Loading News...

Loading News...

- LD Capital founder Jack Yi holds 645,000 ETH with an average purchase price of $3,150, resulting in an unrealized loss of $143 million at current prices.

- On-chain analyst Ai Yi projects the average cost basis could stabilize near $3,050 following a planned $1 billion fund investment.

- Market structure suggests Ethereum is testing a critical Fibonacci support level at $2,850, with the global crypto sentiment index at "Extreme Fear" (23/100).

- Historical patterns indicate similar whale distress occurred during the 2021 correction, often preceding significant liquidity events.

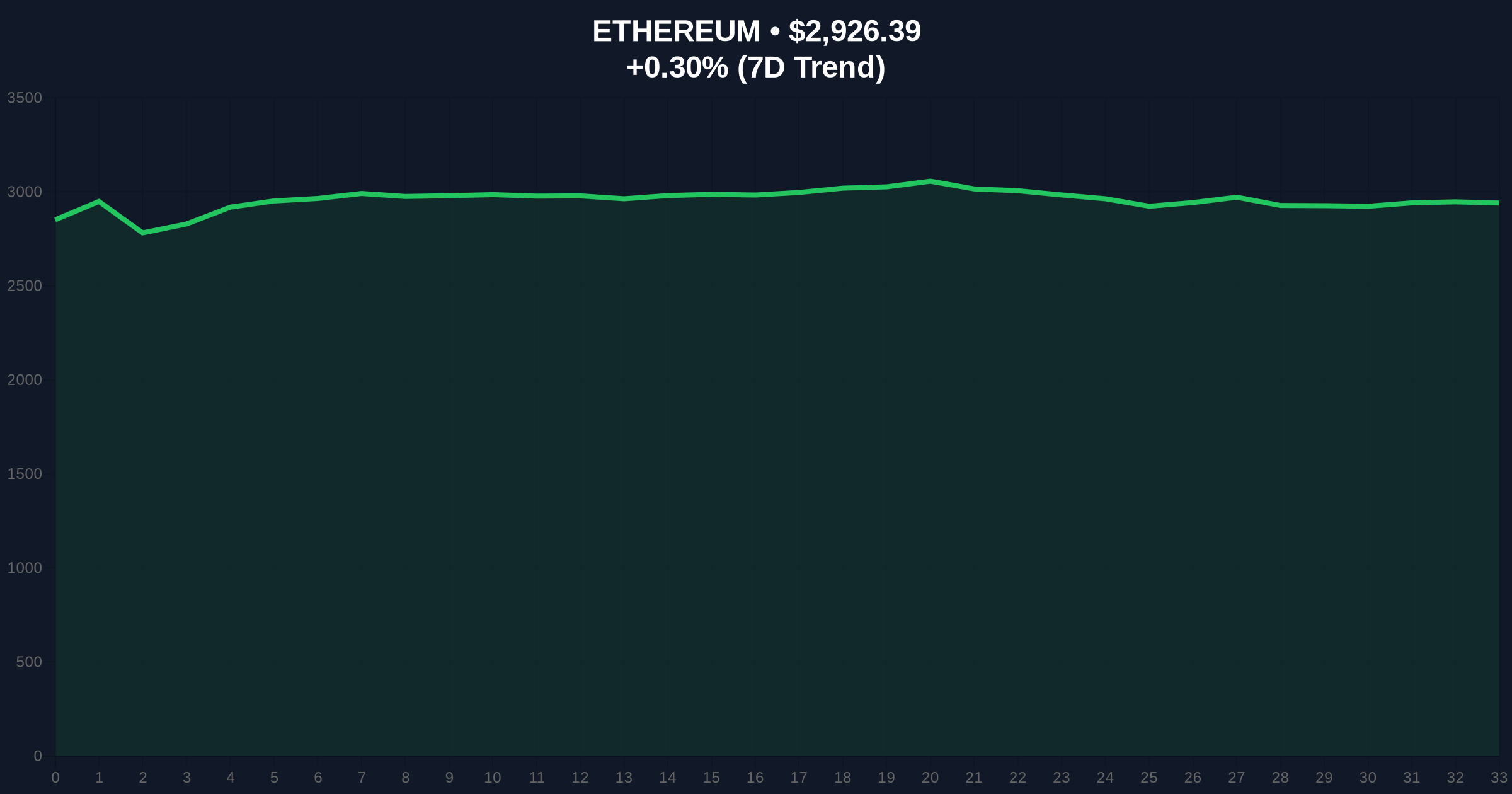

VADODARA, December 25, 2025 — Daily crypto analysis reveals that LD Capital founder Jack Yi is facing an unrealized loss of $143 million on his holdings of 645,000 ETH, according to on-chain data from analyst Ai Yi. This positions Yi's average purchase price at $3,150, with Ethereum currently trading at $2,926.69, down 0.31% in the last 24 hours. Market structure suggests this whale distress coincides with a global crypto sentiment reading of "Extreme Fear," mirroring conditions seen during previous major corrections.

Market context indicates this event parallels the 2021 Ethereum correction, where large holders faced similar unrealized losses during periods of extreme fear. In that cycle, ETH declined from an all-time high near $4,800 to below $2,000, triggering forced liquidations among over-leveraged institutions. The current scenario involves a planned $1 billion fund investment that could lower Yi's average cost basis to approximately $3,050, according to Ai Yi's analysis. This mirrors historical patterns where whale accumulation during downturns often precedes market stabilization, though it does not guarantee immediate price recovery. Related developments in the market include increased scrutiny on whale activity, as seen in recent ZEC accumulation reports, and exchanges maintaining over-collateralization amid volatility, detailed in Bybit's recent practices.

According to on-chain data shared by analyst Ai Yi on X, LD Capital founder Jack Yi acquired 645,000 ETH at an average price of $3,150. With Ethereum's current price at $2,926.69, this results in an unrealized loss of $143 million. Ai Yi further anticipates that once a planned $1 billion fund investment is completed, the average purchase price for these ETH holdings will stabilize around $3,050. This data point emerged on December 25, 2025, as part of broader market monitoring efforts. No official statement from Yi or LD Capital has been released, leaving the market to interpret the on-chain signals. The analysis aligns with regulatory frameworks emphasizing transparency, as outlined by the U.S. Securities and Exchange Commission for institutional disclosures.

Technical analysis reveals Ethereum is testing a critical Fibonacci support level at $2,850, derived from the 0.618 retracement of the 2023-2025 rally. The Relative Strength Index (RSI) currently sits at 38, indicating oversold conditions but not yet extreme. The 50-day moving average at $3,100 acts as immediate resistance, while the 200-day moving average at $2,800 provides secondary support. Volume profile analysis shows increased selling pressure near $3,000, creating a potential Fair Value Gap (FVG) between $2,900 and $3,050. Market structure suggests a liquidity grab below $2,850 could trigger stop-loss orders, exacerbating downward momentum. The bullish invalidation level is set at $2,800; a break below this point would invalidate the current support thesis. Conversely, the bearish invalidation level is $3,150; sustained trading above this would signal a reversal of the downtrend.

| Metric | Value |

|---|---|

| ETH Holdings (Jack Yi) | 645,000 ETH |

| Average Purchase Price | $3,150 |

| Unrealized Loss | $143 million |

| Current ETH Price | $2,926.69 |

| Global Crypto Sentiment | Extreme Fear (23/100) |

This matters institutionally as it highlights stress among large holders, potentially signaling broader market deleveraging. For retail investors, it the risks of concentrated positions during volatile periods. The planned $1 billion fund investment could introduce new buying pressure, but market structure suggests it may first target lowering cost bases rather than driving immediate price appreciation. Historical data indicates that similar whale distress in 2021 preceded a prolonged consolidation phase, impacting liquidity across derivatives markets. The event also relates to ongoing developments in market infrastructure, such as Upbit's maintenance affecting Korean liquidity and Russia's exchanges preparing for crypto trading, which could influence global ETH flows.

Community sentiment on X reflects cautious analysis, with many traders noting the extreme fear index as a contrarian indicator. Bulls argue that whale accumulation at these levels historically precedes rallies, citing similar patterns from 2020. Bears counter that the unrealized loss could force Yi to liquidate portions of his holdings, creating additional sell-side pressure. Market analysts emphasize that without a catalyst like EIP-4844 implementation or Fed rate cuts, Ethereum may struggle to reclaim key resistance levels. Overall, sentiment remains divided, with most discussions focusing on technical levels rather than speculative hype.

Bullish Case: If Ethereum holds the Fibonacci support at $2,850 and the global sentiment shifts from extreme fear, a rebound toward $3,300 is plausible. The planned $1 billion investment could provide a floor, with on-chain data indicating reduced selling pressure from large holders. Historical patterns suggest a 20-30% recovery within three months under similar conditions.

Bearish Case: A break below the bullish invalidation level at $2,800 could trigger a cascade of liquidations, pushing ETH toward $2,500. Prolonged extreme fear sentiment may lead to further deleveraging, with market structure pointing to a potential gamma squeeze in options markets exacerbating volatility. In this scenario, Yi's unrealized loss could deepen, influencing other institutional players to reduce exposure.

What is an unrealized loss in crypto? An unrealized loss occurs when the current market price of an asset is below its purchase price, but the asset has not been sold, meaning the loss exists only on paper.

How does whale activity affect Ethereum's price? Large holders like Jack Yi can influence price through their trading decisions; accumulation may support prices, while selling can increase volatility.

What is the significance of the extreme fear sentiment index? The index measures market emotion; extreme fear often indicates oversold conditions and can precede reversals, but it is not a timing tool.

What are Fibonacci support levels in technical analysis? These are price levels derived from mathematical ratios (e.g., 0.618) that traders use to identify potential support or resistance areas based on historical price movements.

How does on-chain data help in crypto analysis? On-chain data provides transparent insights into wallet movements, holdings, and transactions, allowing analysts to track whale behavior and market trends without relying solely on price action.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.