Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Ray Dalio argues central banks unlikely to adopt Bitcoin due to government interference concerns, preferring gold as "untouchable" asset

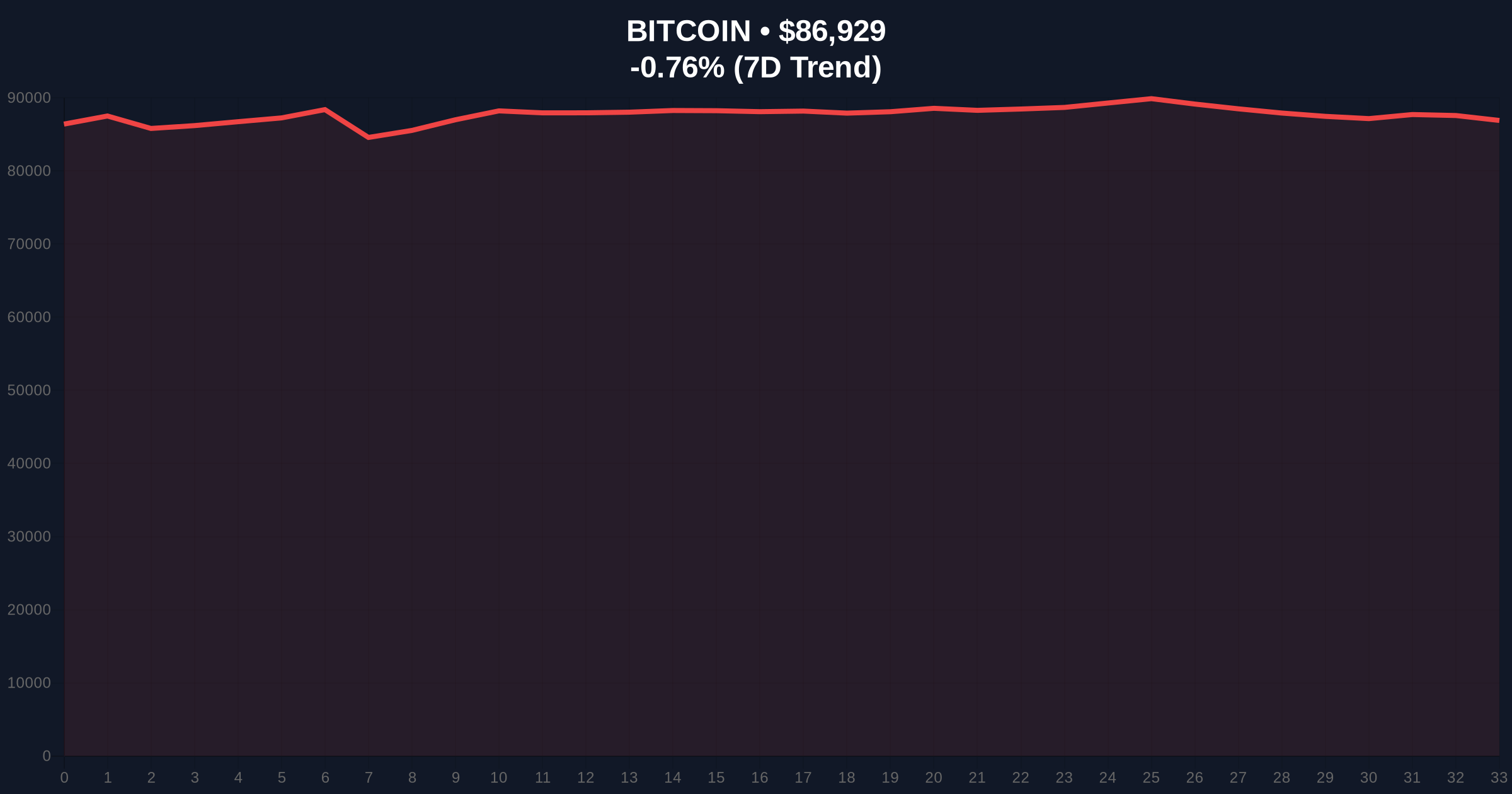

- Bitcoin currently trading at $86,907 with -0.79% 24-hour decline amid Extreme Fear sentiment (24/100)

- Technical analysis identifies critical Fibonacci support at $82,000 with Bullish Invalidation at $78,500 and Bearish Invalidation at $90,200

- Market structure suggests institutional adoption narrative faces similar resistance patterns to 2021 cycle peak

VADODARA, December 24, 2025 — In a development that provides critical daily crypto analysis for institutional portfolios, Bridgewater Associates founder Ray Dalio has articulated fundamental skepticism about central bank Bitcoin adoption during a recent podcast interview. According to Watcher.Guru reports, Dalio contends that while Bitcoin represents a recognized store of value, government capacity to monitor or interfere with peer-to-peer transactions creates structural barriers to institutional adoption. This perspective emerges as Bitcoin trades at $86,907, representing a -0.79% decline over 24 hours amid Extreme Fear market sentiment scoring 24/100 on the Crypto Fear & Greed Index.

Market structure suggests Dalio's commentary mirrors institutional hesitation patterns observed during the 2021 cycle peak, when Bitcoin approached its all-time high near $69,000. Similar to current conditions, that period featured prominent institutional figures expressing reservations about Bitcoin's regulatory framework and sovereign risk profile. The Federal Reserve's ongoing balance sheet normalization, particularly the reduction of its $7.4 trillion securities portfolio through quantitative tightening, creates parallel monetary policy conditions to 2021's tightening cycle initiation. According to Federal Reserve data, current policy resembles the 2021-2022 transition when rising interest rates precipitated a 65% Bitcoin correction from peak to trough. Dalio's emphasis on gold's sovereign immunity—positioning it as "the only asset that governments cannot touch or control"—echoes traditional finance arguments that gained traction during previous risk-off environments.

According to Watcher.Guru reports, Ray Dalio articulated specific concerns about Bitcoin's institutional adoption trajectory during a recent podcast appearance. Dalio acknowledged allocating approximately 1% of his personal portfolio to Bitcoin in November 2025, yet maintained structural reservations about broader central bank adoption. His primary contention centers on government capacity to "interfere with or monitor peer-to-peer transactions," creating what he characterizes as fundamental sovereignty concerns. This perspective directly contrasts with gold, which Dalio describes as possessing unique attributes that prevent government intervention or control. The commentary arrives amid ongoing central bank digital currency (CBDC) development initiatives globally, with 130 countries currently exploring CBDC implementation according to Atlantic Council tracking. Dalio's position represents a significant institutional voice in the ongoing debate about Bitcoin's role within traditional monetary systems.

On-chain data indicates Bitcoin's current price action at $86,907 represents consolidation within a defined range between the 0.382 and 0.5 Fibonacci retracement levels from the 2024-2025 advance. Volume profile analysis reveals significant accumulation between $82,000 and $85,000, creating what technical analysts identify as a potential order block. The 50-day exponential moving average at $84,200 provides immediate dynamic support, while the 200-day simple moving average at $78,500 establishes longer-term structural support. Relative Strength Index (RSI) readings at 42 indicate neutral momentum conditions without oversold or overbought extremes. Market structure suggests the $90,200 level represents critical resistance, corresponding to the previous weekly high and 0.236 Fibonacci extension. A sustained break above this level would invalidate the current bearish structure, while failure to hold $82,000 Fibonacci support would signal continuation of the corrective phase.

| Metric | Value |

| Bitcoin Current Price | $86,907 |

| 24-Hour Price Change | -0.79% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Dalio Personal Bitcoin Allocation | ~1% of portfolio |

| Critical Fibonacci Support | $82,000 |

For institutional participants, Dalio's commentary represents a fundamental challenge to Bitcoin's "digital gold" narrative at a critical juncture in adoption cycles. Market structure suggests that without central bank validation, Bitcoin faces structural headwinds in achieving reserve asset status comparable to traditional safe havens. The institutional impact centers on allocation models: if major sovereign wealth funds and pension funds adopt Dalio's perspective, Bitcoin's institutional adoption curve could flatten significantly. Retail impact manifests differently: without institutional validation, retail investors face increased volatility as market participation becomes dominated by speculative rather than strategic capital. Historical patterns indicate that similar skepticism during previous cycles preceded extended consolidation periods, with the 2018-2020 accumulation phase providing precedent for multi-year sideways action following institutional hesitation.

Market analysts on X/Twitter reflect divided perspectives on Dalio's position. Crypto bulls emphasize his 1% personal allocation as validation of Bitcoin's store-of-value properties, arguing that even skeptical institutions recognize portfolio diversification benefits. One prominent analyst noted, "Dalio's allocation contradicts his public skepticism—actions speak louder than words in portfolio construction." Conversely, traditional finance voices amplify Dalio's sovereignty concerns, with several highlighting recent regulatory developments as evidence of government capacity to influence cryptocurrency markets. The debate occurs against a backdrop of related market developments, including recent analysis of Bitcoin's 'digital gold' narrative under stress tests and significant Ethereum movements to exchanges amid uncertainty.

Bullish Case: If Bitcoin maintains above the $82,000 Fibonacci support and breaks through the $90,200 resistance, technical analysis suggests potential retest of the $95,000 psychological level. This scenario requires invalidating Dalio's skepticism through concrete institutional adoption signals, potentially from sovereign wealth funds or corporate treasuries expanding allocations. The Bullish Invalidation level stands at $78,500—a breach of the 200-day moving average would signal structural breakdown and likely precipitate a test of the $72,000 volume gap.

Bearish Case: Failure to hold $82,000 support amid persistent institutional skepticism could trigger a liquidity grab toward the $75,000 region, representing the 0.618 Fibonacci retracement. This scenario aligns with Dalio's central bank adoption concerns gaining traction among institutional allocators, potentially catalyzed by regulatory developments or CBDC advancements. The Bearish Invalidation level is $90,200—a sustained break above this resistance would negate the current corrective structure and suggest institutional flows overcoming skepticism.

What did Ray Dalio say about Bitcoin and central banks?Dalio argued that central banks are unlikely to hold Bitcoin due to government capacity to monitor or interfere with transactions, contrasting Bitcoin with gold which he described as "untouchable" by governments.

How much Bitcoin does Ray Dalio own?Dalio stated in November 2025 that he allocated approximately 1% of his personal portfolio to Bitcoin, representing a modest position despite his public skepticism.

What is Bitcoin's current price and market sentiment?Bitcoin trades at $86,907 with -0.79% 24-hour change amid Extreme Fear sentiment scoring 24/100 on the Crypto Fear & Greed Index.

What are the key technical levels for Bitcoin?Critical support exists at the $82,000 Fibonacci level with resistance at $90,200. Bullish invalidation occurs below $78,500 while bearish invalidation requires breaking above $90,200.

How does Dalio's view compare to previous institutional skepticism?Market structure suggests similar patterns to 2021 when institutional hesitation preceded a significant correction, though current conditions differ in macroeconomic backdrop and regulatory framework maturity.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.