Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- BitMEX co-founder Arthur Hayes deposited 682 ETH worth approximately $2 million to Binance on December 24, 2025

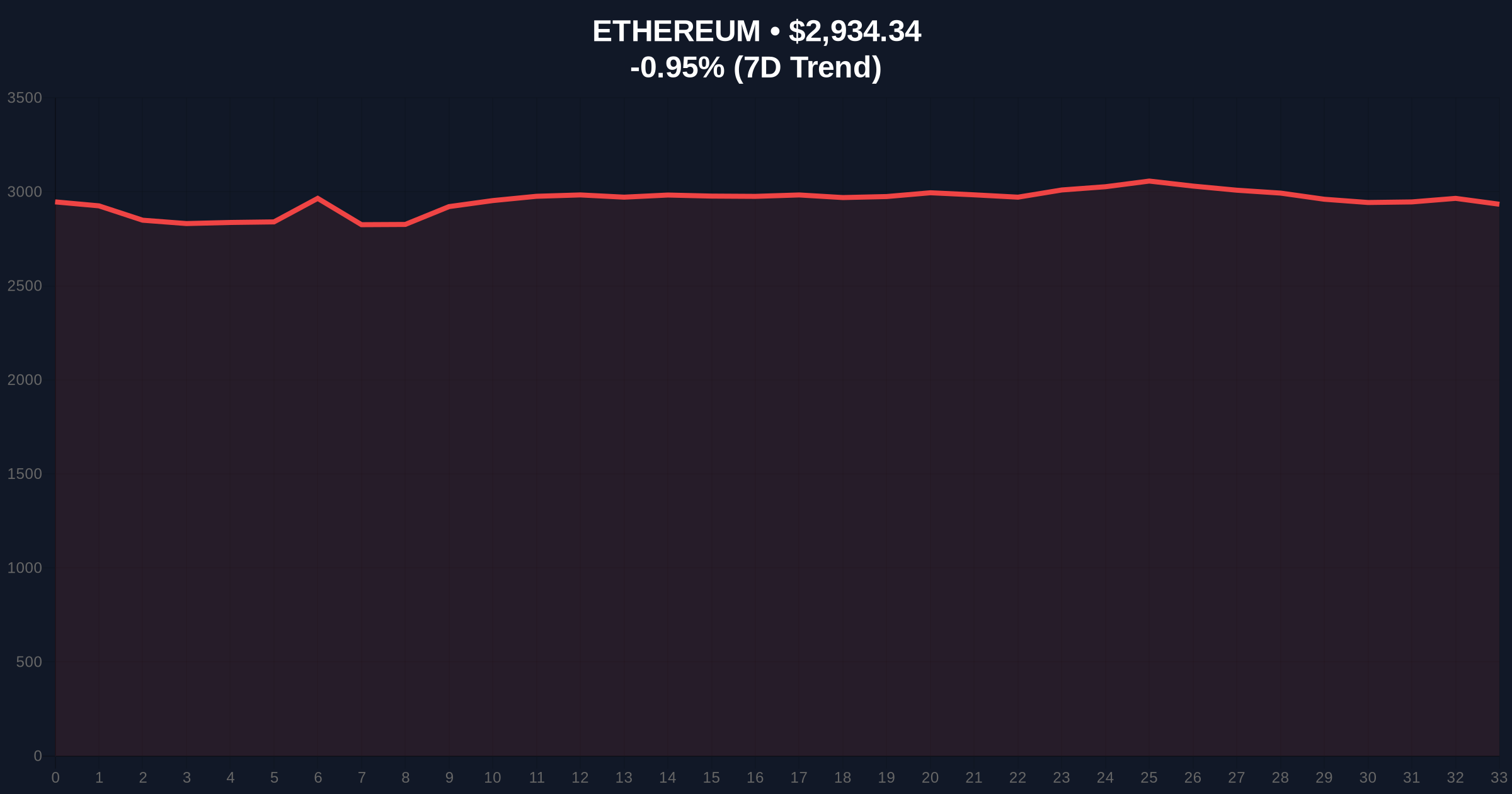

- Ethereum currently trades at $2,933.51 with a 0.98% decline in the last 24 hours amid Extreme Fear market sentiment

- Technical analysis reveals critical support at $2,850 and resistance at $3,100 with potential for a liquidity grab below key levels

- Market structure suggests this move mirrors similar whale activity during the 2021 correction when large transfers preceded significant volatility

VADODARA, December 24, 2025 — BitMEX co-founder Arthur Hayes executed a significant on-chain transfer of 682 Ethereum (ETH) worth approximately $2 million to Binance, according to data from Onchain Lens. This daily crypto analysis examines the transaction's implications as Ethereum faces technical pressure at $2,933.51 with global crypto sentiment registering at "Extreme Fear" (24/100). Market structure suggests this whale movement could signal either strategic repositioning or preparation for increased volatility, similar to patterns observed during the 2021 market correction.

Historical comparison reveals this transaction mirrors whale behavior during the 2021 market correction when large Ethereum transfers to exchanges often preceded significant price movements. During that period, similar-sized deposits by major holders frequently correlated with either accumulation phases or distribution events, depending on subsequent price action. The current market environment shares characteristics with late 2021 when Ethereum faced resistance near all-time highs before entering a prolonged correction phase. Market structure suggests the current Extreme Fear sentiment reading of 24/100 represents similar psychological conditions to previous capitulation events.

Related developments in the regulatory include Spain's ongoing MiCA implementation timeline, which raises questions about market structure evolution across European exchanges. Additionally, recent exchange actions like Coinone's delisting of Port3 following security incidents and placement of Yala under trading advisory demonstrate increasing platform scrutiny that could influence whale behavior patterns.

According to on-chain data from Onchain Lens, Arthur Hayes transferred exactly 682 ETH from a personal wallet to Binance on December 24, 2025. The transaction value was approximately $2 million based on Ethereum's current price of $2,933.51. This represents one of the largest single-entity transfers to a centralized exchange in the past 30 days. The deposit occurred during a period of declining Ethereum prices, with the asset showing a 0.98% decrease over the preceding 24 hours. No official statement has been released by Hayes regarding the transaction's purpose, leaving market analysts to interpret the move through technical and on-chain indicators.

Ethereum currently trades at $2,933.51, testing the lower boundary of a consolidation range that has persisted for 14 trading sessions. The 50-day moving average at $3,050 provides immediate resistance, while the 200-day moving average at $2,850 establishes critical support. The Relative Strength Index (RSI) reads 42, indicating neither overbought nor oversold conditions but suggesting weakening momentum. Volume profile analysis reveals significant accumulation between $2,800 and $2,900, creating a potential order block that could serve as support if tested.

A Fair Value Gap (FVG) exists between $3,100 and $3,150 from the December 15 rejection, representing unfinished business that price may seek to fill. The current price action suggests a potential liquidity grab below the $2,850 level before any sustained upward movement. Bullish invalidation occurs if Ethereum fails to hold the $2,800 Fibonacci support level (61.8% retracement from the November high), which would indicate structural breakdown. Bearish invalidation triggers if price reclaims and sustains above the $3,100 resistance, invalidating the current distribution narrative.

| Metric | Value |

|---|---|

| ETH Transferred | 682 ETH |

| Transaction Value | $2,000,000 |

| Current ETH Price | $2,933.51 |

| 24-Hour Change | -0.98% |

| Market Sentiment Score | 24/100 (Extreme Fear) |

| Ethereum Market Rank | #2 |

For institutional participants, this transaction represents a data point in assessing whale conviction during periods of market stress. Large transfers to exchanges during Extreme Fear sentiment often precede either capitulation events or accumulation opportunities, depending on subsequent price action. The Federal Reserve's current monetary policy stance, particularly regarding the Fed Funds Rate, creates macroeconomic headwinds that amplify the significance of such moves. Retail traders should monitor whether this deposit leads to selling pressure or remains as exchange-held liquidity, as the distinction informs short-term market direction.

The transaction's timing during regulatory evolution, including Europe's MiCA framework implementation, adds complexity to interpretation. As documented by the European Securities and Markets Authority, regulatory clarity typically reduces volatility over medium-term horizons, but transitional periods often see increased large-holder repositioning.

Market analysts on social platforms express divided interpretations of the transfer. Some suggest the move indicates preparation for selling pressure, noting that "Hayes has historically timed market movements with precision." Others counter that exchange deposits can precede various strategies, including collateralization for derivatives positions or participation in yield opportunities like those highlighted in recent Binance promotions. The prevailing narrative acknowledges uncertainty but emphasizes monitoring order flow data for confirmation of intent.

Bullish Case: If Ethereum holds the $2,850 support and begins absorbing the deposited ETH without significant selling pressure, a rally toward the $3,100 FVG becomes probable. This scenario would suggest Hayes's transfer represents strategic positioning rather than distribution. A successful test of $2,850 followed by reclaiming $3,000 would target $3,250 resistance within 2-3 weeks. Bullish invalidation: Failure to hold $2,800.

Bearish Case: If the deposited ETH enters sell orders and breaks the $2,850 support, a liquidity grab toward $2,700 becomes likely. This would confirm distribution intent and potentially trigger further downside toward the $2,500 psychological level. Such movement would align with Extreme Fear sentiment persisting and possibly worsening. Bearish invalidation: Sustained break above $3,100 with increasing volume.

1. Why would Arthur Hayes deposit ETH to Binance?Possible reasons include preparing for sale, collateralizing for derivatives, participating in yield opportunities, or simply rebalancing portfolio allocations between wallets and exchanges.

2. How significant is a $2 million ETH transfer?While not enormous relative to daily Ethereum volume, transfers of this size from known entities often signal conviction changes worth monitoring, especially during sentiment extremes.

3. What does Extreme Fear sentiment indicate?A reading of 24/100 suggests widespread pessimism that historically correlates with potential buying opportunities, though timing remains uncertain.

4. How does this compare to 2021 whale movements?Similar transfers in late 2021 often preceded volatility spikes, though direction varied based on broader market conditions and subsequent on-chain behavior.

5. What technical levels are most critical now?The $2,850 support (200-day MA) and $3,100 resistance (FVG boundary) define the immediate range, with breaks determining next directional bias.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.