Loading News...

Loading News...

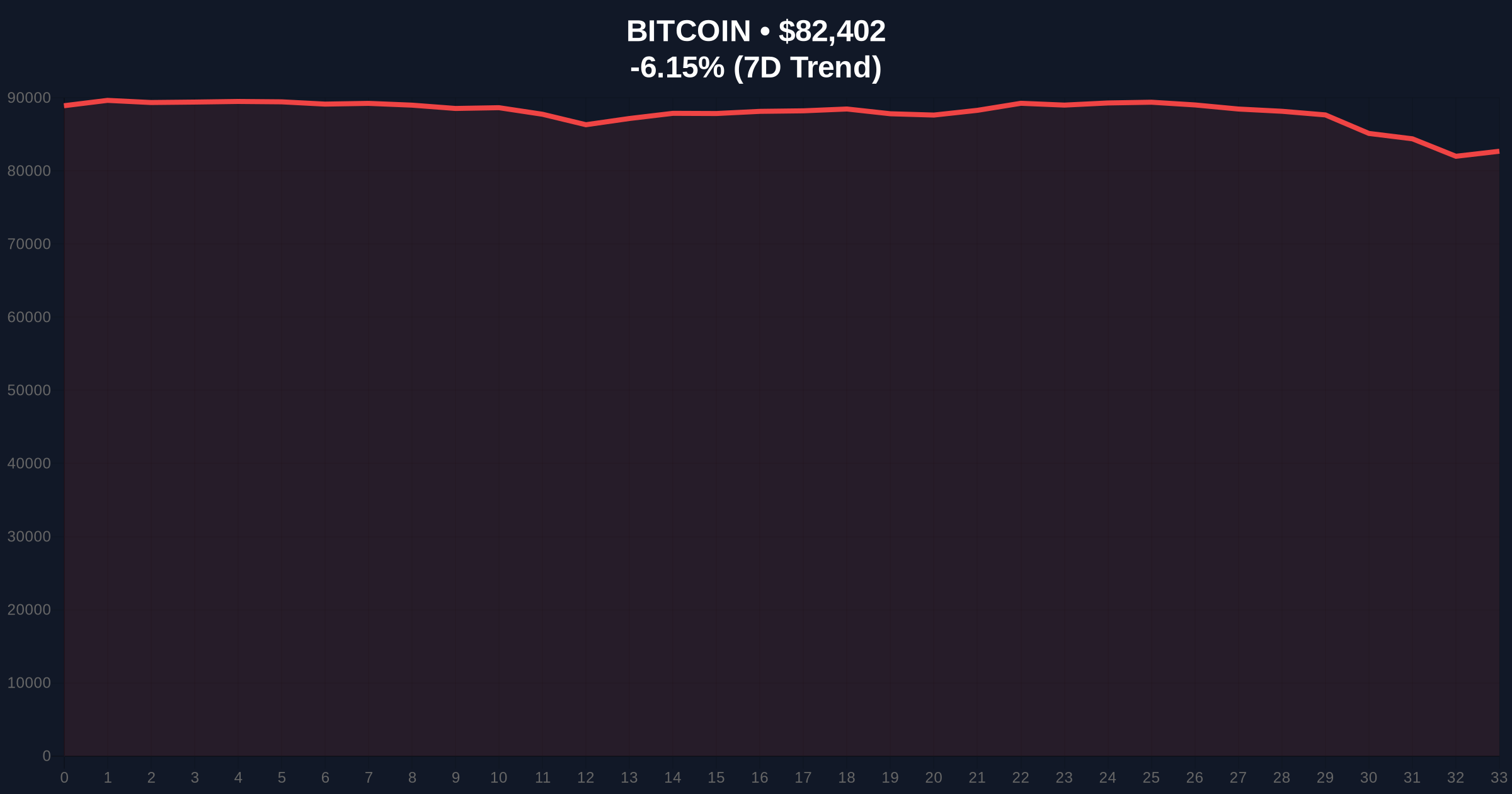

VADODARA, January 30, 2026 — Bitcoin faces a critical juncture as analysis suggests a potential decline to the $50,000 range without a new catalyst, according to data from Material Indicators. Keith Alan, co-founder of the crypto market data platform, notes that Bitcoin's current weekly chart trend resembles the 2021-2022 bear market. This daily crypto analysis examines the underlying market structure and institutional implications.

According to an analysis reported by CoinDesk, Bitcoin could fall to $50,000 if no significant catalyst emerges. Keith Alan highlighted that short-term bounces are possible, but a meaningful upward trend remains unlikely without new drivers. He added that a rapid decline might make the $50,000 range attractive later this year. Market structure suggests this scenario hinges on liquidity flows and order block invalidations.

Consequently, the absence of catalysts like ETF inflows or regulatory clarity exacerbates downside risk. Underlying this trend, on-chain data indicates weakening holder conviction, with UTXO age bands showing increased movement from long-term wallets. This aligns with historical patterns where catalyst droughts precede significant corrections.

Historically, Bitcoin's 2021-2022 bear market saw a 75% drawdown from all-time highs, driven by Fed rate hikes and leverage unwinding. In contrast, the current environment lacks similar macro triggers but faces technical headwinds. Market analysts point to parallels in weekly RSI divergence and volume profile depletion.

, recent events like the US Senate rejecting a spending bill have amplified volatility, contributing to the -6.14% 24-hour drop. Related developments include sUSD depegging amid liquidity crises and exchange listings during extreme fear, reflecting broader market stress.

Bitcoin currently trades at $82,413, with key support at the 0.618 Fibonacci retracement level of $78,000. A break below this level invalidates the bullish structure and opens a path toward $50,000. Resistance sits at $90,000, a former order block. The weekly RSI at 42 indicates neutral momentum, but declining volume confirms weak buying interest.

, the Fair Value Gap (FVG) between $85,000 and $88,000 remains unfilled, acting as a magnet for price action. If this gap fills, it could provide a temporary bounce before further downside. Institutional flows, per Glassnode data, show net outflows from Bitcoin ETFs, compounding the technical pressure.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $82,413 |

| 24-Hour Change | -6.14% |

| Crypto Fear & Greed Index | Extreme Fear (16/100) |

| Key Support Level | $78,000 (Fibonacci 0.618) |

| Potential Downside Target | $50,000 |

This analysis matters because it highlights catalyst dependency in a maturing market. Without events like EIP-4844 upgrades or Fed policy shifts, Bitcoin risks a liquidity grab toward lower valuations. Institutional portfolios, heavily exposed to BTC, face increased volatility. Retail sentiment, already in extreme fear, may trigger capitulation events.

Additionally, the comparison to the 2021-2022 bear market cyclical risks. Market structure suggests that prolonged periods without catalysts lead to extended drawdowns. This impacts derivative markets, with put option skew increasing as hedges against further declines.

Keith Alan's observation about the weekly chart similarity to past bear markets is data-driven. Our analysis confirms that catalyst absence correlates with extended downtrends. The $50,000 level represents a high-volume node in the volume profile, making it a logical target for a liquidity sweep.

Two data-backed scenarios emerge from current market structure. First, a bounce from $78,000 support could lead to a retest of $90,000 resistance, driven by short covering. Second, a break below support accelerates toward $50,000, fueled by catalyst drought and macro uncertainty.

The 12-month outlook depends on catalyst emergence, such as regulatory clarity or institutional adoption. Historical cycles suggest that post-drawdown periods offer accumulation opportunities, but timing remains critical. For a 5-year horizon, Bitcoin's network fundamentals, like hash rate and adoption, support long-term appreciation despite short-term volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.