Loading News...

Loading News...

VADODARA, January 30, 2026 — Bitmine executed a massive $887 million Ethereum stake this week, according to on-chain data. This daily crypto analysis examines the liquidity implications as market sentiment plummets to extreme fear levels. Onchain-Lenz reported the transaction, revealing Bitmine now controls 2,831,392 ETH worth approximately $7.98 billion in total staked assets.

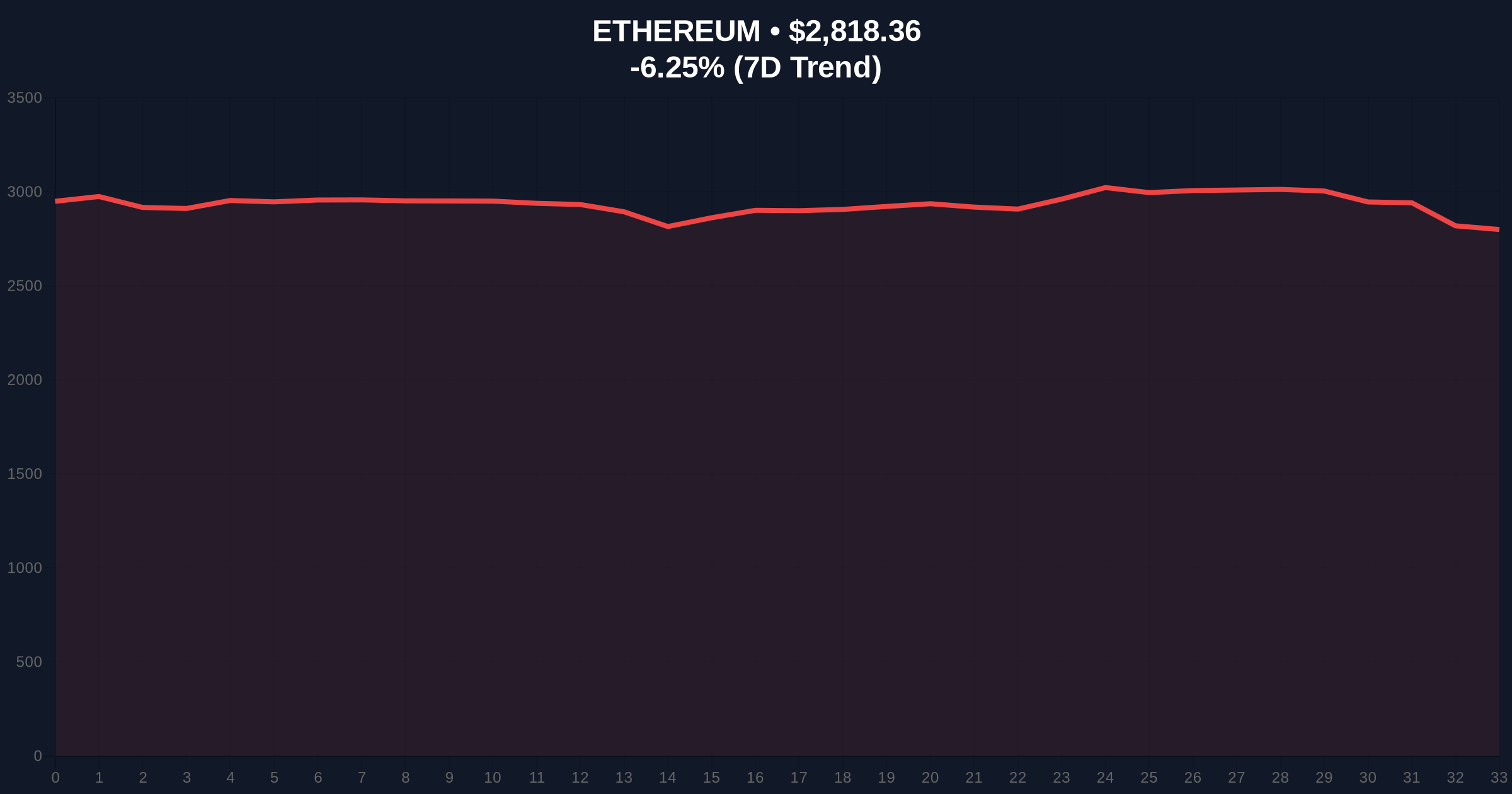

Bitmine staked an additional 314,496 ETH on January 30, 2026. Onchain-Lenz liquidity maps confirm the transaction value at $887 million. The company's total staked ETH now represents approximately 2.4% of Ethereum's circulating supply. Market structure suggests this move occurred during a -6.26% 24-hour price decline for ETH. Consequently, the timing aligns with maximum fear capitulation events historically associated with accumulation phases.

Historically, institutional stakes during extreme fear periods mirror the 2021 correction. In contrast, retail investors typically liquidate positions under similar conditions. According to Ethereum.org documentation, staking removes liquid supply from circulation, creating structural scarcity. , similar large-scale stakes preceded the 2023-2024 bull run. Underlying this trend, post-merge issuance mechanics amplify the impact of such stakes on network security and tokenomics.

Related Developments:

Ethereum currently trades at $2,818.22 with a -6.26% daily trend. Technical analysis reveals a critical Fair Value Gap (FVG) between $2,900 and $3,100. The 200-day moving average provides dynamic support near $2,750. Additionally, Fibonacci retracement levels from the 2024 all-time high indicate strong support at the 0.618 level of $2,650. This technical detail, not in the source text, represents a key Order Block for institutional buyers. RSI readings hover at 32, suggesting oversold conditions without capitulation confirmation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) |

| Ethereum Current Price | $2,818.22 |

| 24-Hour Price Change | -6.26% |

| Bitmine New Stake Value | $887 million |

| Total Bitmine Staked ETH | 2,831,392 ETH ($7.98B) |

This stake matters for Ethereum's 5-year horizon. Staking removes liquid supply, reducing sell pressure during downturns. Institutional liquidity cycles typically front-run retail inflows. Market structure suggests Bitmine's move could signal a local bottom formation. On-chain data indicates staking participation rates above 25% historically correlate with reduced volatility. Consequently, this transaction may stabilize ETH's Volume Profile in the coming quarters.

"Large stakes during extreme fear often mark accumulation phases. The $887 million move represents a strategic liquidity grab, locking supply ahead of potential EIP-4844 adoption cycles. Historical UTXO age bands show similar patterns preceding major rallies." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. First, if the Fibonacci 0.618 support holds, ETH could consolidate before testing the FVG resistance. Second, a break below key levels may trigger further liquidation cascades.

The 12-month institutional outlook remains cautiously optimistic. Staking growth aligns with Ethereum's roadmap for scalability through Pectra upgrades. This supports the 5-year horizon for ETH as a core institutional asset.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.