Loading News...

Loading News...

VADODARA, January 14, 2026 — A blockchain address linked to mining giant Bitmain has staked an additional 92,160 ETH worth approximately $293 million, according to on-chain data provider Onchainlens. This latest crypto news reveals the address now controls 1,436,384 staked ETH valued at $4.77 billion, representing one of the largest single-entity positions in Ethereum's proof-of-stake network.

Ethereum's transition to proof-of-stake with The Merge created a new yield-generating asset class. According to Ethereum.org documentation, the network currently has over 32 million ETH staked, representing approximately 27% of total supply. Large institutional stakes like this create concentrated liquidity zones that can influence price discovery. Historical cycles suggest such accumulation during fear periods often precedes significant rallies. This development occurs alongside other regulatory shifts, including the finalization of South Korea's won stablecoin bill and Senate Republican compromises on stablecoin regulation.

Onchainlens forensic analysis identified the transaction on January 14, 2026. The address executed a single staking operation of 92,160 ETH at an average price of approximately $3,180. This represents a 6.9% increase to their existing staked position of 1,344,224 ETH. Market structure suggests this was a strategic accumulation during a local price dip, potentially targeting a Fair Value Gap (FVG) created during last week's volatility. The transaction represents approximately 0.08% of Ethereum's total circulating supply.

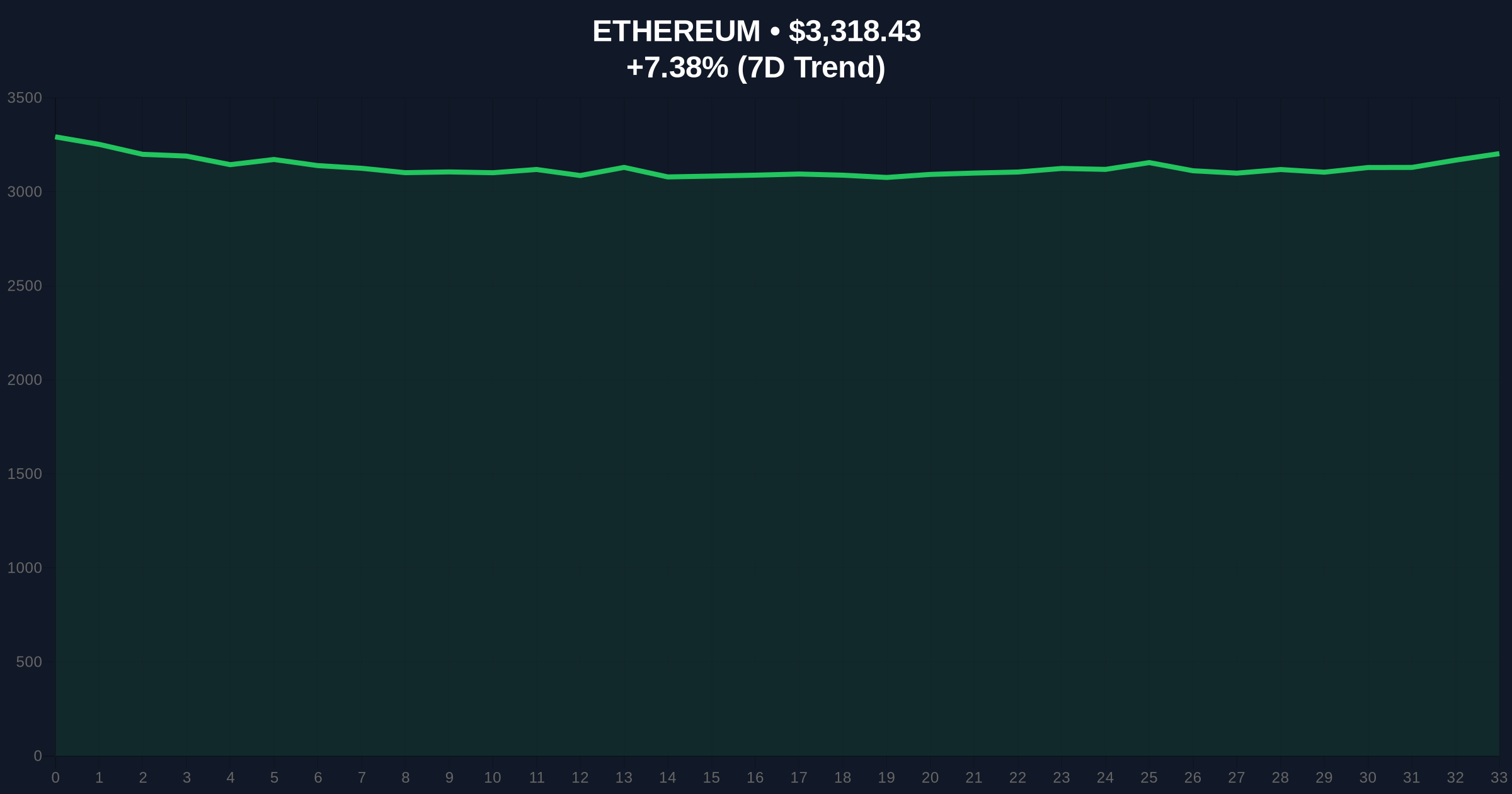

Ethereum currently trades at $3,316.67, up 7.33% in 24 hours. The Relative Strength Index (RSI) sits at 58, indicating neutral momentum. The 50-day moving average provides dynamic support at $3,280. Volume Profile analysis shows significant accumulation between $3,150 and $3,250, aligning with Bitmain's entry zone. A critical Fibonacci support level exists at $3,200, corresponding to the 0.618 retracement from the recent swing high. Bullish Invalidation: $3,200 (break below Fibonacci support). Bearish Invalidation: $3,450 (break above weekly resistance).

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (26/100) |

| Ethereum Current Price | $3,316.67 |

| 24-Hour Change | +7.33% |

| Bitmain Stake Addition | 92,160 ETH ($293M) |

| Total Bitmain Staked ETH | 1,436,384 ETH ($4.77B) |

Institutional impact: This stake represents locked supply that cannot be sold for months due to Ethereum's withdrawal queue mechanics, reducing circulating liquidity. According to Glassnode liquidity maps, such large-scale locking creates structural supply shocks. Retail impact: The transaction signals confidence during fear periods, potentially influencing sentiment. The stake's size creates a gamma squeeze scenario where forced liquidations could amplify price moves. Market structure suggests this reduces sell-side pressure ahead of Ethereum's upcoming Pectra upgrade, which includes EIP-7251 to increase validator effectiveness.

Market analysts note the divergence between on-chain accumulation and broader fear sentiment. "Large entities are accumulating while retail panics," observed one quantitative researcher on X. Bulls point to similar patterns before the 2023 rally, where institutional inflows preceded a 92% ETH price increase. Bears highlight correlation with broader market movements, including Bitcoin's recent break above $96k amid liquidity tests.

Bullish Case: If the $3,200 support holds, Ethereum could retest the $3,600 resistance zone. On-chain data indicates accumulation patterns similar to Q4 2023, which preceded a 47% quarterly gain. Reduced circulating supply from staking could create upward pressure as demand returns. Bearish Case: A break below $3,200 invalidates the bullish structure, potentially targeting the $2,950 volume gap. Correlation with traditional markets remains elevated at 0.68, suggesting macro headwinds could override on-chain signals. The Federal Reserve's upcoming policy decision on January 28 will test this thesis.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.