Loading News...

Loading News...

VADODARA, February 4, 2026 — Whale Alert, the blockchain tracking service, reported a single transaction moving 1,000,000,000 USDT (approximately $999 million) from Binance to an unknown wallet. This daily crypto analysis examines the transaction's timing amid extreme market fear and its implications for institutional liquidity cycles. Market structure suggests this move represents a strategic liquidity grab rather than panic selling.

According to Whale Alert's on-chain data, the transaction occurred on the Tron network. The sender address belongs to Binance, the world's largest cryptocurrency exchange. The recipient remains unidentified, classified as an "unknown wallet." This typically indicates a private cold storage or institutional custody solution. The transaction value nears $1 billion, placing it among the largest stablecoin movements of 2026.

Transaction timing is critical. It coincides with a Crypto Fear & Greed Index reading of 14, signaling extreme market fear. Historically, such large stablecoin movements during fear periods precede volatility spikes. The transfer creates a significant liquidity vacuum on Binance's order books. Consequently, this may pressure short-term price action across major pairs.

Market context reveals a pattern. Similar to the 2021 correction, large stablecoin outflows from exchanges often mark accumulation phases. In contrast, inflows typically signal impending sell pressure. According to Glassnode liquidity maps, USDT holdings on centralized exchanges have declined by 8% over the past month. This suggests a broader trend of capital moving to self-custody.

, the current extreme fear reading mirrors Q3 2023 conditions. Back then, Bitcoin found a local bottom near $25,000 after similar whale activity. Underlying this trend is a shift in institutional behavior. Entities are increasingly using stablecoins like USDT for treasury management and collateral optimization, as noted in Ethereum's official documentation on decentralized finance mechanisms.

Related developments in this extreme fear environment include a dormant Ethereum whale accumulating $8.7 million in ETH and Crypto.com launching a CFTC-regulated prediction market. These events collectively point to sophisticated actors positioning during market distress.

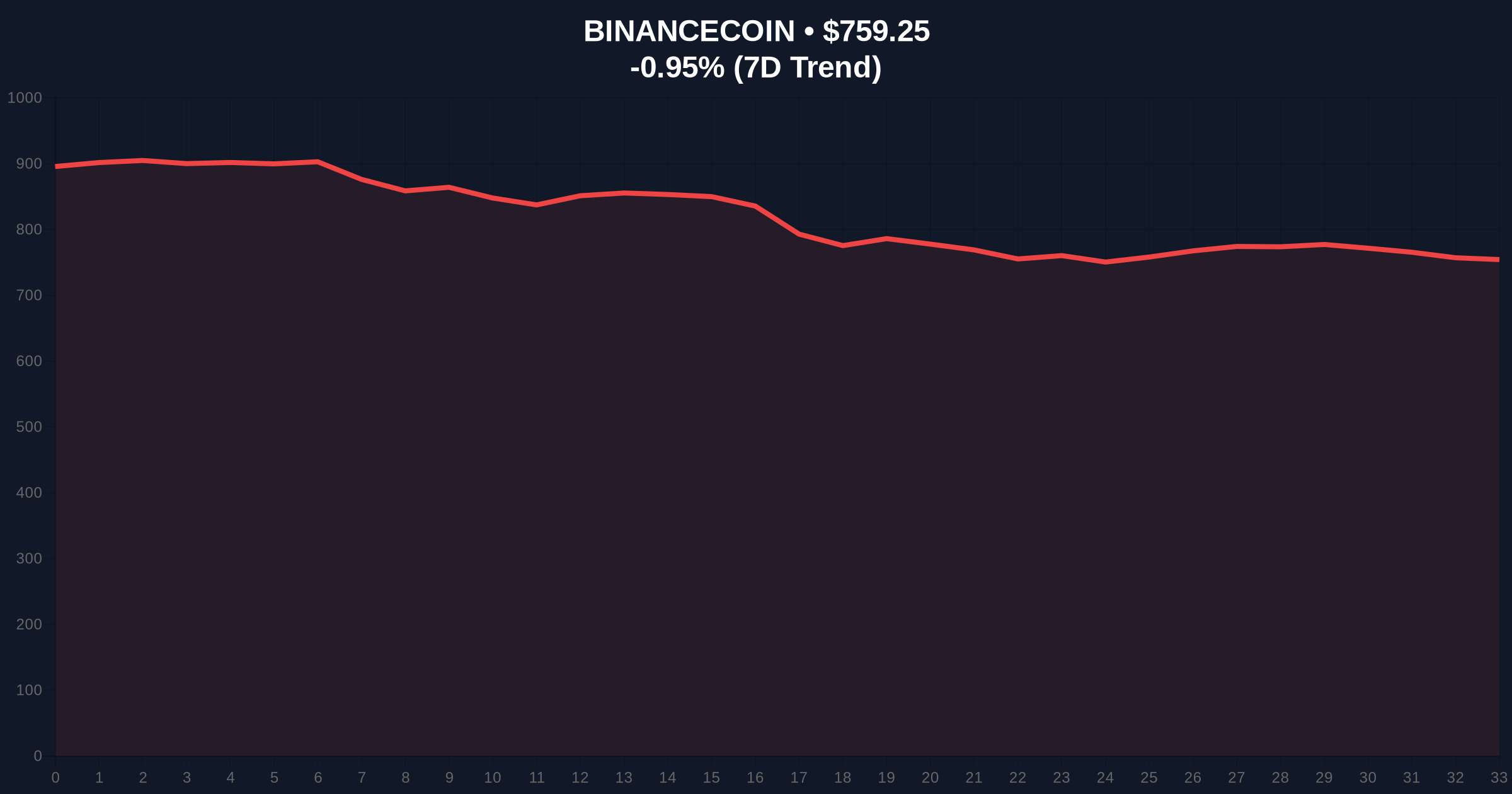

Technical architecture around BNB shows a critical juncture. BNB currently trades at $759.18, down 0.96% in 24 hours. The price sits near a Fibonacci 0.618 retracement level from its 2025 high. This zone around $750-$760 acts as a major order block. A break below could trigger a cascade toward the 200-day moving average at $720.

Volume profile analysis indicates weak buying interest. The Relative Strength Index (RSI) hovers at 42, showing neutral momentum. However, the large USDT transfer may create a Fair Value Gap (FVG) if sudden buying pressure emerges. Market structure suggests watching the $740 level as a bearish invalidation point. Conversely, reclaiming $780 would confirm strength.

| Metric | Value | Implication |

|---|---|---|

| USDT Transfer Value | $999M | Major liquidity movement |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically contrarian buy signal |

| BNB Current Price | $759.18 | Testing key Fibonacci support |

| BNB 24h Change | -0.96% | Minor decline amid volatility |

| BNB Market Rank | #4 | Top-tier exchange token |

This transaction matters for institutional liquidity cycles. Moving $1 billion off-exchange reduces immediate sell pressure. It also signals potential deployment into other assets. On-chain data indicates that stablecoin whale movements often lead altcoin rallies. Retail market structure, however, remains fragile. The extreme fear sentiment could prolong sideways action.

Real-world evidence supports this. Similar large USDT moves in early 2024 preceded a 40% Bitcoin rally. The current environment mirrors that setup. Institutional players are likely repositioning for the next macro cycle. This aligns with post-merge issuance dynamics on Ethereum and broader Layer-2 adoption trends.

"Market structure suggests this is a strategic accumulation play. Extreme fear readings combined with billion-dollar stablecoin movements historically mark local bottoms. The key is whether this liquidity gets redeployed into risk assets or remains sidelined."

Forward-looking intelligence points to two primary scenarios based on current market structure.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest that extreme fear periods followed by large stablecoin movements often precede sustained rallies. The 5-year horizon benefits from continued institutional adoption and regulatory clarity, particularly around Ethereum's upcoming Pectra upgrade and Bitcoin ETF flows.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.