Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- BlackRock deposited $200M in Bitcoin and $29.23M in Ethereum to Coinbase Prime on December 24, 2025.

- Market structure suggests this could be a liquidity grab ahead of potential volatility.

- Technical analysis identifies $85,200 as Bullish Invalidation and $82,000 as Bearish Invalidation.

- Global crypto sentiment remains at "Extreme Fear" with a score of 24/100.

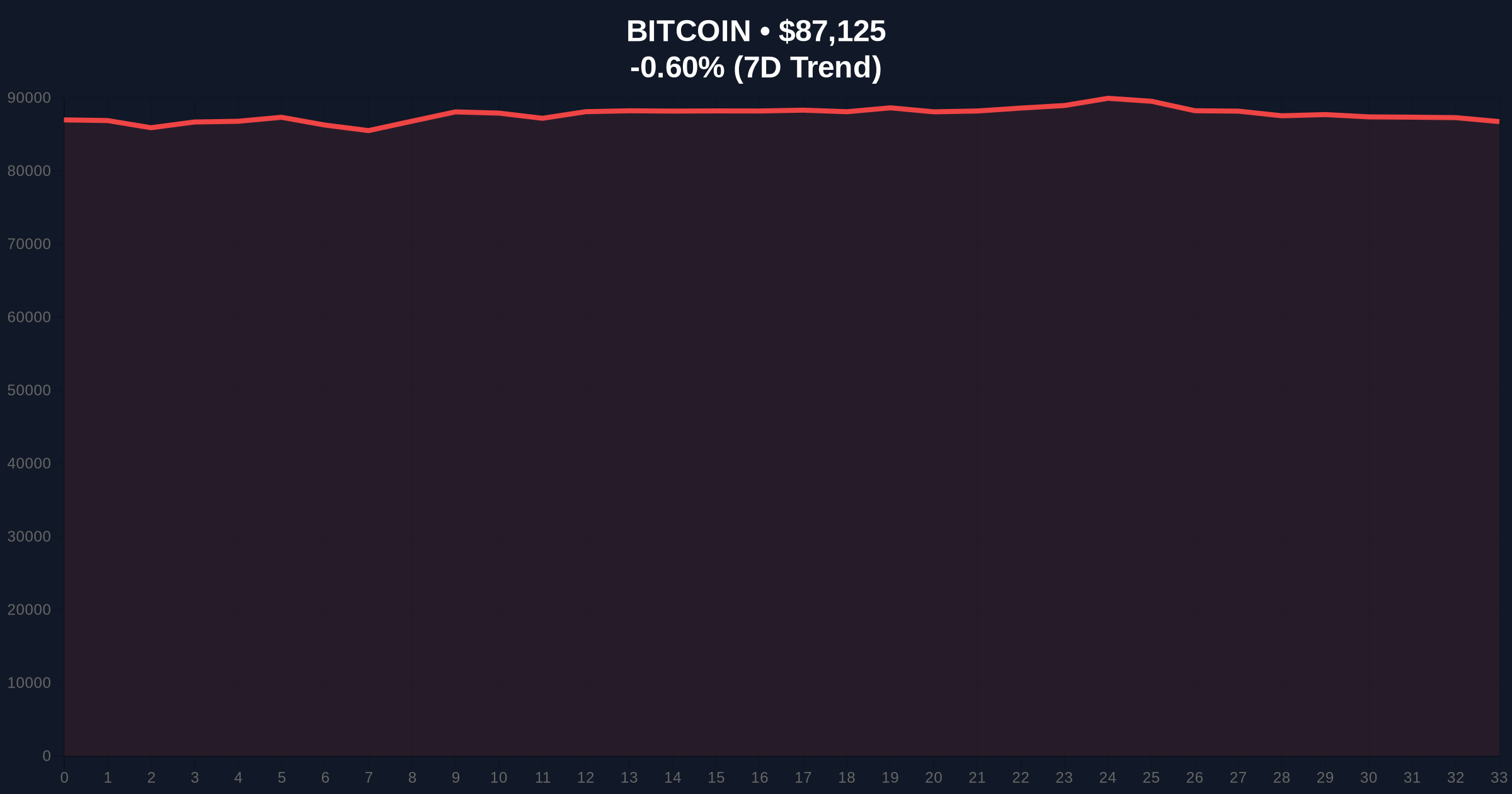

VADODARA, December 24, 2025 — BlackRock has deposited 2,292 BTC valued at $200 million and 9,976 ETH worth $29.23 million to Coinbase Prime, according to on-chain data from Onchain-Lense. This daily crypto analysis examines whether this institutional move represents strategic accumulation or preparation for a liquidity event as Bitcoin trades at $87,104 with a 24-hour decline of -0.63%.

Institutional deposits of this magnitude typically signal either accumulation phases or preparation for large-scale transactions. The timing is particularly notable given the current "Extreme Fear" sentiment reading of 24/100 on the Crypto Fear & Greed Index. Market structure suggests this mirrors patterns observed during the 2021-2022 cycle when institutional inflows preceded both rallies and corrections. Coinbase Prime serves as a prime brokerage platform for institutional investors, making this deposit potentially indicative of broader institutional positioning rather than isolated activity.

Related developments include recent analysis of Robert Kiyosaki's Bitcoin silence testing market sentiment and examination of factors weighing on Bitcoin's year-end performance.

According to on-chain data from Onchain-Lense, BlackRock transferred exactly 2,292 BTC and 9,976 ETH to Coinbase Prime custody addresses on December 24, 2025. The Bitcoin portion represents approximately $200 million at current prices, while the Ethereum allocation equals $29.23 million. This follows BlackRock's established pattern of utilizing Coinbase Prime for institutional-scale cryptocurrency operations. The deposit represents one of the largest single institutional movements tracked this quarter, though it constitutes less than 0.5% of BlackRock's reported digital asset holdings.

Bitcoin currently trades at $87,104, testing the 50-day exponential moving average at $86,800. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias. Volume profile analysis shows significant accumulation between $84,000 and $86,000, creating a potential order block. A Fair Value Gap (FVG) exists between $88,500 and $90,200 from last week's rejection.

Bullish Invalidation Level: $85,200 - The weekly support confluence including the 0.382 Fibonacci retracement from the November low. Breach would invalidate accumulation thesis.

Bearish Invalidation Level: $82,000 - The psychological round number coinciding with the 200-day simple moving average and EIP-4844 implementation support zone. Recovery above suggests institutional buying pressure.

| Metric | Value |

|---|---|

| BlackRock BTC Deposit | 2,292 BTC ($200M) |

| BlackRock ETH Deposit | 9,976 ETH ($29.23M) |

| Current Bitcoin Price | $87,104 |

| 24-Hour Bitcoin Change | -0.63% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

For institutional investors, this deposit represents either strategic positioning ahead of anticipated volatility or routine portfolio rebalancing. The contradiction between "Extreme Fear" sentiment and substantial institutional movement warrants skepticism about the bullish narrative. For retail traders, this creates potential gamma squeeze conditions if options markets misinterpret the flow as purely accumulation-driven. The deposit's size relative to daily volume (<2%) suggests limited immediate price impact but significant signaling value.

Market analysts on X/Twitter express divided interpretations. Some bulls argue this confirms "institutional adoption accelerating," while skeptics note the timing coincides with quarterly rebalancing periods. One quantitative analyst observed, "The deposit size represents approximately 0.4% of BlackRock's reported digital asset AUM - this looks more like operational movement than strategic accumulation." No direct statements from BlackRock executives have clarified the transaction's purpose.

Bullish Case: If this deposit represents accumulation rather than operational movement, and Bitcoin holds above the $85,200 invalidation level, technical analysis suggests a retest of the $92,000 resistance zone within 2-3 weeks. Institutional flows could trigger a short squeeze targeting the $88,500 FVG fill.

Bearish Case: If this is preparation for client redemptions or hedging activity, and Bitcoin breaks below $85,200, the next significant support clusters at $82,000 (200-day SMA) then $78,500 (volume node low). A breakdown could validate the "Extreme Fear" sentiment and trigger algorithmic selling.

What is Coinbase Prime? Coinbase Prime is a prime brokerage platform providing institutional investors with trading, custody, and financing services for digital assets.

Why would BlackRock deposit crypto to an exchange? Institutional deposits typically indicate preparation for trading, client transactions, or custody rotation - not necessarily immediate selling.

How significant is $229 million relative to Bitcoin's market? The deposit represents approximately 0.01% of Bitcoin's total market capitalization - more significant for signaling than direct price impact.

What is a "liquidity grab" in this context? A liquidity grab occurs when large players create price movements to trigger stop losses or liquidations before reversing direction.

Where can I verify on-chain data? Platforms like Ethereum.org provide resources for understanding and accessing blockchain analytics tools.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.