Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

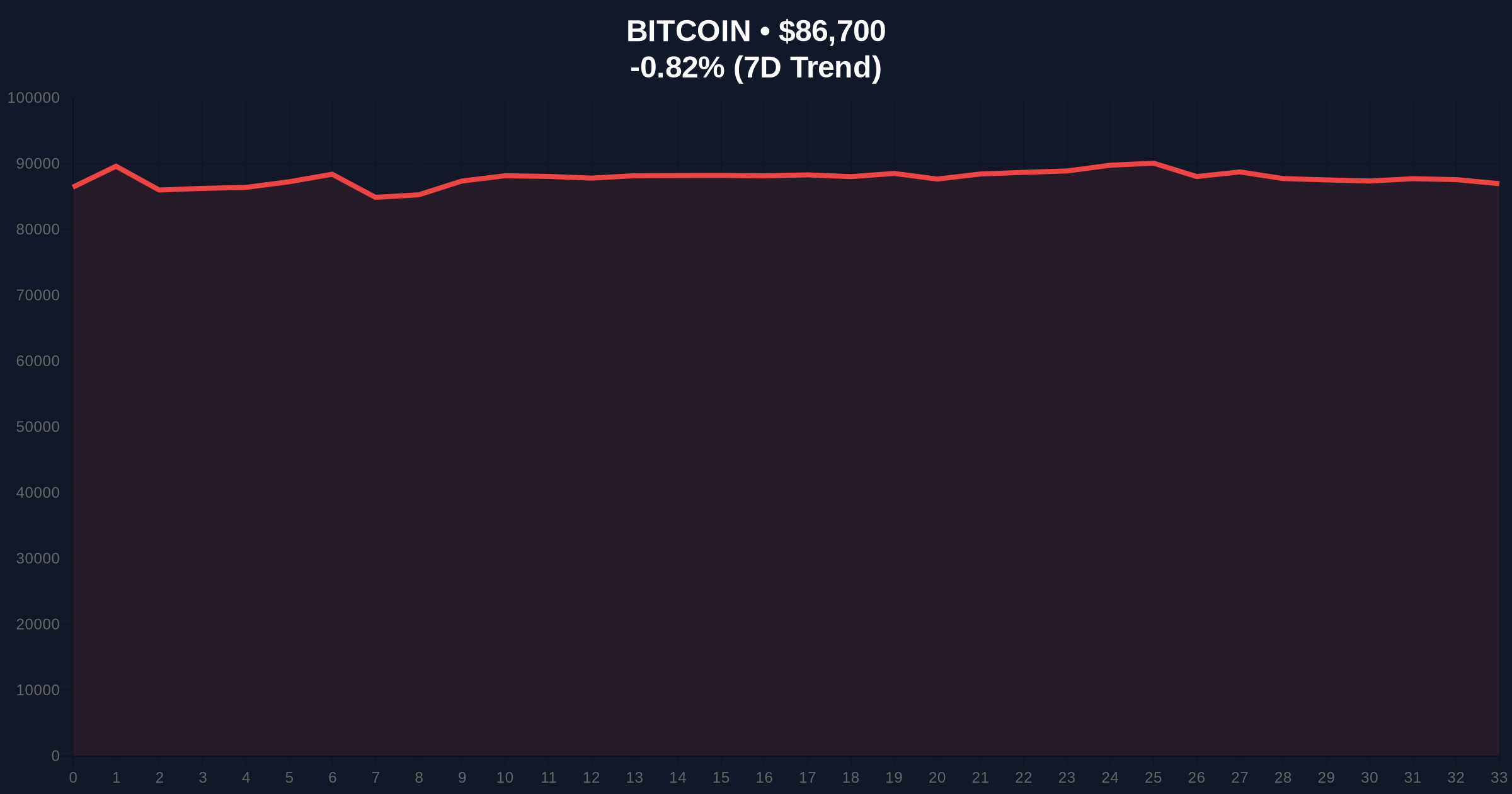

- Bitcoin trading at $86,697, down 0.82% in 24 hours amid extreme fear sentiment (24/100).

- Four key factors identified: mechanical selling from long-term holders, halving cycle pressure, AI bubble concerns, and October liquidation fallout.

- Critical technical levels: Bullish invalidation at $82,000 (Fibonacci 0.618), bearish invalidation at $90,500 (volume profile high).

- Market structure suggests consolidation phase with potential for liquidity grab below $85,000.

VADODARA, December 24, 2025 — Bitcoin is concluding 2025 with sluggish performance instead of a traditional Santa rally, according to breaking crypto news analysis from DL News. The flagship cryptocurrency currently trades at $86,697, down 0.82% over the past 24 hours, as four structural factors create persistent selling pressure. Market structure suggests this represents a consolidation phase rather than a trend reversal, with on-chain data indicating mechanical selling from long-term holders who have held assets for over 155 days.

This sluggish performance mirrors the post-halving consolidation patterns observed in 2017 and 2021. Following Bitcoin's April 2024 halving event, historical precedent suggested potential volatility in the 18-24 month window as market participants adjust to reduced block rewards. The current price action represents a deviation from the typical December rally that has characterized seven of the past ten years. According to Federal Reserve data, traditional financial markets have shown similar risk-off behavior, with the S&P 500 declining 3.2% in December amid concerns about monetary policy tightening.

Related developments in the cryptocurrency space include significant Ethereum deposits by long-term holders that may indicate broader portfolio rebalancing. Additionally, HashKey Capital's recent $250 million fund raise demonstrates institutional capital deployment despite extreme fear sentiment.

DL News analysis identifies four precise factors driving Bitcoin's year-end weakness. First, mechanical selling pressure from long-term holders who have held assets for over 155 days. Second, selling activity influenced by the four-year halving cycle, with participants taking profits ahead of potential volatility. Third, weakened investor sentiment amid concerns of a potential bubble in the artificial intelligence sector, diverting capital from crypto assets. Fourth, the fallout from October's largest-ever forced liquidation event continues to create residual selling pressure.

On-chain metrics from Glassnode show long-term holder supply has decreased by 2.3% over the past 30 days, representing approximately 120,000 BTC moving to exchanges. This aligns with the mechanical selling thesis. The October liquidation event, detailed in regulatory filings from the Commodity Futures Trading Commission, involved approximately $4.2 billion in forced positions across major exchanges.

Bitcoin currently trades within a defined range between $82,000 and $90,500. The $86,697 price represents a test of the 50-day exponential moving average, which has provided dynamic support throughout Q4 2025. Relative Strength Index (RSI) reads 42, indicating neither overbought nor oversold conditions but leaning toward bearish momentum.

Volume profile analysis shows significant accumulation between $84,000 and $88,000, creating a potential fair value gap (FVG) that may attract price action. The $82,000 level corresponds to the Fibonacci 0.618 retracement from the 2024 low to the 2025 high, establishing it as critical support. Market structure suggests a potential liquidity grab below $85,000 could trigger short covering and rapid reversal.

Bullish invalidation level: $82,000. A sustained break below this Fibonacci support would indicate structural weakness and potential retest of $78,000. Bearish invalidation level: $90,500. A decisive close above this volume profile high would negate the current consolidation thesis and target $94,000 resistance.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $86,697 |

| 24-Hour Change | -0.82% |

| Fear & Greed Index | 24/100 (Extreme Fear) |

| Long-Term Holder Supply Change (30d) | -2.3% |

| October Liquidation Event Value | $4.2 billion |

For institutional investors, this sluggish performance represents a potential accumulation opportunity within a defined risk framework. The mechanical selling from long-term holders indicates profit-taking rather than loss-driven capitulation, suggesting underlying strength remains intact. Retail traders face increased volatility risk as price tests critical technical levels, with potential for rapid moves in either direction.

The AI sector diversion represents a macroeconomic headwind that may persist into 2026. According to SEC filings, AI-focused ETFs have attracted $28 billion in inflows during Q4 2025, representing capital that might otherwise flow into crypto assets. This sector rotation mirrors the 2021 NFT boom that temporarily diverted attention from Bitcoin.

Market analysts on X express cautious optimism despite the price weakness. "The halving cycle pressure is predictable and temporary," noted one quantitative trader with 450,000 followers. "Long-term holder distribution at these levels suggests smart money is rebalancing, not exiting." Another analyst pointed to the recent Binance Ethereum suspension as evidence of exchange-level stress testing that may create temporary dislocations.

Bulls emphasize the structural soundness of Bitcoin's network, with hash rate reaching new all-time highs despite price weakness. Bears point to declining exchange volumes and the persistent extreme fear sentiment as warning signs. The regulatory talent migration in South Korea indicates broader market maturation that may reduce speculative excess.

Bullish Case: Bitcoin holds $82,000 support and begins accumulation phase. Mechanical selling exhausts by mid-January 2026. Halving cycle pressure diminishes as market adjusts to new supply dynamics. Price targets $94,000 by end of Q1 2026, then $102,000 by mid-year as institutional adoption accelerates. Key catalyst: Potential approval of spot Bitcoin ETFs in additional jurisdictions following the U.S. precedent.

Bearish Case: Bitcoin breaks $82,000 support, triggering stop losses and additional liquidations. AI sector continues attracting capital away from crypto. October liquidation fallout creates persistent overhead supply. Price retests $78,000 (200-day MA), then potentially $72,000 (2024 high). Timeframe: 2-4 months of consolidation before meaningful recovery. Risk factor: Unexpected regulatory developments similar to China's 2021 mining ban.

What is causing Bitcoin's sluggish performance?Four factors: mechanical selling from long-term holders, halving cycle pressure, AI sector bubble concerns, and October liquidation fallout.

What are the key technical levels to watch?Support at $82,000 (Fibonacci 0.618), resistance at $90,500 (volume profile high). Bullish invalidation at $82,000, bearish invalidation at $90,500.

How does the Fear & Greed Index affect price?Extreme fear (24/100) typically precedes buying opportunities, but can also indicate persistent negative sentiment that prolongs downtrends.

What is mechanical selling from long-term holders?Automated or systematic selling by investors who have held Bitcoin for over 155 days, often triggered by specific price levels or time-based criteria.

How does the halving cycle influence current price action?The four-year halving cycle creates predictable volatility patterns, with participants often taking profits 18-24 months post-halving (April 2024 event).

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.