Loading News...

Loading News...

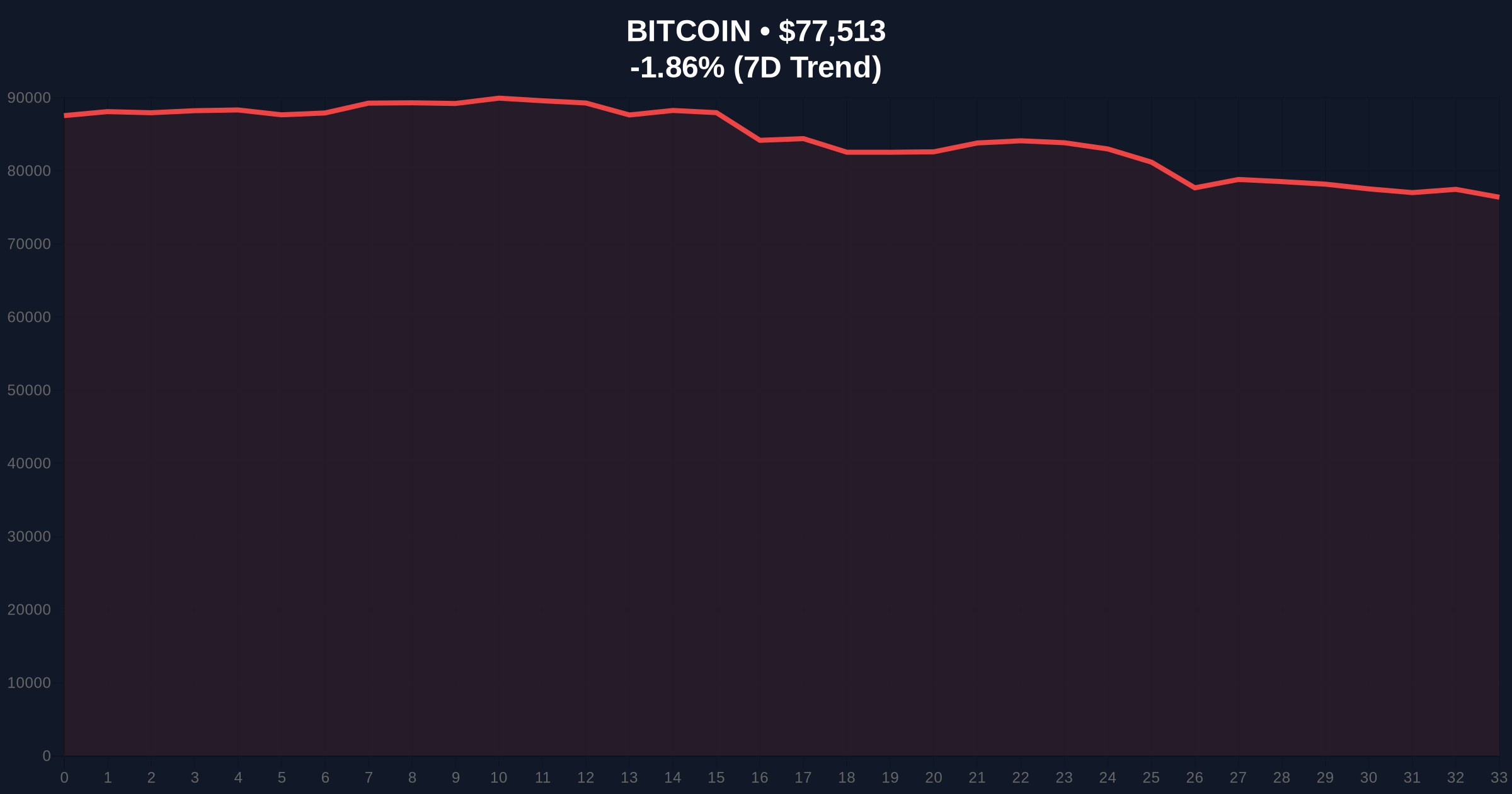

VADODARA, February 2, 2026 — Blockstream, a foundational Bitcoin infrastructure firm, has categorically denied any connection to the late financier and convicted sex offender Jeffrey Epstein. This statement follows the emergence of documents linking its co-founder and CEO to Epstein's network. The denial surfaces as the broader cryptocurrency market grapples with Extreme Fear, with Bitcoin trading at $77,515, down 1.81% on the day. This latest crypto news injects a layer of reputational uncertainty into a core segment of the digital asset ecosystem.

According to a report by The Block, newly surfaced documents reveal Blockstream co-founder Austin Hill exchanged emails with Jeffrey Epstein in 2014. The correspondence reportedly discussed increasing an investment. , the names of both Hill and Blockstream CEO Adam Back appeared on a flight reservation to St. Thomas, an island owned by Epstein. The U.S. Department of Justice released these documents among hundreds of thousands related to the Epstein case. In response, Blockstream issued a firm statement, asserting it has "no connection to the deceased sex offender Jeffrey Epstein or his foundation." Market structure suggests such allegations, even if unproven, can act as a negative sentiment catalyst during fragile liquidity conditions.

Historically, allegations against key industry figures have precipitated short-term volatility but rarely altered long-term technological adoption trajectories. In contrast, the current market environment is uniquely sensitive. The Crypto Fear & Greed Index sits at a score of 14, indicating Extreme Fear. This sentiment is compounded by other negative flows, such as the $1.7 billion outflow from digital asset funds reported last week. Underlying this trend is a market questioning the resilience of its foundational players. The narrative conflict between corporate denial and document evidence creates a classic Fair Value Gap (FVG) in market perception versus on-chain reality.

Bitcoin's price action provides the clearest read on systemic stress. The asset is currently testing a critical Order Block between $77,000 and $75,000. This zone aligns with the 50-day simple moving average and a key Fibonacci 0.618 retracement level from the recent swing high. A breakdown below $75,000 would invalidate the current bullish higher-low structure and likely trigger a Liquidity Grab toward the $72,000 support cluster. On-chain data from Glassnode indicates exchange reserves are stable, suggesting no panic selling from long-term holders. However, the low Volume Profile near current prices indicates weak conviction, making the market susceptible to headline-driven moves.

| Metric | Value | Context |

|---|---|---|

| Bitcoin Price | $77,515 | -1.81% (24h) |

| Crypto Fear & Greed Index | 14/100 | Extreme Fear |

| Key Technical Support | $75,000 | 50-Day MA & Psychological Level |

| Key Technical Resistance | $82,000 | Previous Weekly High |

| Market Context | Extreme Fear | Amid fund outflows & negative news |

Blockstream's role in Bitcoin development, including its work on the Liquid Network and mining technology, makes it a systemic player. Allegations against its leadership introduce a non-financial risk vector. Institutional allocators, already cautious amid mining sector stress in Russia, may perceive this as a governance red flag. Real-world evidence shows that during periods of Extreme Fear, negative news flows have an outsized impact on price. This event tests the market's ability to decouple technological fundamentals from associated human capital risks. The Gamma Squeeze potential remains low due to suppressed volatility, but sentiment can shift rapidly.

"Market narratives are fragile during fear cycles. While Blockstream's denial is explicit, the market must price the uncertainty of document authenticity and the potential for further revelations. Technically, Bitcoin's hold above $75,000 is more critical than any single corporate headline. A break below that level would signal a broader risk-off move, potentially exacerbating the current liquidity drain from digital asset funds." – CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the interplay of technical levels and sentiment.

The 12-month institutional outlook remains cautiously constructive, but hinges on macroeconomic factors beyond crypto-specific news. Events like this test the maturity of the asset class's price discovery mechanisms. For the 5-year horizon, the resilience of Bitcoin's protocol-level decentralization ultimately outweighs corporate governance issues at any single company.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.