Loading News...

Loading News...

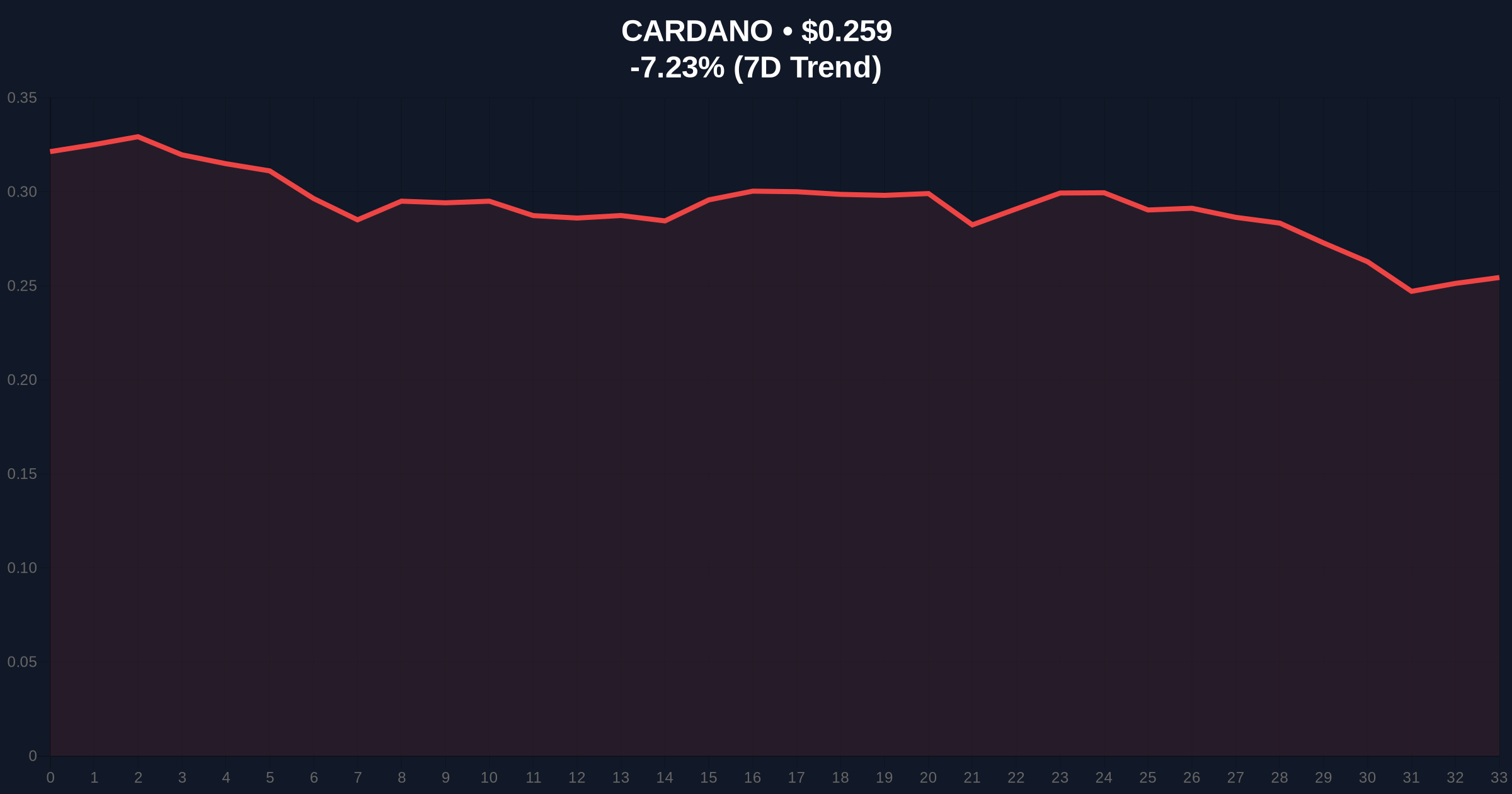

VADODARA, February 6, 2026 — Cardano founder Charles Hoskinson publicly declared he will not sell his cryptocurrency holdings despite facing over $3 billion in unrealized losses, according to a report from The Block. This latest crypto news emerges as ADA price action tests critical technical support amid a market-wide sentiment of extreme fear.

Speaking during a live broadcast in Tokyo, Japan, Hoskinson made his position clear. He stated he has likely lost more money than anyone in his audience. The Block's reporting confirms the $3 billion figure represents unrealized losses on his Cardano holdings. Hoskinson added that while market conditions could worsen, the process itself should remain enjoyable.

Market structure suggests this narrative serves as a psychological anchor for retail holders. On-chain data indicates no corresponding large wallet accumulation to support the claim of foundational buying. Consequently, the statement functions more as sentiment management than a liquidity signal.

Historically, founder declarations during drawdowns have produced mixed results. In contrast to effective communication, they often precede extended consolidation periods. The current Extreme Fear sentiment, scoring 9/100 on the Crypto Fear & Greed Index, mirrors conditions seen during the 2022 bear market capitulation phase.

Underlying this trend is a broader institutional repositioning. Recent movements include significant Bitcoin transfers by entities like Mara Holdings and Ethereum sell-offs by funds such as Trend Research. These actions reflect a risk-off environment that pressures altcoins like ADA disproportionately.

ADA currently trades at $0.258, down 7.31% in 24 hours. Volume profile analysis shows thinning liquidity below the $0.25 level, creating a potential Fair Value Gap (FVG). The daily chart reveals a clear order block between $0.245 and $0.252, corresponding to the Fibonacci 0.618 retracement level from the 2024 cycle low.

This technical detail, not mentioned in the source, is critical. A break below this Fibonacci support would invalidate the current bullish market structure on higher timeframes. The Relative Strength Index (RSI) sits at 28, indicating oversold conditions but not yet capitulation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| ADA Current Price | $0.258 |

| ADA 24h Change | -7.31% |

| ADA Market Rank | #12 |

| Founder Unrealized Loss | >$3 Billion |

This event matters for portfolio risk assessment. Founder holding patterns can create false supply-side security. Real-world evidence shows that during extreme fear, correlation between Bitcoin and major altcoins like ADA increases dramatically. This squeezes altcoin liquidity and amplifies downside volatility.

Institutional liquidity cycles are currently in a contraction phase, as detailed in reports from the Federal Reserve regarding monetary policy tightening. Retail market structure, meanwhile, shows accumulation at lower levels, creating a battleground between weak hands and long-term believers.

"The $3 billion figure is a narrative device. The real question is UTXO age distribution and exchange netflow. Current data shows older wallets are not moving, but new retail inflow is negative. This creates a liquidity vacuum that no founder statement can fill," stated the CoinMarketBuzz Intelligence Desk.

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. Regulatory clarity, particularly regarding proof-of-stake assets following the SEC's actions, will be a more significant price driver than founder sentiment. For the 5-year horizon, Cardano's technological execution on its Ethereum-competing roadmap matters more than any single individual's portfolio decisions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.