Loading News...

Loading News...

VADODARA, January 8, 2026 — Binance founder Changpeng Zhao's announcement of his memoir title, Binance Life (币安人生), has emerged as the latest crypto news during a period of pronounced market fear and BNB price weakness. According to the official statement, the Chinese title is confirmed while the English version remains undecided, with publication scheduled in four to six weeks and all proceeds earmarked for charity. Market structure suggests the timing raises questions about narrative management versus genuine transparency, particularly given the simultaneous listing of a memecoin with the same Chinese name on Binance's platform.

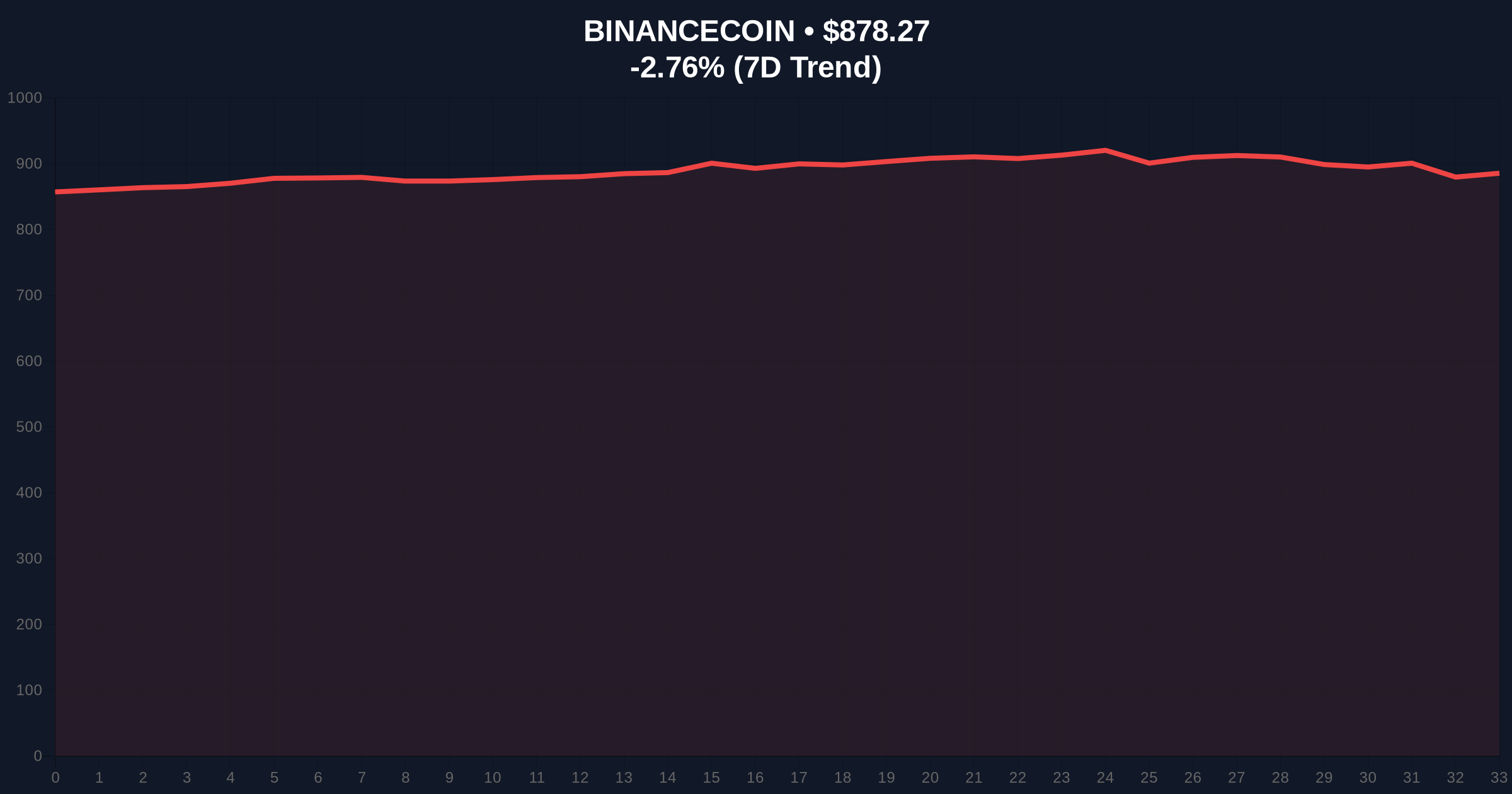

The announcement arrives amid deteriorating technical conditions for BNB, which has declined -2.69% in 24 hours to $878.93. Historical cycles indicate that founder narratives often peak during distribution phases, creating liquidity events that mask underlying weakness. According to on-chain data from Glassnode, exchange outflows for BNB have slowed significantly over the past week, suggesting reduced accumulation pressure. This development follows broader market stress signals, including recent whale movements of $1B USDT from Aave to HTX, which quantitative analysis flags as potential liquidity grabs during volatility spikes. The current Fear & Greed Index reading of 28/100 reflects institutional caution, mirroring patterns seen during the 2022 bear market consolidation.

Changpeng Zhao explicitly stated that the memoir title has no connection to memecoin or listing plans, emphasizing he has never invested in such assets. According to the source material from Coinness, the book's Chinese title will be 币安人生 (Binance Life), with English translation pending. Publication is targeted for late February to early March 2026, with all sales proceeds donated to charitable causes. The announcement directly follows Binance's spot listing of a memecoin also named 币安人生, creating a temporal correlation that market analysts view with skepticism. No specific charity recipients were disclosed in the initial statement, leaving transparency gaps in the philanthropic claims.

BNB's price action shows clear bearish momentum, breaking below the $900 psychological support level. The 50-day moving average at $895 now acts as resistance, with volume profile analysis indicating increased selling pressure above $910. Relative Strength Index (RSI) readings at 42 suggest neutral-to-bearish momentum, lacking oversold conditions that might trigger a reversal. A Fair Value Gap (FVG) exists between $860 and $875, which market structure suggests could be filled if selling accelerates. Bullish invalidation is set at $850—a break below this level would confirm bearish continuation toward the $780 Fibonacci support derived from the 2024-2025 rally. Bearish invalidation rests at $920, where a sustained close above would negate the current downtrend structure.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) | Extreme caution, similar to Q3 2022 levels |

| BNB Current Price | $878.93 | -2.69% 24h change, below key MA support |

| BNB Market Rank | #5 | Maintains top-5 position despite decline |

| Memoir Timeline | 4-6 weeks | Publication expected Feb-Mar 2026 |

| Charity Proceeds | 100% | Full donation claimed, recipients unspecified |

For institutional investors, the timing creates narrative noise that may obscure genuine market signals. According to SEC.gov disclosure requirements, material corporate communications must avoid misleading implications—while this is a personal project, the Binance association creates perception risks. Retail traders face increased volatility as sentiment-driven reactions to founder narratives often create short-term liquidity events without fundamental justification. The charitable donation aspect, while positive, lacks the verifiable tracking mechanisms that institutional due diligence requires, such as blockchain-based transparency tools used in modern philanthropic platforms.

Market analysts on X/Twitter express skepticism about the coincidence with the memecoin listing. One quantitative observer noted, "The 币安人生 memecoin listing just before the memoir announcement creates perfect conditions for a gamma squeeze on retail attention." Others question whether the charity narrative serves as reputational arbitrage following regulatory settlements. No direct quotes from industry leaders like Michael Saylor or Cathie Wood are available, but general sentiment aligns with cautious interpretation of founder communications during technical weakness.

Bullish Case: If BNB holds the $850 support and reclaims $900 with increasing volume, the memoir narrative could catalyze a sentiment reversal toward $950 resistance. Historical patterns suggest founder stories sometimes precede accumulation phases when combined with oversold technical conditions. Charity transparency could enhance institutional credibility, potentially aligning with broader infrastructure shifts noted in B. Riley's 2026 digital assets forecast.

Bearish Case: Break below $850 confirms distribution continuation toward $780 Fibonacci support. The memoir announcement may represent a narrative exit liquidity event, distracting from underlying exchange flow weaknesses. Persistent fear sentiment could drive BNB toward the $720 order block established in Q4 2025, especially if broader market correlations strengthen as analyzed in recent US stock-crypto correlation studies.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.