Loading News...

Loading News...

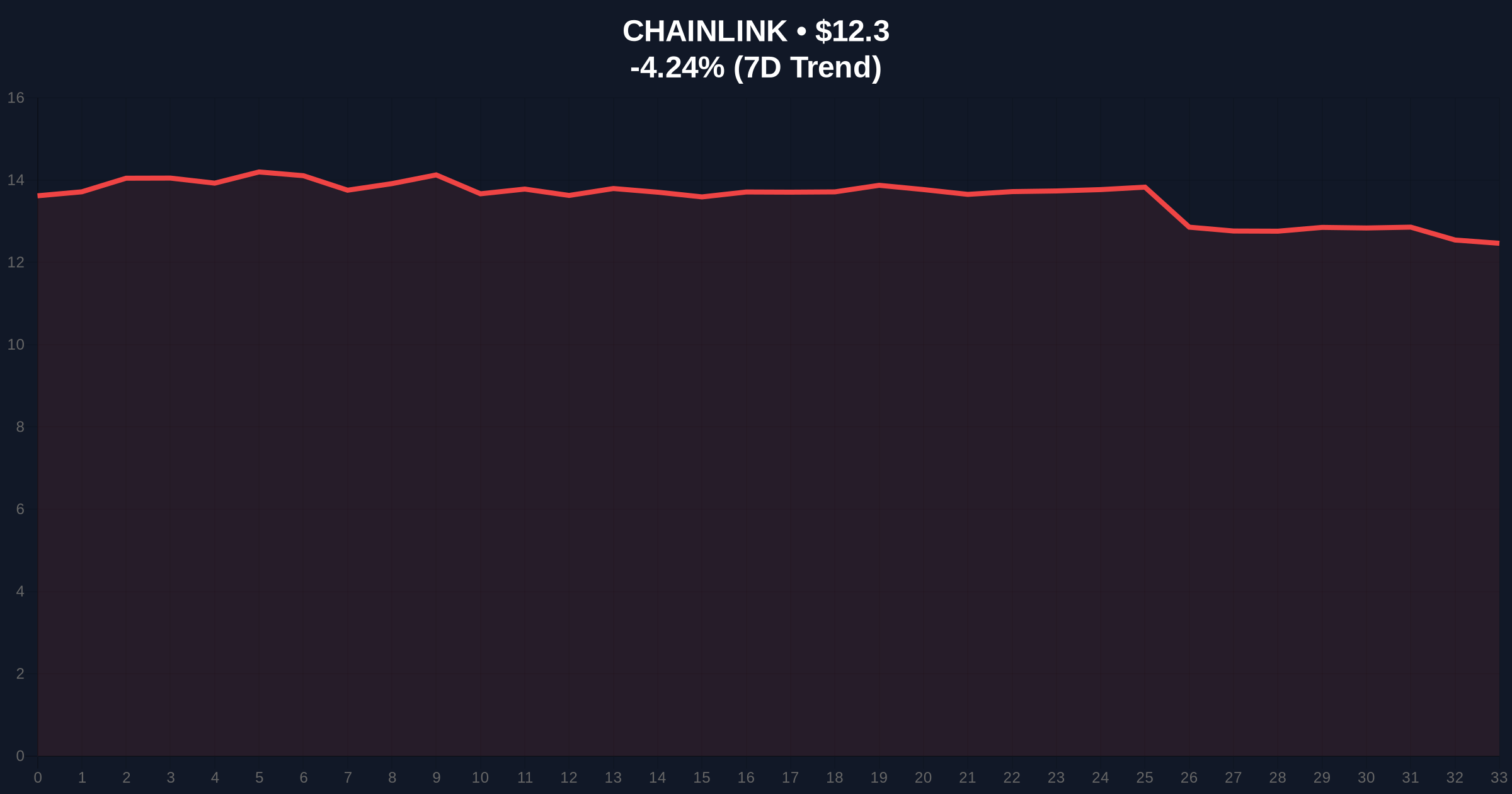

VADODARA, January 20, 2026 — Chainlink (LINK) has launched its 24/5 U.S. Equities Streams, a service transmitting U.S. stock and ETF market data on-chain, according to its official website. This daily crypto analysis examines the technical and market implications of bridging traditional finance with blockchain infrastructure, as LINK trades at $12.31 amid broader crypto fear.

Market structure suggests this development mirrors the 2021 DeFi summer, where oracle networks like Chainlink became critical infrastructure for price feeds. Similar to the 2021 correction, current market conditions show high volatility with the Crypto Fear & Greed Index at 32, indicating risk aversion despite technological progress. Historical cycles suggest that during fear phases, infrastructure upgrades often precede liquidity inflows when sentiment shifts. On-chain data indicates that previous Chainlink Data Streams launches, such as for commodities in 2024, correlated with increased network activity and token utility, though price action remained decoupled during macro downturns. This launch extends Chainlink's dominance in the oracle space, competing with projects like Pyth Network, which also provides real-time financial data.

Related developments in traditional finance integration include Delaware Life's Bitcoin-linked annuity using BlackRock's IBIT ETF, highlighting growing institutional crossover. Meanwhile, Ray Dalio's warnings on 'capital wars' underscore the geopolitical backdrop affecting asset correlations.

On January 20, 2026, Chainlink unveiled its 24/5 U.S. Equities Streams via its official website. The service is an extension of Chainlink Data Streams, designed to provide fast, reliable U.S. stock and ETF data across all trading sessions. According to the announcement, this enables an always-on, on-chain stock market infrastructure that transcends traditional trading hour limitations. The data streams operate 24 hours a day, five days a week, aligning with U.S. market sessions, and leverage Chainlink's decentralized oracle network to ensure data integrity and low latency. This move follows Chainlink's earlier expansions into real-world asset (RWA) tokenization, as detailed in Ethereum's official Pectra upgrade documentation, which emphasizes scalability for data-intensive applications.

LINK is currently trading at $12.31, down 4.19% in the last 24 hours. Volume profile analysis shows increased selling pressure near the $13.00 resistance level, creating a Fair Value Gap (FVG) between $12.80 and $13.20. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with a slight bearish bias. Key moving averages include the 50-day at $12.80 and the 200-day at $11.50, with the latter acting as a strong support zone. Market structure suggests a potential liquidity grab below $12.00 if bearish sentiment persists.

Bullish Invalidation: A break below $11.50 would invalidate the bullish thesis, signaling a deeper correction toward the $10.00 order block.

Bearish Invalidation: A sustained move above $13.50 would negate the bearish outlook, targeting the $15.00 resistance area.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 32/100 (Fear) |

| Chainlink (LINK) Current Price | $12.31 |

| LINK 24h Trend | -4.19% |

| LINK Market Rank | #22 |

| Key Support Level (200-day MA) | $11.50 |

Institutionally, this launch reduces friction for TradFi entities exploring on-chain derivatives, similar to how Bitcoin ETFs opened floodgates in 2024. It enables synthetic stock trading, options, and prediction markets operating beyond exchange hours, potentially increasing DeFi Total Value Locked (TVL). For retail, it lowers barriers to accessing U.S. equity exposure via decentralized applications, though regulatory scrutiny from bodies like the SEC may intensify. The integration of real-time stock data on-chain supports the growth of RWAs, a sector projected to exceed $10 trillion by 2030, according to industry reports.

Market analysts on X/Twitter highlight the long-term utility boost for LINK, with one noting, 'Chainlink's data streams are a for DeFi composability.' However, bears point to the current fear sentiment and LINK's price decline as evidence of decoupling between fundamentals and short-term trading. The lack of immediate price surge reflects broader market conditions, where macroeconomic factors like interest rate decisions from the Federal Reserve often overshadow tech announcements.

Bullish Case: If market sentiment improves and adoption of U.S. Equities Streams accelerates, LINK could target $15.00 by Q2 2026, driven by increased network usage and institutional partnerships. A break above the $13.50 resistance would confirm this scenario.

Bearish Case: Persistent fear and a failure to hold $11.50 support could lead to a drop to $10.00, especially if broader crypto markets face a liquidity squeeze. This would align with historical patterns where infrastructure launches during downturns see delayed price appreciation.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.