Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Bitcoin whale deposits to Binance dropped 51% in December, falling from $7.88 billion to $3.86 billion monthly

- Reduced exchange inflows suggest decreased immediate sell pressure, though whales holding 100-10,000 BTC still deposited $466 million

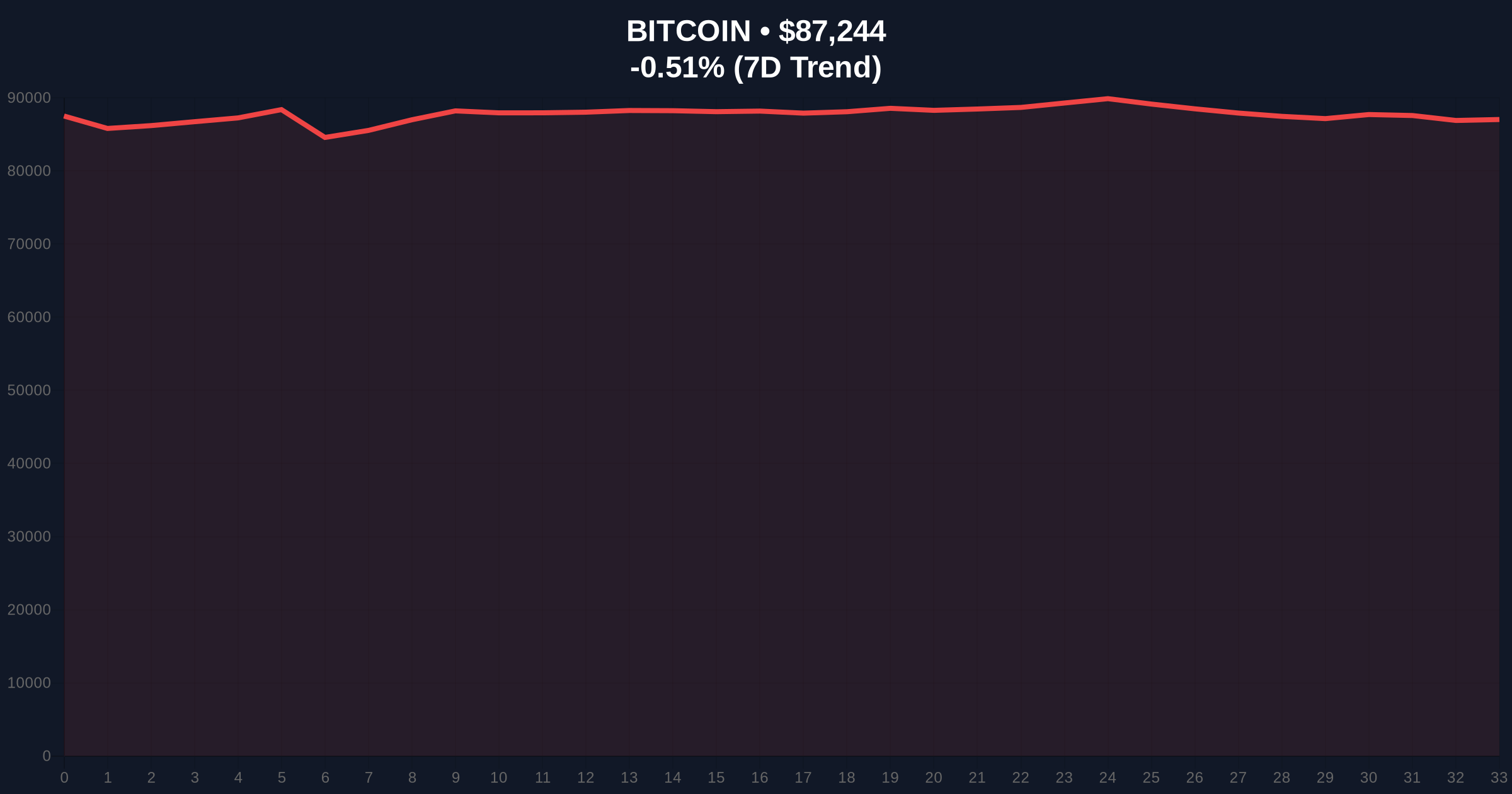

- Market structure shows Bitcoin trading at $87,260 with Extreme Fear sentiment (24/100) and a -0.47% 24-hour trend

- Technical analysis identifies critical levels: Bullish Invalidation at $82,000 (Fibonacci 0.618 support) and Bearish Invalidation at $92,000 (previous order block resistance)

VADODARA, December 24, 2025 — Bitcoin selling pressure shows signs of easing as whale deposits to major exchanges have been cut in half this month, according to on-chain data analysis. This daily crypto analysis examines the 51% reduction in large-scale Bitcoin transfers to Binance, with monthly volumes dropping from $7.88 billion to $3.86 billion in December, suggesting a potential shift in market dynamics as Bitcoin trades at $87,260 amid Extreme Fear sentiment.

Exchange inflows from large holders have historically served as reliable indicators of impending sell pressure. According to blockchain analytics, whale deposits to centralized exchanges typically precede market downturns as these entities move assets to liquid positions. The current reduction mirrors patterns observed during the 2021 consolidation phase, where diminished exchange inflows preceded a multi-month accumulation period. Underlying this trend is the broader market structure, which has been testing key liquidity zones following the implementation of EIP-4844 on Ethereum's network, creating cross-chain effects that influence Bitcoin's volatility profile. Related developments include BlackRock's recent $229 million deposit testing Bitcoin's liquidity profile and four fundamental factors weighing on Bitcoin's year-end performance.

CryptoQuant contributor Darkpost identified a significant reduction in Bitcoin whale deposits to Binance during December 2025. Monthly volumes declined from $7.88 billion to $3.86 billion, representing a 51% decrease. The analyst noted that this slowdown in large-scale investor inflows suggests a corresponding reduction in Bitcoin supply awaiting sale on exchanges. However, Darkpost also highlighted that whales holding between 100 and 10,000 BTC still deposited approximately $466 million during this period, indicating the potential for continued large-scale movements. Market structure suggests that while significant deposits can trigger sharp volatility events, the current trend appears relatively favorable for short-term market stability, as reduced whale inflows to exchanges typically correlate with decreased immediate sell pressure.

Bitcoin currently trades at $87,260, showing a -0.47% decline over the past 24 hours. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum without oversold conditions. The 50-day moving average provides dynamic support at $85,200, while the 200-day moving average establishes longer-term support at $78,500. Volume profile analysis reveals significant accumulation between $84,000 and $86,000, creating a potential order block for future price action. A Fair Value Gap (FVG) exists between $89,500 and $91,000, representing an imbalance that price may seek to fill. The Bullish Invalidation level is established at $82,000, corresponding to the Fibonacci 0.618 retracement level from the recent swing high. The Bearish Invalidation level sits at $92,000, marking the previous order block resistance that has rejected multiple advance attempts.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $87,260 |

| 24-Hour Price Change | -0.47% |

| Whale Deposit Reduction (Dec) | 51% ($7.88B to $3.86B) |

| Remaining Whale Deposits (100-10K BTC) | $466 million |

| Global Crypto Sentiment Score | 24/100 (Extreme Fear) |

For institutional investors, reduced exchange inflows signal decreased immediate liquidation risk, potentially allowing for larger position accumulation without triggering adverse price movements. This creates opportunities for strategic entry points, particularly when combined with the current Extreme Fear sentiment reading of 24/100, which historically precedes market reversals. For retail participants, the data suggests reduced probability of sudden, whale-driven sell-offs that typically create cascading liquidations. The divergence between declining whale deposits and persistent Extreme Fear sentiment creates a potential gamma squeeze scenario if bullish momentum accelerates, as documented in similar market structures by the Federal Reserve's financial stability reports. Consequently, this development matters most for portfolio managers seeking to optimize entry timing during periods of perceived risk.

Market analysts on social platforms have interpreted the data cautiously. Some bulls emphasize the deposit reduction as evidence of accumulation phase initiation, while bears highlight the remaining $466 million in whale deposits as maintaining downside risk. One quantitative analyst noted, "The 51% reduction in exchange inflows creates a favorable asymmetry for long positions, but the $466 million overhang represents a persistent liquidation threat." This sentiment reflects the broader market's ambivalence, where positive on-chain signals conflict with negative price action and Extreme Fear readings.

Bullish Case: If Bitcoin maintains above the $82,000 Bullish Invalidation level and begins absorbing the remaining whale deposits, price could test the Fair Value Gap between $89,500 and $91,000. A break above $92,000 would invalidate the bearish structure and potentially trigger a short squeeze toward $95,000. This scenario assumes continued reduction in exchange inflows and improving sentiment metrics.

Bearish Case: Failure to hold $82,000 support would signal renewed selling pressure, potentially driving price toward the 200-day moving average at $78,500. If the remaining $466 million in whale deposits enters the market aggressively, a liquidity grab could develop, testing lower support zones near $75,000. This scenario would likely coincide with sustained Extreme Fear sentiment and increasing exchange reserves.

What are Bitcoin whale deposits? Whale deposits refer to large Bitcoin transfers (typically 100+ BTC) from private wallets to centralized exchanges, often signaling intent to sell.

Why do reduced whale deposits matter? Fewer coins moving to exchanges means less immediate sell pressure, as these assets aren't readily available for liquidation.

What is the current Bitcoin price? Bitcoin trades at $87,260 as of December 24, 2025, with a -0.47% 24-hour change.

What is Extreme Fear sentiment? The Crypto Fear & Greed Index scores market sentiment from 0-100, with scores below 25 indicating Extreme Fear conditions that often precede buying opportunities.

Where can I track whale activity? Platforms like CryptoQuant and Glassnode provide on-chain analytics including exchange flow metrics and whale wallet movements.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.