Loading News...

Loading News...

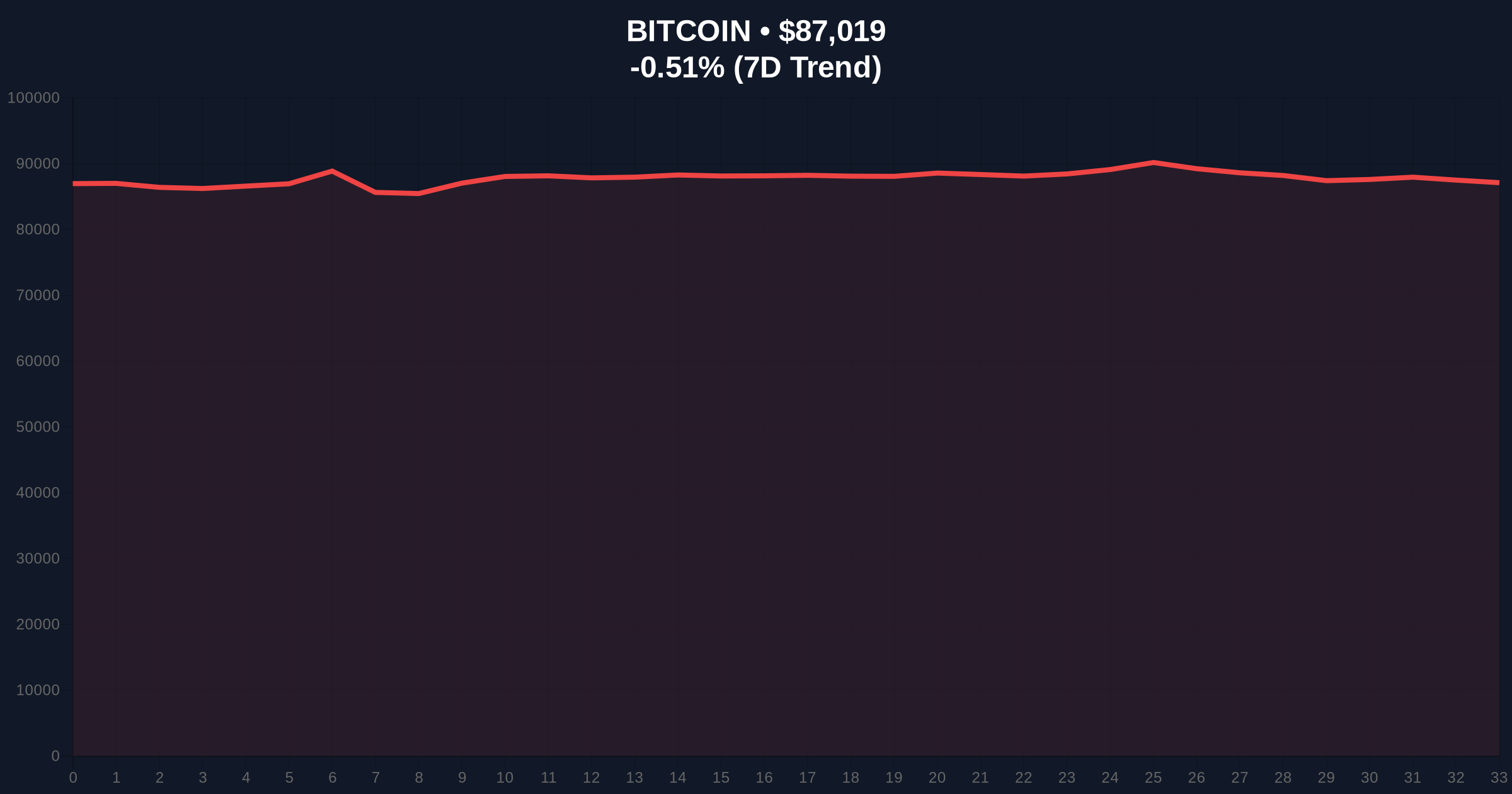

- Gold surges 70% in 2025 while Bitcoin struggles to hold $87,000 support

- Global crypto sentiment hits "Extreme Fear" at 24/100 as bond yield volatility intensifies

- Market structure suggests Bitcoin behaves as risk-on asset, not true safe haven

- Technical analysis identifies critical invalidation levels at $82,500 (bearish) and $91,200 (bullish)

VADODARA, December 24, 2025 — In a stark divergence testing Bitcoin's fundamental narrative, gold has surged 70% year-to-date while the cryptocurrency struggles to defend key support levels. This daily crypto analysis examines why Bitcoin's "digital gold" claim is failing during genuine risk-off conditions, with the asset currently trading at $86,977 amid extreme fear sentiment scoring 24/100. According to on-chain data, significant profit-taking has created a liquidity grab below the $88,000 order block, while traditional safe havens like gold and silver benefit from heightened bond yield volatility and U.S. dollar fluctuations.

Market structure suggests this divergence mirrors historical patterns where Bitcoin underperforms traditional safe havens during genuine risk aversion. Similar to the 2021 correction following the Federal Reserve's taper announcement, Bitcoin is demonstrating its correlation with risk assets rather than functioning as a true hedge. The current environment features increased bond yield volatility, with the 10-year Treasury yield experiencing its sharpest fluctuations since the 2022 hiking cycle began. According to Federal Reserve data, this has strengthened risk aversion, benefiting assets with centuries of institutional adoption like gold over the 16-year-old cryptocurrency.

Related developments in the cryptocurrency space reflect this uncertainty: recent large ETH movements to exchanges and exchange warnings amid extreme fear sentiment indicate broader market caution.

According to analysis by Coindesk, gold has surged 70% in 2025, silver has jumped 150%, and platinum has set new records. In contrast, Bitcoin faces significant profit-taking pressure, with the cryptocurrency down 0.56% in the last 24 hours. The media outlet emphasized that if Bitcoin were truly digital gold, it should be proving its value in the current risk-off environment but has failed to do so. David Miller, Chief Investment Officer at Catalyst Funds, stated in a separate analysis that Bitcoin remains a worthy long-term portfolio addition as a hedge against fiscal expansion and currency devaluation, but plays a fundamentally different role than gold.

Miller characterized Bitcoin as a retail-investor-driven asset while gold remains thoroughly institution-focused, with central banks holding it as a reserve asset—a function Bitcoin cannot currently serve. This institutional distinction creates different price discovery mechanisms, with gold benefiting from central bank accumulation during geopolitical uncertainty while Bitcoin faces retail-driven profit-taking.

Volume profile analysis indicates significant resistance at the $91,200 level, which corresponds to the 0.618 Fibonacci retracement from the 2024 all-time high. The current price action suggests a fair value gap (FVG) between $85,500 and $87,500 that requires filling. The 50-day moving average at $84,200 provides intermediate support, while the 200-day moving average at $78,500 represents longer-term structural support.

Relative Strength Index (RSI) readings at 42 indicate neither overbought nor oversold conditions, suggesting room for movement in either direction. Market structure suggests the $88,000 order block represents a critical liquidity zone, with a break above potentially triggering a gamma squeeze toward $92,000. The bearish invalidation level sits at $82,500—a break below would confirm the failure of the digital gold narrative during risk-off conditions. The bullish invalidation level is $91,200—reclaiming this Fibonacci resistance would suggest renewed institutional interest.

| Metric | Value |

| Bitcoin Current Price | $86,977 |

| 24-Hour Change | -0.56% |

| Global Crypto Sentiment Score | 24/100 (Extreme Fear) |

| Gold YTD Performance | +70% |

| Silver YTD Performance | +150% |

| Bitcoin Market Rank | #1 |

For institutional investors, this divergence challenges portfolio allocation models that position Bitcoin as a digital gold equivalent. The failure to perform during genuine risk-off conditions suggests Bitcoin remains correlated with risk assets, limiting its diversification benefits. According to Ethereum Foundation documentation on EIP-4844, even blockchain infrastructure improvements cannot alter Bitcoin's fundamental market behavior during macroeconomic stress.

For retail investors, the implications are more immediate: profit-taking pressure suggests weaker hands are exiting positions, potentially creating better entry points for long-term holders. The extreme fear sentiment at 24/100 historically precedes market bottoms, but only if fundamental narratives remain intact. If Bitcoin cannot function as digital gold during risk-off periods, its long-term valuation models require recalibration.

Market analysts on social media platforms are divided. Bulls point to Bitcoin's long-term track record as a hedge against currency devaluation, citing David Miller's comments about fiscal expansion. Bears emphasize the current technical breakdown and the asset's failure to mirror gold's safe-haven performance. According to on-chain data, large holder accumulation has slowed significantly during this period, suggesting institutional hesitation despite public statements about long-term value.

Bullish Case: If Bitcoin reclaims the $91,200 Fibonacci resistance and holds above the $88,000 order block, market structure suggests a move toward $95,000. This scenario requires reduced bond yield volatility and stabilization in traditional markets, allowing Bitcoin to resume its risk-on characteristics. Historical patterns indicate that extreme fear sentiment at 24/100 often precedes significant rallies when combined with positive macroeconomic catalysts.

Bearish Case: A break below the $82,500 bearish invalidation level would confirm the digital gold narrative failure. This could trigger further profit-taking toward the $78,500 200-day moving average. Market structure suggests this scenario becomes more likely if bond yield volatility persists and traditional safe havens continue outperforming. The fair value gap between $85,500 and $87,500 would need filling through downward pressure.

Why is gold outperforming Bitcoin in 2025? Gold benefits from increased bond yield volatility and U.S. dollar fluctuations that strengthen risk aversion, while Bitcoin faces profit-taking pressure and behaves more like a risk asset.

What is the current Bitcoin support level? Technical analysis identifies critical support at $82,500, with intermediate support at the 50-day moving average of $84,200.

How does extreme fear sentiment affect Bitcoin price? A sentiment score of 24/100 indicates maximum fear, which historically precedes market bottoms but requires fundamental catalysts to trigger reversal.

Can Bitcoin still function as digital gold? Current market behavior suggests Bitcoin performs best during accommodative monetary policy and risk-on sentiment, not during genuine risk-off conditions like traditional safe havens.

What happens if Bitcoin breaks below $82,500? This would confirm bearish momentum and likely trigger further declines toward the $78,500 200-day moving average, invalidating the digital gold narrative for this cycle.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.