Loading News...

Loading News...

- MSTR CEO Phong Le expresses optimism for Bitcoin in 2026 despite recent price drop below $87,000.

- Bitcoin's correction triggered an 8.5% decline in MSTR stock, highlighting correlation risks.

- Le cites potential Fed accommodation, midterm election risk-on environment, and institutional adoption as bullish catalysts.

- Market structure suggests current volatility represents a liquidity grab above the $85,000 psychological support.

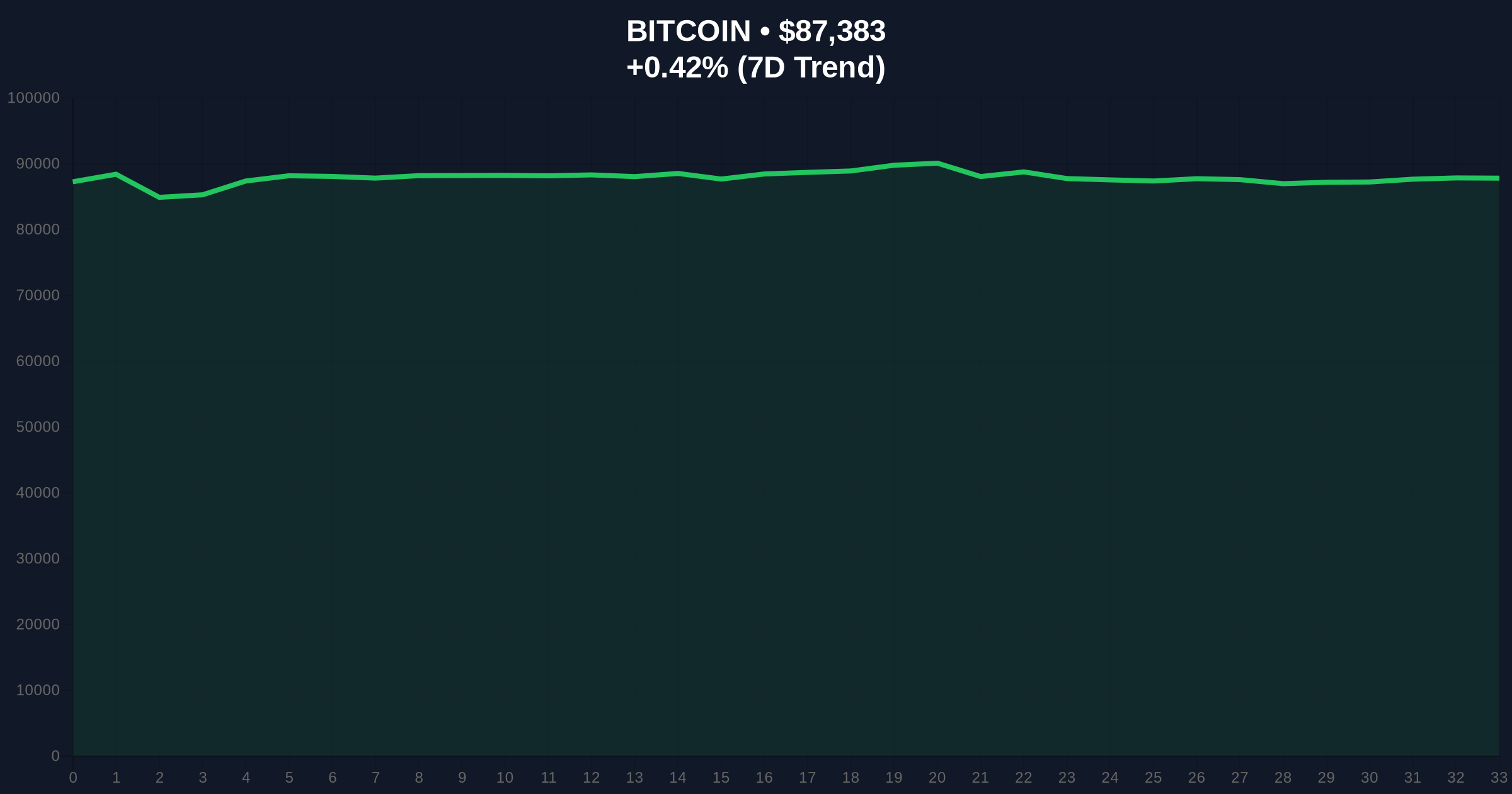

VADODARA, December 25, 2025 — In today's daily crypto analysis, Phong Le, CEO of Strategy (MSTR), has articulated a structurally bullish thesis for Bitcoin through 2026, despite the asset's recent breakdown below the $87,000 level. This commentary arrives as the Crypto Fear & Greed Index registers an "Extreme Fear" reading of 23/100, indicating severe market stress. According to on-chain data, the price action reflects a classic liquidity grab, where weak hands are being flushed from positions above key support zones.

Bitcoin's current correction mirrors the volatility patterns observed during the 2021 cycle, where sharp drawdowns of 20-30% preceded extended bullish phases. Market structure suggests these movements are necessary to reset leverage and establish higher-timeframe support. The correlation between Bitcoin's price and MSTR's stock performance—exemplified by the 8.5% decline in MSTR shares—highlights the embedded beta risk in corporate Bitcoin holdings. This dynamic creates a feedback loop where Bitcoin sell-offs pressure equity valuations, potentially triggering further deleveraging. Underlying this trend is the maturation of Bitcoin as a macro asset, increasingly sensitive to Federal Reserve policy shifts and institutional capital flows. Related developments in this environment include analysis of US firms dominating corporate Bitcoin holdings and exchanges maintaining over-collateralization amid extreme fear.

On December 25, 2025, Phong Le communicated to investors via The Daily Hodl that Bitcoin remains a "generational technological invention" combining innovations in macroeconomics and capital markets. He acknowledged short-term volatility akin to risk assets but projected a favorable 2026 outlook based on three catalysts: a more accommodative Federal Reserve stance, a risk-on environment during the midterm election season, and broader adoption by banks and state governments. This statement followed Bitcoin's drop below $87,000, which precipitated an 8.5% decline in MSTR's stock price. The price action represents a breakdown from a consolidation range that had held since early December, indicating a shift in market microstructure.

Bitcoin's current price of $87,384 sits just above the critical Fibonacci 0.618 retracement level at $85,000, drawn from the November 2024 low to the December 2025 high of $92,500. The Relative Strength Index (RSI) on the daily chart reads 42, suggesting neutral momentum with a bearish bias. The 50-day moving average at $88,200 now acts as immediate resistance, while the 200-day moving average at $82,000 provides longer-term support. Volume profile analysis indicates a high-volume node near $86,500, making this a zone for price discovery. A sustained break below this level would likely trigger stop-loss orders, creating a Fair Value Gap (FVG) down to $84,000. Market structure suggests the recent sell-off was a liquidity grab targeting leveraged long positions above $88,000. The Bullish Invalidation level is set at $82,000—a breach would invalidate the higher-timeframe uptrend. The Bearish Invalidation level is $90,000; a reclaim above this threshold would signal resumption of the bullish impulse.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $87,384 |

| 24-Hour Price Change | 0.43% |

| MSTR Stock Decline | 8.5% |

| Crypto Fear & Greed Index | 23/100 (Extreme Fear) |

| Bitcoin Market Rank | #1 |

For institutions, Le's outlook the strategic rationale for holding Bitcoin despite volatility, as detailed in corporate treasury frameworks like those discussed on SEC.gov. His emphasis on Fed policy and election cycles highlights Bitcoin's evolving role as a hedge against monetary debasement and political uncertainty. For retail traders, the correlation between Bitcoin and MSTR stock serves as a cautionary tale about concentration risk in crypto-correlated equities. The extreme fear sentiment suggests capitulation may be nearing, often a precursor to trend reversal. Consequently, this analysis provides a data-driven framework for assessing whether current prices represent a buying opportunity or a warning sign.

Market analysts on X/Twitter are divided. Bulls argue that Le's macro thesis aligns with historical patterns where Fed pivots catalyze crypto rallies. One analyst noted, "The midterm election cycle typically sees risk-on flows—Bitcoin could benefit from political liquidity injections." Bears counter that the extreme fear reading and breakdown below $87,000 indicate deeper structural issues, possibly linked to broader financial stress as seen in recent high-profile losses in Ethereum. The consensus is that Bitcoin's reaction to the $85,000 support will dictate near-term direction.

Bullish Case: If Bitcoin holds above the $85,000 Fibonacci support and the Fed signals accommodation in Q1 2026, a rally toward $95,000 is plausible. Increased adoption by state governments, as hinted by Le, could drive demand-side shocks. Market structure suggests a gamma squeeze above $90,000 could accelerate gains.Bearish Case: Failure to maintain $85,000 support risks a slide to the $82,000 200-day moving average. Persistent extreme fear sentiment and tighter monetary policy could extend the correction to $78,000. A break below the Bearish Invalidation at $82,000 would target order blocks near $75,000.

1. Why did MSTR stock drop 8.5%?MSTR stock declined due to its high correlation with Bitcoin's price, which fell below $87,000. The company's substantial Bitcoin holdings make its equity sensitive to crypto volatility.

2. What is the Crypto Fear & Greed Index?It's a sentiment indicator ranging from 0 (Extreme Fear) to 100 (Extreme Greed). A reading of 23 suggests widespread panic, often seen at market bottoms.

3. What are Phong Le's main reasons for Bitcoin optimism?Le cites potential Fed accommodation, a risk-on midterm election environment, and growing adoption by banks and state governments as key 2026 catalysts.

4. What is a liquidity grab in trading?A liquidity grab is a price move that triggers stop-loss orders or liquidates leveraged positions, allowing larger players to accumulate assets at better prices.

5. How does Bitcoin's current price compare to its all-time high?Bitcoin's all-time high is $92,500, reached in December 2025. The current price of $87,384 represents a 5.5% correction from that peak.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.