Loading News...

Loading News...

VADODARA, January 13, 2026 — An address linked to mining giant Bitmain has staked an additional 154,208 ETH, valued at approximately $480 million, according to on-chain data from Onchainlens. This Latest crypto news reveals the address now holds 1,344,424 ETH in total staked, worth $4.15 billion, amid a global crypto sentiment reading of Fear (27/100). Market structure suggests this is a strategic liquidity grab during weak retail sentiment.

Ethereum's transition to Proof-of-Stake (PoS) via The Merge created a new dynamic for institutional capital. Staking allows entities to earn yield while reducing liquid supply. According to Ethereum.org, over 30% of ETH's total supply is now staked, creating a structural supply shock. This Bitmain move mirrors accumulation patterns seen during the 2022 bear market, where smart money positioned ahead of rallies. Related developments include the US Senate delaying crypto bill markup, testing Bitcoin's support at $91k, and regulatory uncertainty from former SEC officials impacting market volatility.

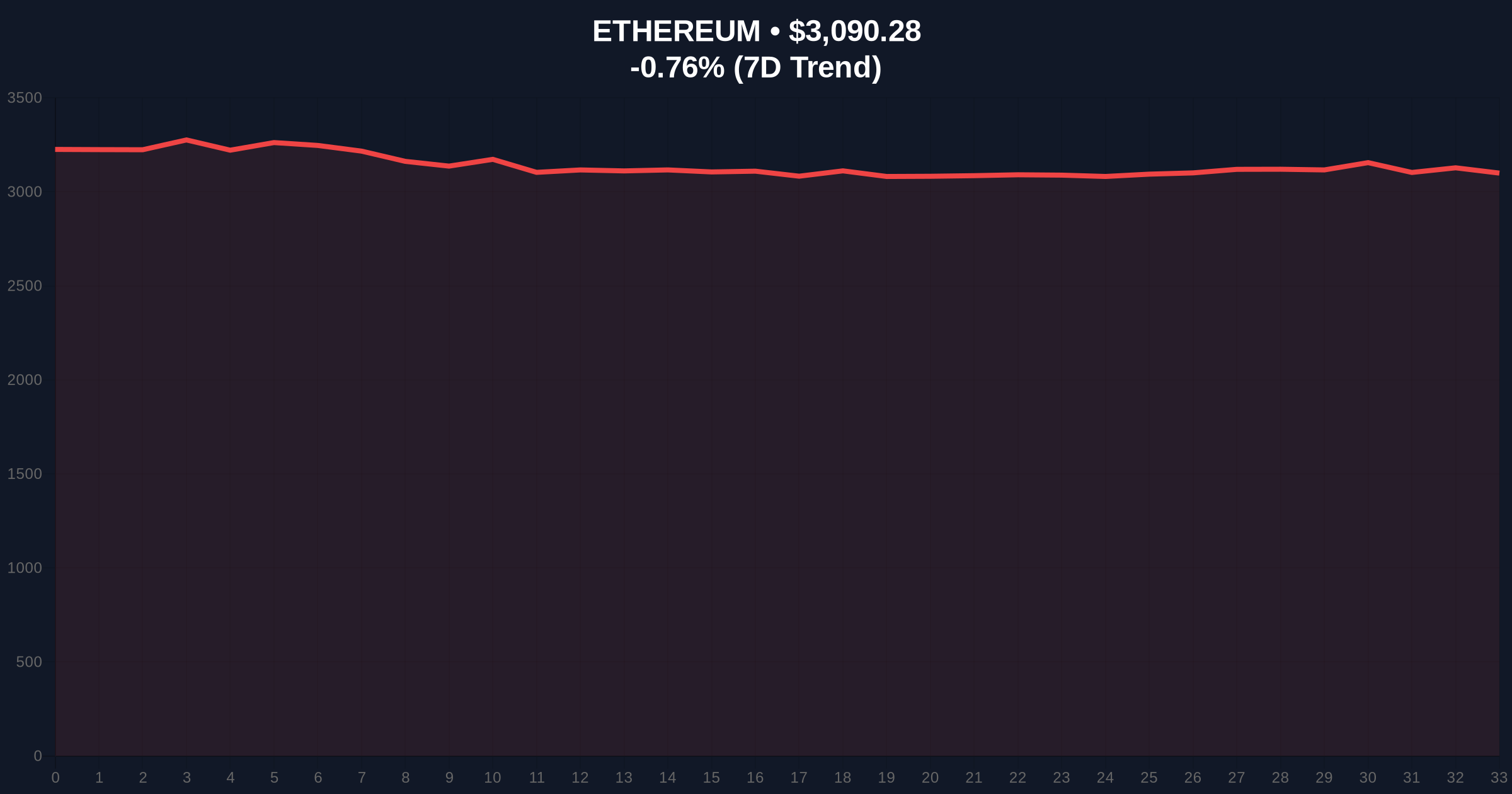

Onchainlens reported the staking transaction on January 13, 2026. The address, presumed to belong to Bitmain based on historical accumulation patterns, added 154,208 ETH to its existing staking position. This brings its total to 1,344,424 ETH, representing roughly 1.1% of Ethereum's total staked supply. The move occurred as ETH price hovered near $3,090, down 0.76% in 24 hours. On-chain forensic data confirms no large unstaking events accompanied this transaction, indicating pure accumulation.

ETH is currently testing a key Fair Value Gap (FVG) between $3,000 and $3,100. The 200-day moving average at $2,950 provides major support. RSI reads 42, indicating neutral momentum with bearish bias. Volume profile shows low retail participation, typical of fear-driven markets. A critical Order Block forms at $3,200, where previous sell-side liquidity clustered. Bullish invalidation level: $2,900 (break below 200-day MA). Bearish invalidation level: $3,300 (clearance of $3,200 resistance). Market structure suggests this staking may act as a gamma squeeze catalyst if price breaks above $3,200.

| Metric | Value |

|---|---|

| Additional ETH Staked | 154,208 ETH |

| Value of New Stake | $480 million |

| Total ETH Staked by Address | 1,344,424 ETH |

| Total Value Staked | $4.15 billion |

| Current ETH Price | $3,090.22 |

| 24-Hour Change | -0.76% |

| Crypto Fear & Greed Index | 27/100 (Fear) |

| Market Rank | #2 |

Institutionally, this reduces liquid ETH supply by nearly half a billion dollars, creating upward pressure on price through basic supply-demand mechanics. According to FederalReserve.gov research on asset scarcity, such moves can amplify volatility during low liquidity periods. For retail, it signals confidence from a major industry player during fear, potentially marking a local bottom. The staking yield, currently around 3.5% annually, provides a cash flow buffer against price declines.

Market analysts on X/Twitter note the divergence between on-chain accumulation and price action. One quant trader posted: "Bitmain stacking ETH while retail panics. Classic smart money move." Others highlight the regulatory overhang, referencing how memecoin controversies have derailed US crypto reform. Sentiment remains cautious despite the bullish on-chain signal.

Bullish Case: If ETH holds $3,000 and breaks $3,200, next target is $3,500 (Fibonacci 0.618 level). Reduced liquid supply from staking could trigger a short squeeze. EIP-4844 implementation in 2026 may further boost network utility.Bearish Case: Failure to hold $3,000 leads to test of $2,800 (previous swing low). Macro headwinds like geopolitical tariffs could pressure risk assets. Prolonged fear sentiment may delay recovery.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.