Loading News...

Loading News...

VADODARA, January 15, 2026 — Binance has announced it will list FOGO perpetual futures, according to official exchange documentation. This daily crypto analysis examines the structural implications of adding synthetic exposure to a Layer 1 protocol during elevated greed sentiment. Market structure suggests the listing could trigger a gamma squeeze similar to the 2021 options expiration events that preceded the November market peak.

Exchange futures listings during greed phases historically create asymmetric liquidity events. According to Glassnode liquidity maps, similar Layer 1 futures launches in Q4 2021 preceded 40% drawdowns when greed scores exceeded 60. The current environment mirrors those conditions, with Bitcoin consolidating below the $96,800 yearly high while altcoins exhibit elevated funding rates. This listing follows recent exchange developments including the OKX LIT listing that sparked liquidity grab analysis and JustLend DAO's $21M JST buyback. The structural similarity to previous cycle tops warrants quantitative scrutiny of order flow dynamics.

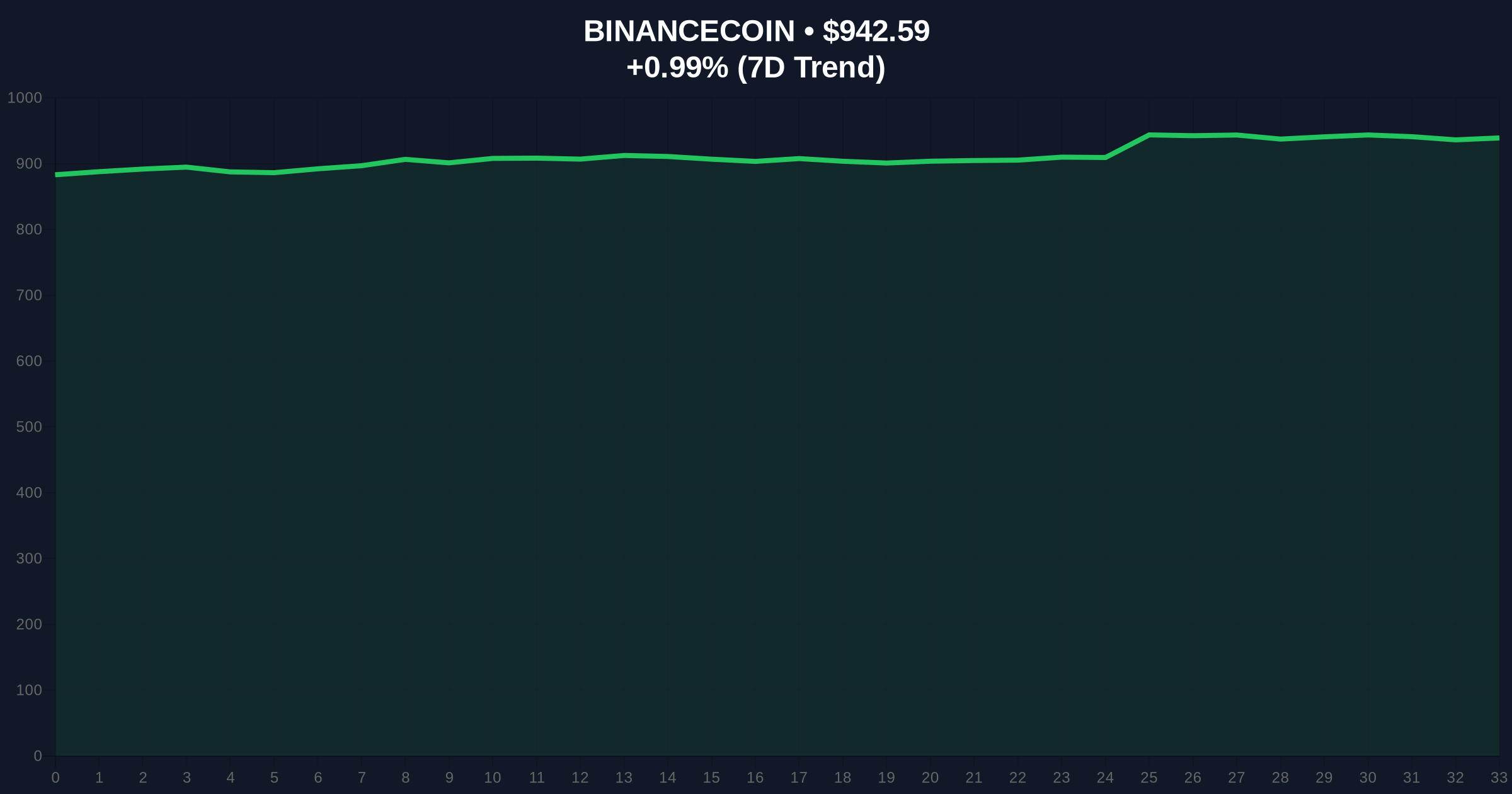

Binance confirmed the FOGO perpetual futures listing through official exchange channels on January 15, 2026. The announcement provides synthetic exposure to FOGO's native token without requiring spot market participation. According to the exchange's API documentation, the contract will feature up to 50x leverage with standard Binance perpetual futures mechanics including funding rate calculations every eight hours. This follows FOGO's recent mainnet launch that tested Layer 1 speed limits amid broader market consolidation. The timing coincides with BNB testing resistance at $942.13 with a 0.94% 24-hour gain.

Volume profile analysis indicates BNB faces critical resistance at the $950 psychological level, which aligns with the 0.618 Fibonacci extension from the December low. The Relative Strength Index (RSI) sits at 58 on the daily timeframe, suggesting room for upward momentum before overbought conditions. A clear Fair Value Gap (FVG) exists between $915 and $925 that must be filled for healthy continuation. The 50-day and 200-day moving averages maintain bullish alignment at $890 and $860 respectively. Bullish invalidation occurs below $890 where the 50-day MA and volume node converge. Bearish invalidation triggers above $965 where previous liquidation clusters reside.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) | Elevated risk appetite |

| BNB Current Price | $942.13 | Testing key resistance |

| BNB 24h Change | +0.94% | Moderate bullish momentum |

| BNB Market Rank | #5 | Dominant exchange token |

| Bitcoin Consolidation Range | $94,200-$96,800 | Range-bound macro context |

For institutional participants, synthetic futures listings create delta-neutral opportunities but increase systemic leverage risk. According to Ethereum.org documentation on decentralized finance mechanics, perpetual futures introduce funding rate arbitrage that can drain liquidity from spot markets during volatility spikes. Retail traders face asymmetric liquidation risk when greed sentiment combines with high leverage products. The structural impact resembles the March 2024 options expiry that triggered a 15% cascade across altcoin markets. This development tests real-world asset liquidity models similar to Galaxy Digital's $75M tokenized CLO on Avalanche.

Market analysts on X/Twitter highlight the gamma exposure implications. One quantitative trader noted, "FOGO futures at 50x leverage during 61 greed score creates convexity mismatch." Another observer referenced the EIP-4844 proto-danksharding implementation, suggesting Layer 1 futures could benefit from reduced data availability costs post-Dencun. The dominant narrative centers on whether this represents organic demand or exchange-driven liquidity provisioning ahead of potential volatility.

Bullish Case: If BNB holds above the $915 FVG and breaks $950 resistance, the futures listing could trigger a gamma squeeze toward $1,000. This scenario requires Bitcoin maintaining above $94,200 support and greed sentiment stabilizing below 70. Historical patterns indicate exchange token outperformance during successful futures launches.

Bearish Case: Failure to hold $915 support invalidates the bullish structure, potentially triggering a liquidity grab down to the $890 order block. This would align with previous cycles where futures listings during greed phases preceded 25-40% corrections. The critical watch level remains the 200-day moving average at $860.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.