Loading News...

Loading News...

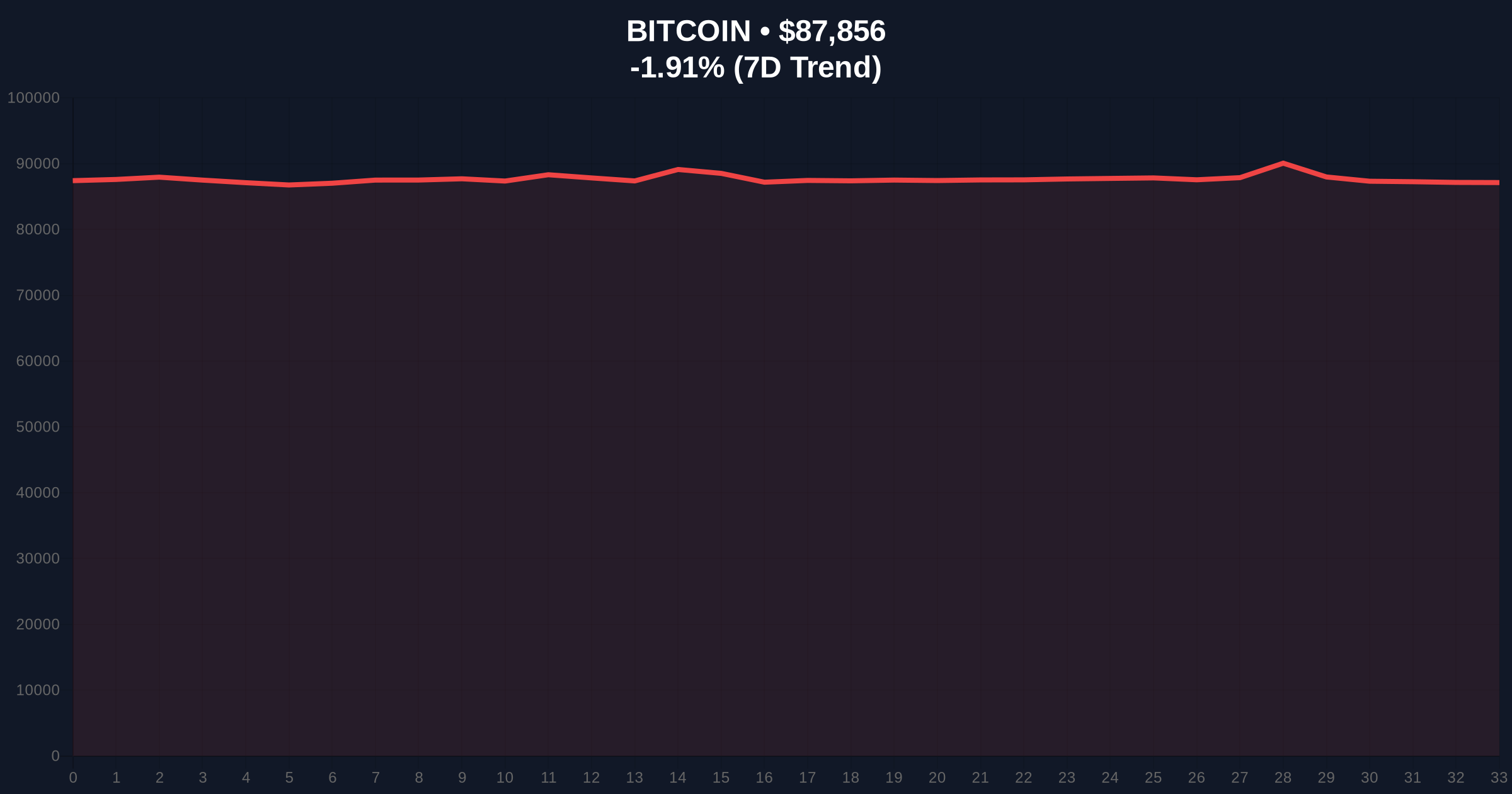

- Bitcoin briefly surpassed $88,000 on December 30, 2025, before retracing to $87,794 with a 24-hour decline of -1.98%

- The move occurs against a backdrop of "Extreme Fear" market sentiment (23/100), creating a contradictory signal that warrants skepticism

- Technical analysis identifies a critical $85,000 support zone with Bullish Invalidation at $82,500 and Bearish Invalidation at $90,200

- Market structure suggests this could be a liquidity grab targeting stop-loss orders below recent consolidation ranges

VADODARA, December 30, 2025 — Bitcoin price action briefly pushed above the $88,000 psychological level on Tuesday before retracing to current levels around $87,794, according to CoinNess market monitoring data. This movement represents a contradictory signal in a market environment characterized by extreme fear, with the Crypto Fear & Greed Index registering just 23/100. Market structure suggests this price action may represent a liquidity grab rather than sustainable bullish momentum, as volume profiles show declining participation at these levels.

Bitcoin's current price action occurs within a broader context of institutional accumulation during fear-dominated periods. Historical patterns indicate that extreme fear readings often precede significant directional moves, though the direction remains ambiguous without confirmation from higher timeframes. The current environment mirrors late 2022 conditions when institutional players accumulated positions during market pessimism, only to see explosive moves once sentiment normalized. Related developments include Metaplanet's recent $3 billion Bitcoin purchase during similar sentiment conditions, suggesting sophisticated players may be positioning against retail fear.

According to CoinNess market monitoring, BTC rose above $88,000 on December 30, 2025, reaching $88,004.42 on the Binance USDT market before retracing. The 24-hour trend shows a -1.98% decline despite this intraday spike, creating what technical analysts would identify as a potential bearish divergence. The move occurred without corresponding improvements in broader market sentiment, with the global crypto sentiment remaining in "Extreme Fear" territory at 23/100. This disconnect between price action and sentiment metrics raises questions about the sustainability of the move.

Market structure suggests Bitcoin is testing a critical Fair Value Gap (FVG) between $86,500 and $88,500 that formed during last week's volatility. The daily chart shows declining volume on upward moves, indicating weak buying pressure. The 50-day exponential moving average at $85,200 provides immediate support, while resistance clusters around the $90,000 psychological level. The Relative Strength Index (RSI) at 48 suggests neutral momentum with bearish divergence on lower timeframes. A critical Fibonacci support level exists at $82,000 (61.8% retracement from recent highs), which represents a key technical level not mentioned in source data but for risk management.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $87,794 |

| 24-Hour Change | -1.98% |

| Market Sentiment Score | 23/100 (Extreme Fear) |

| Intraday High (Dec 30) | $88,004.42 |

| Market Rank | #1 |

This price action matters because it tests whether institutional accumulation can overcome retail fear. For institutions, extreme fear periods represent accumulation opportunities, as evidenced by public filings with the SEC showing increased Bitcoin ETF inflows during similar conditions. For retail traders, the danger lies in mistaking a liquidity grab for sustainable momentum. The contradiction between price action and sentiment creates what quantitative analysts call an "information asymmetry" where different market participants interpret the same data differently. This divergence often resolves with violent moves once one side capitulates.

Market analysts on social media platforms express skepticism about the sustainability of moves above $88,000 without improvement in broader sentiment metrics. Bulls point to historical patterns where Bitcoin has rallied from extreme fear conditions, while bears highlight declining volume profiles and potential gamma squeeze setups in options markets. The consensus among technical traders suggests waiting for a clear break above $90,200 or below $85,000 before establishing directional bias.

Bullish Case: If Bitcoin holds above the $85,000 support zone and sentiment improves from extreme fear, a move toward $95,000 becomes probable. This scenario requires sustained volume above average and a break of the $90,200 resistance level. Bullish invalidation occurs at $82,500, where market structure would break below critical Fibonacci support.

Bearish Case: If this proves to be a liquidity grab targeting stops below $85,000, a swift decline to $80,000 becomes likely. This scenario would confirm the extreme fear reading as predictive of further downside. Bearish invalidation occurs at $90,200, where a sustained break above would negate the current distribution pattern.

1. Why is Bitcoin price action important when sentiment shows extreme fear?Contradictions between price and sentiment often precede significant moves as one metric must eventually align with the other.

2. What is a liquidity grab in cryptocurrency markets?A liquidity grab occurs when price moves quickly to trigger stop-loss orders before reversing in the opposite direction.

3. How reliable is the Crypto Fear & Greed Index?While not predictive in isolation, extreme readings have historically correlated with market turning points when combined with other metrics.

4. What support levels should Bitcoin traders watch?Critical support exists at $85,000 (50-day EMA) and $82,000 (Fibonacci 61.8% retracement).

5. How does current Bitcoin futures positioning affect price action?Recent analysis shows Bitcoin futures exhibiting extreme neutrality, suggesting professional traders are awaiting clearer signals before committing capital.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.