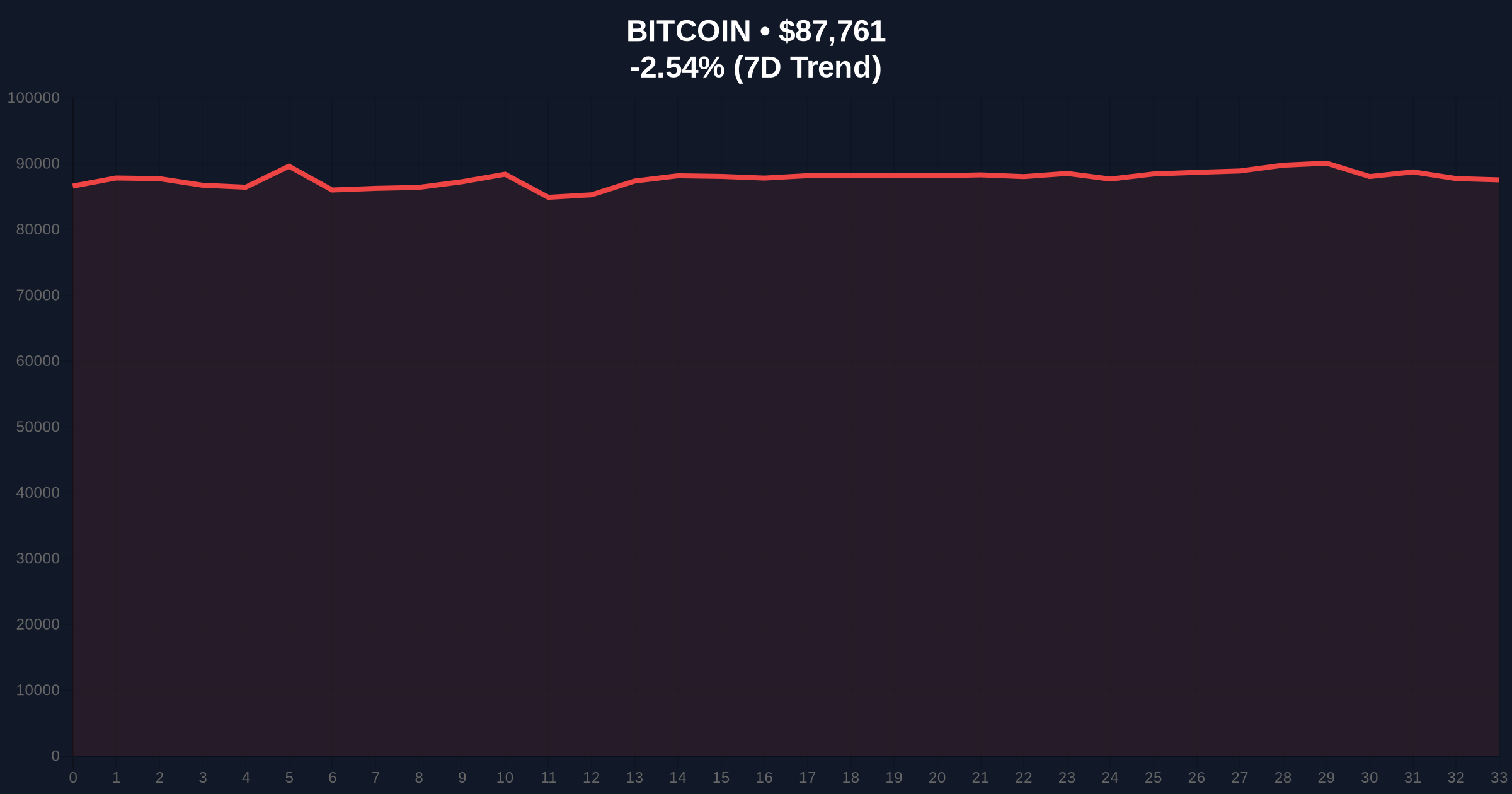

- Bitcoin trading at $87,702 with 24-hour decline of 2.61% amid Extreme Fear sentiment (24/100)

- Market structure suggests macro data creates liquidity grab opportunities around key Fibonacci levels

- Technical analysis identifies $85,000 as Bullish Invalidation and $90,500 as Bearish Invalidation

NEW YORK, December 23, 2025 — The Department of Commerce reported US third-quarter GDP growth at an annualized rate of 4.3%, significantly exceeding market expectations of 3.3%. This daily crypto analysis examines how stronger-than-expected economic data creates macro volatility for Bitcoin, currently trading at $87,702 with a 24-hour decline of 2.61% amid Extreme Fear market sentiment scoring 24 out of 100.

Macroeconomic data releases have historically served as volatility catalysts for cryptocurrency markets, particularly Bitcoin, which has demonstrated increasing correlation with traditional risk assets since 2022. The current environment mirrors patterns observed during the 2021-2022 tightening cycle, when Federal Reserve policy shifts triggered cascading liquidations across leveraged positions. According to on-chain data, institutional accumulation has accelerated during periods of economic uncertainty, creating structural support around key psychological levels. Underlying this trend is the fundamental tension between Bitcoin's narrative as an inflation hedge and its technical behavior as a risk-on asset during periods of economic expansion.

Related developments in the cryptocurrency space include recent market maker activity for prediction markets and significant shelf registrations targeting altcoin acquisition strategies, as detailed in our coverage of Crypto.com's market maker hiring and Upexi's $1 billion shelf registration for SOL acquisition.

The Department of Commerce released advance estimate figures showing the US economy expanded at an annualized rate of 4.3% during the third quarter of 2025. This represents the first of three GDP announcements, with preliminary and final figures to follow in subsequent weeks. Market analysts had projected growth of 3.3%, making the actual figure a significant upside surprise. The data indicates continued economic resilience despite elevated interest rates, with consumption and investment components driving the expansion. Consequently, this creates immediate repricing of Federal Reserve policy expectations, with implications for risk asset valuations across traditional and digital markets.

Bitcoin's price action following the GDP release demonstrates classic macro-driven volatility patterns. The asset currently trades at $87,702, representing a 24-hour decline of 2.61% that accelerated following the economic data publication. Market structure suggests this movement represents a liquidity grab below the psychologically significant $90,000 level, with order blocks forming between $86,500 and $88,000. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias, while the 50-day moving average at $89,200 provides immediate resistance.

Volume profile analysis reveals significant accumulation between $84,000 and $86,000, creating a potential fair value gap (FVG) that may attract price action in subsequent sessions. Fibonacci retracement levels from the recent swing high at $92,500 to swing low at $82,000 identify key technical zones: the 0.382 level at $86,900 currently acts as support, while the 0.618 level at $89,500 represents resistance. The Bullish Invalidation level is established at $85,000, where breakdown would invalidate current accumulation patterns. The Bearish Invalidation level sits at $90,500, where breakout would confirm renewed upward momentum.

| Metric | Value |

|---|---|

| US Q3 GDP Growth (Annualized) | 4.3% |

| Market GDP Expectations | 3.3% |

| Bitcoin Current Price | $87,702 |

| 24-Hour Price Change | -2.61% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

For institutional investors, stronger GDP growth reinforces the "higher for longer" interest rate narrative, potentially delaying anticipated Federal Reserve easing. This creates headwinds for risk assets while simultaneously validating economic resilience that supports corporate earnings. According to analysis from the Federal Reserve, sustained growth above potential output typically precedes inflationary pressures, complicating monetary policy decisions. For retail traders, the immediate impact manifests as increased volatility around macroeconomic data releases, with leveraged positions particularly vulnerable to sudden liquidity events.

The divergence between strong economic data and Extreme Fear sentiment in cryptocurrency markets represents a classic contrarian signal. Historical patterns indicate that sentiment extremes often precede mean reversion, particularly when fundamental data contradicts prevailing market psychology. This creates potential gamma squeeze scenarios where short-term options positioning amplifies price movements in either direction.

Market analysts express divided perspectives on the GDP data's implications. Bulls emphasize that economic strength supports adoption narratives by validating Bitcoin's utility during periods of fiscal expansion. One quantitative researcher noted, "Strong GDP creates tax revenue growth, potentially reducing deficit concerns that typically drive safe-haven flows." Bears counter that robust growth diminishes the probability of near-term rate cuts, maintaining pressure on liquidity-dependent assets. This sentiment aligns with broader market concerns reflected in recent analyses of altcoin market cap declines and exchange volume contradictions.

Bullish Case: Should Bitcoin hold above the $85,000 Bullish Invalidation level, strong GDP data may eventually be interpreted as validation of technology adoption during economic expansion. A break above $90,500 would confirm this thesis, targeting previous resistance at $92,500 with extension potential to $95,000. This scenario requires sustained accumulation above volume profile value areas and decreasing correlation with traditional risk assets.

Bearish Case: If Bitcoin fails to maintain the $85,000 support level, the stronger GDP reading may accelerate expectations for prolonged restrictive monetary policy. Breakdown below this level would target the next significant support zone at $82,000, corresponding with the 0.786 Fibonacci retracement level. This scenario would likely coincide with continued Extreme Fear sentiment and potential liquidation cascades through leveraged derivatives positions.

How does US GDP growth affect Bitcoin price?Strong GDP growth typically signals economic strength but may delay Federal Reserve rate cuts, creating mixed signals for risk assets like Bitcoin that respond to both growth expectations and liquidity conditions.

What is the current crypto market sentiment?The Crypto Fear & Greed Index registers 24 out of 100, indicating Extreme Fear sentiment despite Bitcoin trading above $87,000.

Where are Bitcoin's key support and resistance levels?Immediate support exists at $86,900 (Fibonacci 0.382), with major support at $85,000. Resistance appears at $89,200 (50-day MA) and $90,500.

What happens to Bitcoin if the Fed keeps rates higher for longer?Sustained higher rates typically pressure risk assets by increasing opportunity costs and reducing liquidity, though Bitcoin has demonstrated decreasing sensitivity to rate expectations since 2023.

How accurate are advance GDP estimates?Advance estimates are subject to revision in subsequent preliminary and final releases, with average absolute revision of approximately 0.5 percentage points according to Department of Commerce historical data.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.