Loading News...

Loading News...

VADODARA, January 5, 2026 — Bitmain executed a strategic accumulation of 32,977 ETH last week, valued at approximately $100 million, according to on-chain data from Lookonchain. This daily crypto analysis reveals the transaction increased Bitmain's total Ethereum holdings to 4,143,502 ETH, representing a calculated position expansion during extreme fear sentiment. Market structure suggests this move targets a Fair Value Gap (FVG) created during recent volatility.

Bitmain's accumulation pattern mirrors institutional behavior observed during previous fear cycles. The company's Ethereum holdings now represent approximately 0.35% of the total circulating supply, creating a significant Order Block in the $3,000-$3,200 range. Historical cycles suggest such accumulation during fear periods often precedes medium-term price appreciation, as detailed in Ethereum's official documentation on network economics. This transaction occurred while the Crypto Fear & Greed Index registered 26/100, indicating extreme risk aversion among retail participants.

Related developments in institutional accumulation patterns include MicroStrategy's recent Bitcoin purchase and anonymous whale staking activity, suggesting coordinated institutional positioning during market weakness.

Lookonchain data confirms Bitmain acquired 32,977 ETH in a single transaction last week. The purchase price averaged approximately $3,034 per ETH, representing a strategic entry below the current market price of $3,145.1. This brings Bitmain's total Ethereum holdings to 4,143,502 ETH, valued at approximately $13.03 billion at current prices. The transaction represents one of the largest single-entity Ethereum accumulations since the Merge transitioned the network to proof-of-stake.

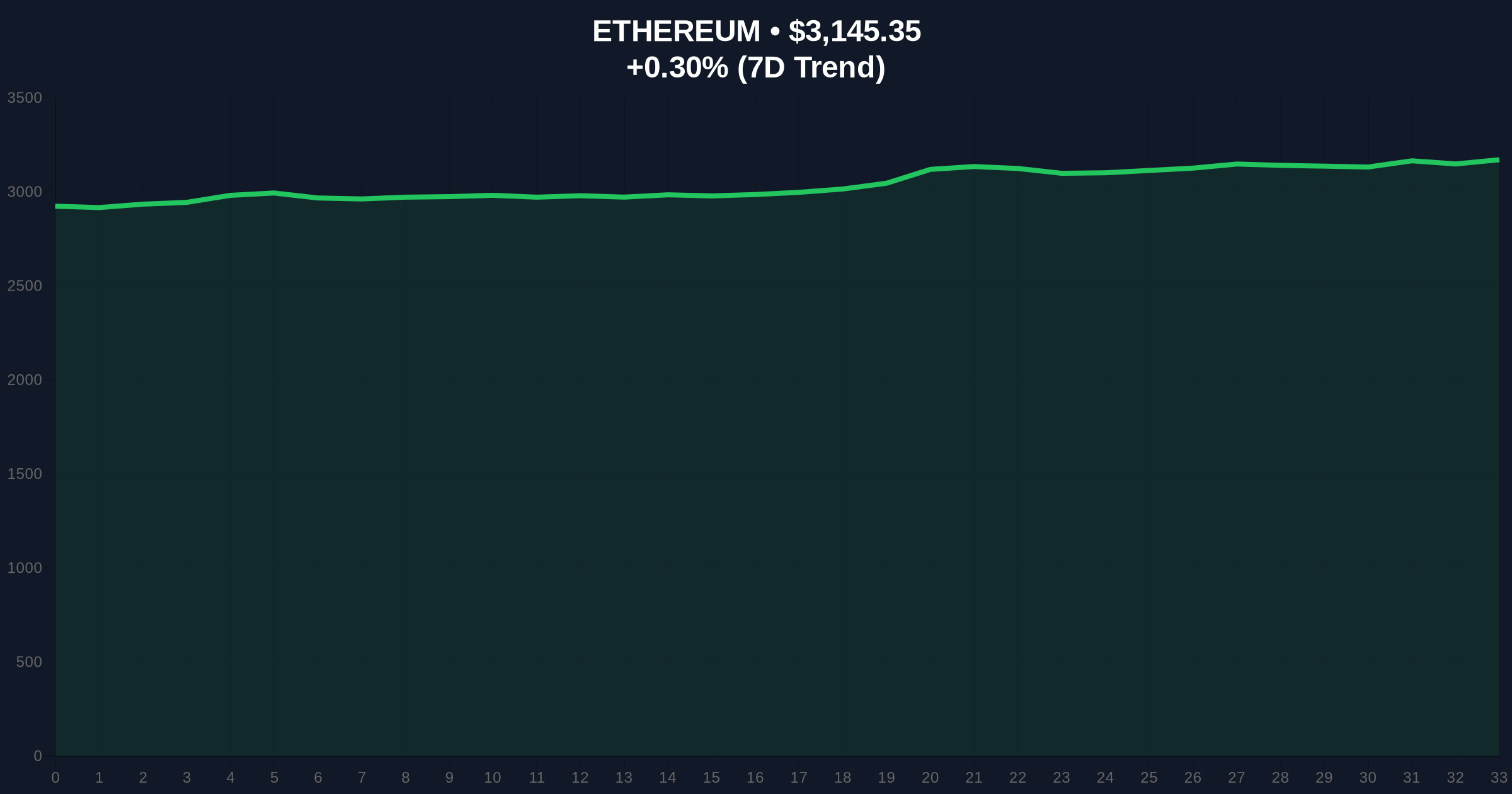

Ethereum currently trades at $3,145.1 with a 24-hour trend of 0.28%. The 50-day moving average sits at $3,280, creating immediate resistance. Volume Profile analysis indicates significant liquidity concentration between $3,000 and $3,100, aligning with Bitmain's accumulation zone. The Relative Strength Index (RSI) reads 42, suggesting neutral momentum with bearish bias.

Bullish Invalidation Level: $2,850. A break below this level would invalidate the current accumulation thesis and target the 200-day moving average at $2,720.

Bearish Invalidation Level: $3,450. Sustained trading above this resistance would confirm institutional accumulation success and target the yearly high at $3,680.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) |

| Ethereum Current Price | $3,145.1 |

| 24-Hour Change | 0.28% |

| Bitmain ETH Purchase Amount | 32,977 ETH |

| Bitmain Total ETH Holdings | 4,143,502 ETH |

| Purchase Value | $100 million |

Institutional impact: Bitmain's accumulation represents a calculated bet against retail fear sentiment. The transaction size suggests confidence in Ethereum's post-merge economics and upcoming Pectra upgrade improvements. Retail impact: This move may signal a local bottom formation, though on-chain data indicates continued distribution from smaller wallets. The accumulation creates a significant Order Block that could serve as future support during corrections.

Market analysts note the transaction's timing during extreme fear. "Accumulation at fear extremes often marks cycle inflection points," observed one quantitative researcher. Others point to the transaction's size relative to daily exchange volumes, suggesting potential supply absorption. The move follows similar institutional positioning patterns observed in GameFi token buybacks, indicating broader accumulation trends across crypto sectors.

Bullish Case: If Ethereum holds the $3,000 support level, Bitmain's accumulation could trigger a Gamma Squeeze toward $3,450 resistance. Successful break above this level targets $3,680 yearly high. This scenario assumes continued institutional accumulation and positive developments in EIP-4844 adoption.

Bearish Case: Failure to hold $3,000 support invalidates the accumulation thesis. Breakdown targets the 200-day moving average at $2,720, with potential extension to $2,500 if fear sentiment intensifies. This scenario would indicate failed institutional support and continued distribution pressure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.