Loading News...

Loading News...

- Nasdaq-listed Upexi files for $1 billion shelf registration to fund SOL acquisitions and corporate operations

- Market structure suggests this move could create a liquidity grab in Solana markets

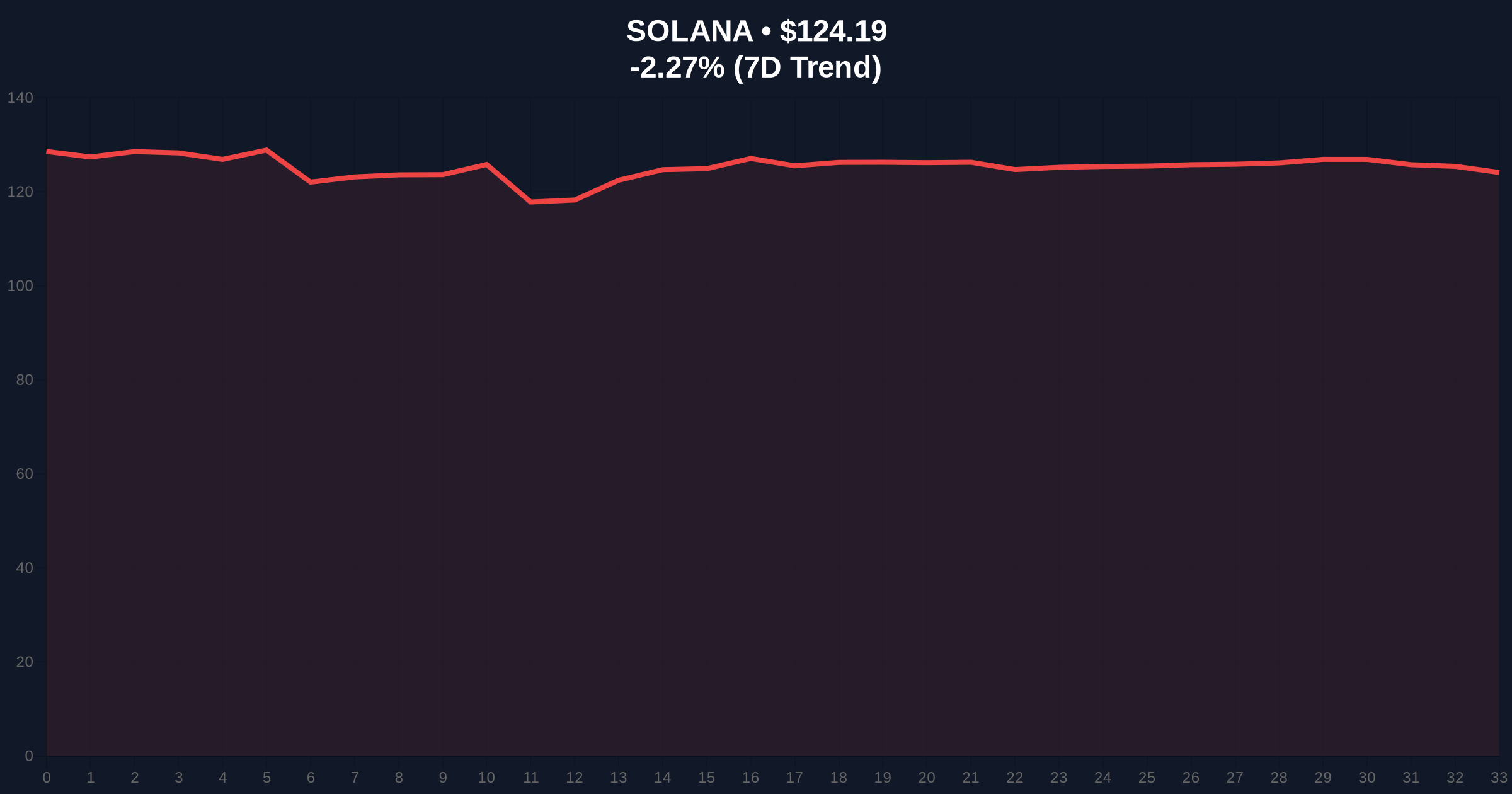

- Solana currently trading at $124.17 with 24-hour decline of -2.37% amid extreme fear sentiment

- Technical analysis identifies $115 as bullish invalidation and $135 as bearish invalidation levels

NEW YORK, December 23, 2025 — Nasdaq-listed Upexi has initiated a shelf registration to issue up to $1 billion in securities, with proceeds earmarked for strategic SOL acquisitions and corporate development. This daily crypto analysis examines the market implications of a publicly-traded company positioning for substantial cryptocurrency exposure during a period of extreme market fear.

Public companies entering cryptocurrency markets through shelf registrations represent a structural shift in institutional adoption patterns. The SEC's regulatory framework for shelf offerings under Rule 415 allows companies to register securities for future issuance, providing flexibility to capitalize on market conditions. Underlying this trend is the maturation of cryptocurrency as an asset class, with companies like MicroStrategy establishing precedent for corporate treasury strategies. Consequently, Upexi's move follows a pattern of traditional finance entities seeking exposure to digital assets through regulated channels. Market structure suggests these corporate acquisitions can create order blocks that influence price discovery mechanisms.

Related developments in the current market environment include Nasdaq delisting risks for cryptocurrency-linked strategies and slowing institutional buying pressure patterns that mirror late-stage bull market dynamics.

According to regulatory filings, Upexi has submitted documentation for a shelf registration statement that would enable the company to issue up to $1 billion in securities over the next three years. The company has identified multiple use cases for the proceeds, including operational expenses, research and development initiatives, and potential mergers and acquisitions. Of particular significance is Upexi's stated strategy of acquiring SOL tokens, positioning the company as one of the first Nasdaq-listed entities to explicitly target Solana exposure through corporate treasury operations.

The timing coincides with a global cryptocurrency sentiment reading of "Extreme Fear" at 24/100, suggesting Upexi may be executing a contrarian accumulation strategy. Market analysts note that shelf registrations provide companies with tactical flexibility to access capital markets during optimal conditions, potentially allowing Upexi to execute its SOL acquisition strategy during periods of price weakness.

Solana's current price of $124.17 represents a -2.37% decline over the past 24 hours, with the asset maintaining its position as the seventh-largest cryptocurrency by market capitalization. Volume profile analysis indicates reduced trading activity in the $120-$130 range, creating a potential fair value gap that could be targeted by institutional accumulation.

The 200-day moving average at $118.50 provides dynamic support, while Fibonacci retracement levels from the recent swing high of $142.80 to swing low of $98.40 identify key technical zones. The 0.618 Fibonacci level at $125.80 currently acts as resistance, with the 0.382 level at $115.20 serving as primary support. Relative Strength Index (RSI) readings at 42 suggest neutral momentum with bearish bias.

Bullish invalidation occurs below $115, which would break multiple technical support levels and indicate structural weakness. Bearish invalidation occurs above $135, which would represent a breakout from the current consolidation range and suggest renewed institutional interest.

| Metric | Value |

|---|---|

| Shelf Registration Amount | $1 billion |

| Solana Current Price | $124.17 |

| 24-Hour Price Change | -2.37% |

| Market Sentiment Score | 24/100 (Extreme Fear) |

| Solana Market Rank | #7 |

Institutional impact centers on the precedent of publicly-traded companies using shelf registrations specifically for cryptocurrency acquisition strategies. This represents a more sophisticated approach than previous corporate treasury allocations, as shelf offerings provide flexibility to time market entries based on technical conditions. The U.S. Securities and Exchange Commission's regulatory stance on such offerings, detailed in SEC guidance, creates a framework that could encourage additional public companies to pursue similar strategies.

Retail impact manifests through potential gamma squeeze scenarios if Upexi's accumulation creates concentrated buying pressure in derivatives markets. Market structure suggests that corporate acquisitions of this magnitude can create order blocks that influence price discovery, particularly in assets like Solana with substantial options market activity. The strategic timing during extreme fear sentiment indicates a potential liquidity grab targeting retail capitulation.

Market analysts on social platforms have noted the strategic implications of Upexi's timing. "Corporate accumulation during fear periods represents sophisticated market timing," observed one quantitative researcher. Another analyst commented, "The shelf registration structure provides optionality that traditional spot buying lacks." The consensus among institutional observers suggests this move represents a maturation of corporate cryptocurrency strategies beyond simple treasury allocation.

Bullish Case: Successful execution of Upexi's acquisition strategy could create sustained buying pressure that fills the fair value gap between $130-$140. If global sentiment shifts from extreme fear to neutral, Solana could retest the $142.80 resistance level. Corporate adoption patterns following Upexi's lead could establish $150 as the next psychological target.

Bearish Case: Failure to maintain the $115 support level would invalidate the bullish structure and potentially trigger a test of the $98.40 swing low. If broader market conditions deteriorate further, with Bitcoin breaking below its $82,000 Fibonacci support, Solana could experience accelerated selling pressure toward the $85 level. Regulatory scrutiny of shelf offerings for cryptocurrency purposes could create additional headwinds.

What is a shelf registration?A shelf registration allows companies to register securities with the SEC for future issuance, providing flexibility to access capital markets when conditions are favorable.

Why would a company use a shelf registration for cryptocurrency acquisitions?The structure provides timing flexibility, allowing companies to execute acquisitions during optimal market conditions rather than being forced to raise capital at inopportune moments.

How does Upexi's move affect Solana's price?Large-scale corporate accumulation can create order blocks that influence price discovery, potentially providing support during market weakness and creating upward pressure during accumulation phases.

What are the risks of this strategy?Regulatory uncertainty, cryptocurrency volatility, and execution risk during extreme market conditions represent primary concerns for shelf offerings targeting digital assets.

How does this compare to other corporate cryptocurrency strategies?Unlike simple treasury allocations, shelf registrations provide strategic flexibility and timing advantages, representing a more sophisticated approach to corporate cryptocurrency exposure.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.