Loading News...

Loading News...

- US-based companies control 8 of the top 10 corporate Bitcoin treasuries globally.

- Strategy leads with 671,268 BTC, followed by MARA Holdings (53,250 BTC) and Twenty-One Capital (43,514 BTC).

- Market sentiment registers at "Extreme Fear" with a score of 23/100 despite Bitcoin trading at $87,405.

- This concentration creates a structural liquidity profile vulnerable to coordinated selling pressure.

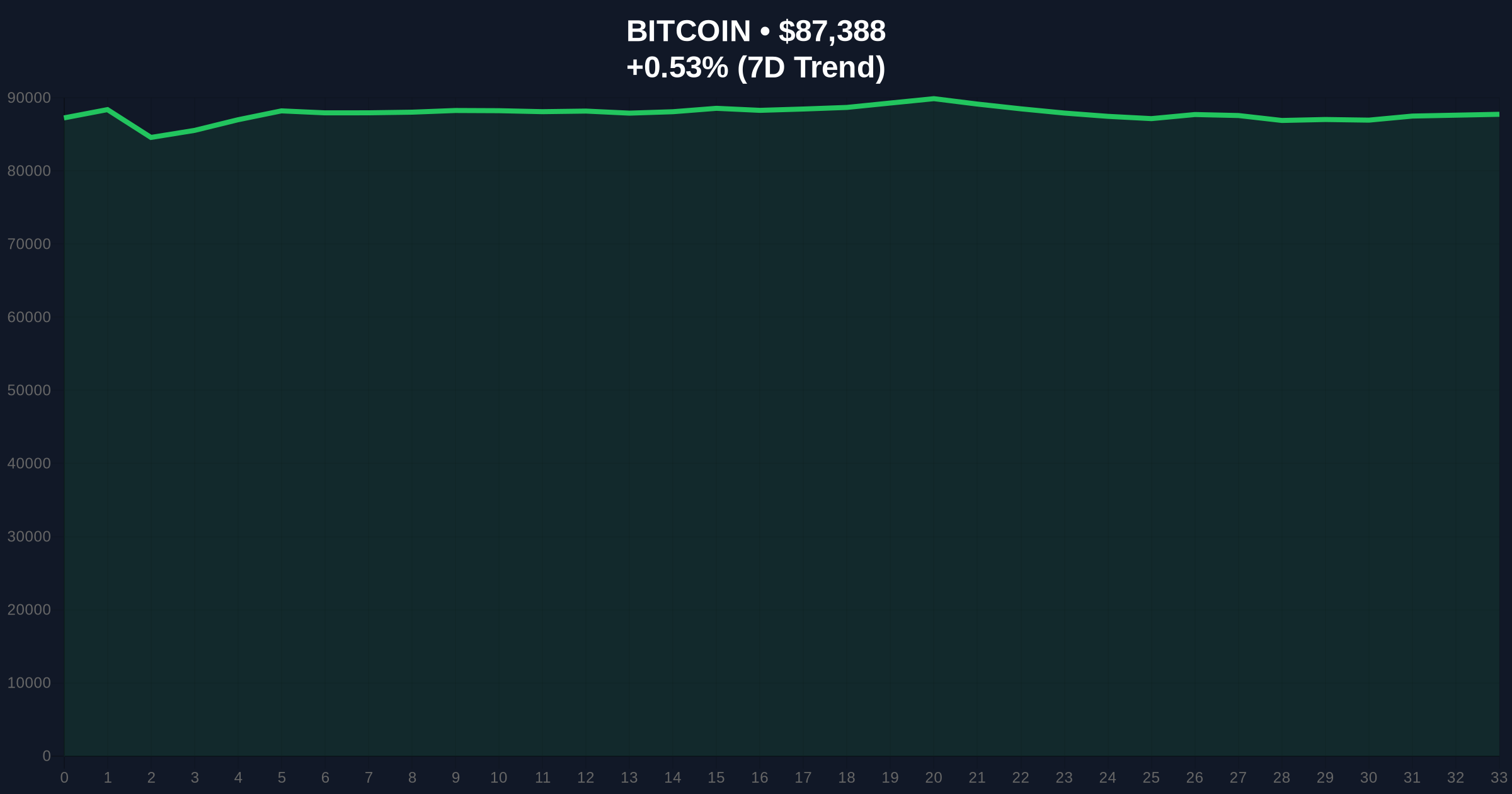

VADODARA, December 25, 2025 — A new analysis reveals US firms dominate corporate Bitcoin holdings, controlling eight of the top ten positions. This daily crypto analysis examines the implications for market structure amid extreme fear sentiment. According to DeFi analytics platform Sentora, formerly IntoTheBlock, the concentration creates significant on-chain liquidity pools. Strategy leads with 671,268 BTC, followed by MARA Holdings and Twenty-One Capital. Bitcoin currently trades at $87,405, up 0.55% in 24 hours.

Corporate Bitcoin adoption began accelerating in 2020 with MicroStrategy's initial purchases. The trend mirrored institutional interest during the 2021 bull run. Current holdings represent a structural shift from speculative retail accumulation to balance sheet allocation. Market structure suggests this concentration creates identifiable order blocks. These large positions act as potential liquidity magnets during volatility. The SEC's evolving stance on Bitcoin ETFs has influenced corporate strategy. Historical patterns indicate such concentrations precede periods of increased volatility. Related developments include recent market stress events like the LD Capital founder's $143M ETH loss and Bybit's over-collateralization during extreme fear.

Sentora's analysis identified the top corporate Bitcoin treasuries. Strategy holds 671,268 BTC, valued at approximately $58.7 billion at current prices. MARA Holdings follows with 53,250 BTC ($4.65 billion). Twenty-One Capital holds 43,514 BTC ($3.8 billion). The remaining US firms in the top ten include undisclosed positions ranging from 15,000 to 40,000 BTC. Only two non-US companies made the list. The data reflects holdings as of December 24, 2025. This represents the most comprehensive snapshot of corporate Bitcoin allocation since 2023.

Bitcoin trades at $87,405, testing the weekly Fibonacci 0.618 retracement level from the 2024 high. The RSI sits at 42, indicating neutral momentum with bearish divergence on the daily chart. The 50-day moving average provides dynamic resistance at $89,200. Volume profile shows increased accumulation between $82,000 and $85,000. This zone represents a significant fair value gap (FVG) from October's rally. Market structure suggests a potential liquidity grab below $85,000 to trigger stop losses. The concentration of corporate holdings creates identifiable invalidation levels. Bullish invalidation: A sustained break below $82,000 would invalidate the current accumulation thesis. Bearish invalidation: A weekly close above $92,000 would signal renewed institutional demand.

| Metric | Value |

|---|---|

| Top Corporate Holder (Strategy BTC) | 671,268 |

| Second Holder (MARA Holdings BTC) | 53,250 |

| Third Holder (Twenty-One Capital BTC) | 43,514 |

| Current Bitcoin Price | $87,405 |

| Fear & Greed Index Score | 23/100 (Extreme Fear) |

For institutions, this concentration creates systemic risk. Coordinated selling from one major holder could trigger cascading liquidations. The SEC's regulatory framework, detailed on SEC.gov, influences corporate disclosure requirements. For retail, these positions represent potential gamma squeeze catalysts during volatility events. Market structure suggests reduced liquidity during stress periods. The dominance of US firms indicates regulatory acceptance despite political rhetoric. This allocation pattern mirrors traditional corporate treasury management with digital assets.

Market analysts express concern about concentration risk. "Large corporate holdings create identifiable liquidation clusters," noted one quantitative researcher on X. Bulls highlight the long-term holding pattern as bullish for scarcity. Bears point to potential regulatory pressure following recent enforcement actions. The extreme fear sentiment contradicts the fundamental strength suggested by corporate accumulation. This divergence creates trading opportunities for volatility strategies.

Bullish Case: Corporate holding patterns indicate long-term conviction. A break above $92,000 could trigger a short squeeze targeting $95,000. Institutional inflows following Bitcoin ETF approvals could amplify momentum. The Fed's potential rate cuts in 2026 might provide macro tailwinds. Market structure suggests a retest of all-time highs if $85,000 support holds.

Bearish Case: Extreme fear sentiment persists. A break below $82,000 could trigger stop losses from corporate holders. Regulatory uncertainty remains a headwind. Technical indicators show weakening momentum. The concentration risk increases vulnerability to black swan events. Market structure suggests a test of $78,000 if the current support fails.

1. Which company holds the most Bitcoin?Strategy holds 671,268 BTC, making it the largest corporate Bitcoin treasury.

2. What is the Fear & Greed Index currently?The index reads 23/100, indicating "Extreme Fear" market sentiment.

3. How many US firms are in the top 10 Bitcoin holders?Eight of the top ten corporate Bitcoin treasuries are US-based companies.

4. What is Bitcoin's current price?Bitcoin trades at $87,405, up 0.55% in the last 24 hours.

5. Why does corporate Bitcoin concentration matter?Large concentrated holdings create liquidity risks and potential volatility triggers during market stress.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.