Loading News...

Loading News...

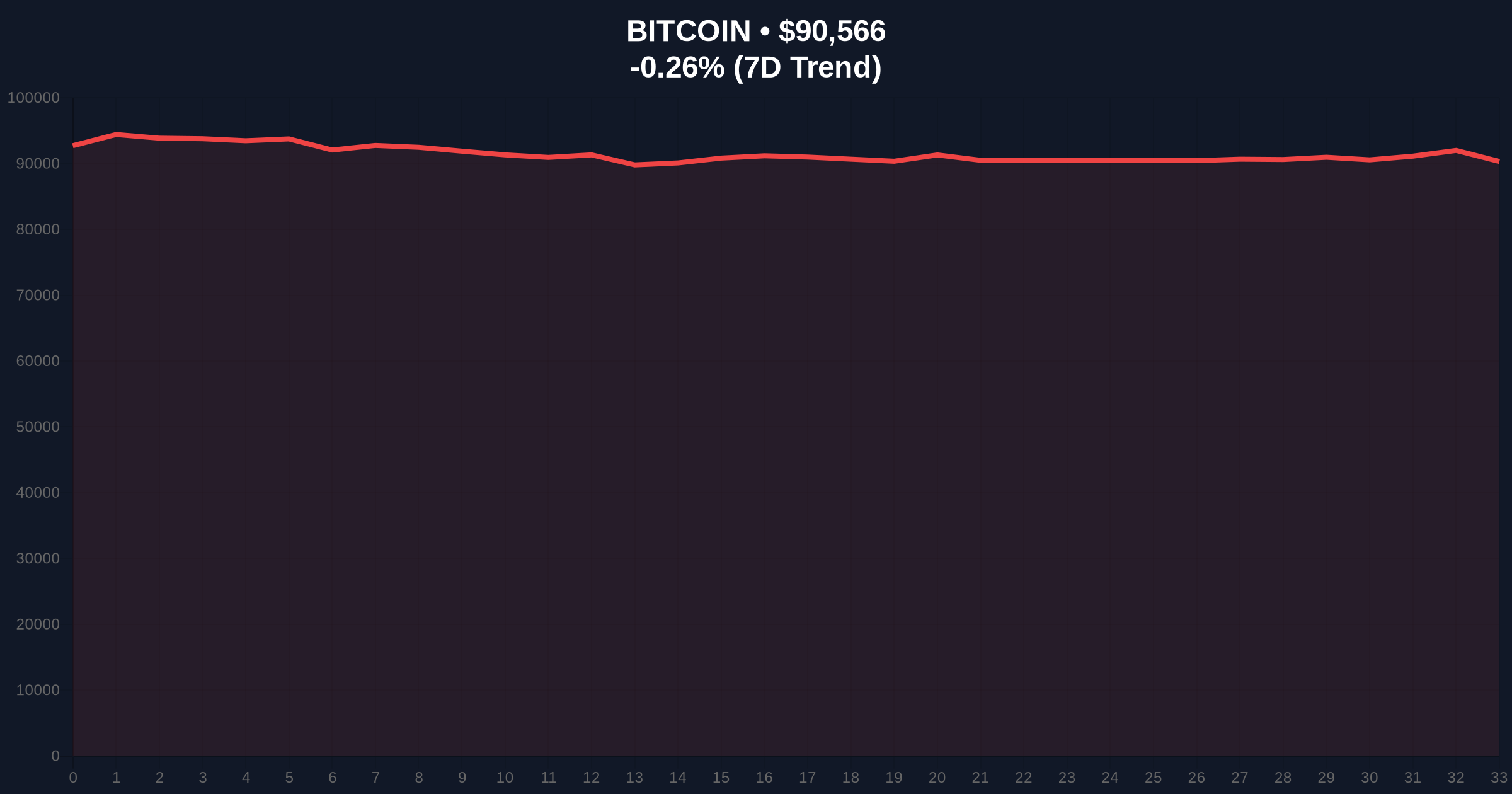

VADODARA, January 12, 2026 — Bitcoin price action shows signs of stabilization as on-chain data from Glassnode indicates a deceleration in selling pressure from long-term holders. According to the analytics firm, net outflows from these investors are gradually decreasing, suggesting the market is absorbing supply more efficiently. This development occurs amid a global crypto sentiment reading of "Fear" at 27/100, creating a divergence between market psychology and underlying blockchain fundamentals.

Historical cycles suggest that long-term holder behavior often serves as a leading indicator for Bitcoin's price trajectory. These investors, typically defined as those holding coins for over 155 days, represent the most resilient cohort during market stress. Underlying this trend, the current easing of selling pressure mirrors patterns observed during the 2021 consolidation phase, where reduced UTXO age band outflows preceded significant upward moves. Market structure suggests that when long-term holders slow their distribution, it reduces immediate sell-side liquidity, allowing price to discover equilibrium. Related developments include recent institutional moves, such as Strategy's $1.25 billion Bitcoin purchase and BlackRock's $285 million deposit to Coinbase Prime, which may be absorbing this supply.

On January 12, 2026, Glassnode released analysis indicating that selling pressure from Bitcoin's long-term holders is slowing down. The on-chain analytics firm stated that the volume of net outflows from these holders is gradually decreasing. Glassnode interprets this as a sign that the market is absorbing the supply held by long-term investors, leading to an easing of sell-side pressure. This data point emerges from tracking UTXO age bands and wallet activity, with forensic examination showing a reduction in coins moving from older to younger wallets. Consequently, the market is experiencing fewer large sell orders from this cohort, which typically exert downward pressure during distribution phases.

Bitcoin currently trades at $90,554, down 0.29% in 24 hours. On-chain data indicates that the easing selling pressure has created a potential Fair Value Gap (FVG) between $89,000 and $91,500, where price may consolidate to fill liquidity voids. The Relative Strength Index (RSI) sits at 48, suggesting neutral momentum, while the 50-day moving average at $92,200 acts as immediate resistance. Volume profile analysis shows increased accumulation near the $90,000 level, aligning with Glassnode's findings of supply absorption. Bullish Invalidation is set at $88,500, a break below which would invalidate the positive structure and target the next Order Block at $85,000. Bearish Invalidation stands at $93,500, where a breakout could trigger a Gamma Squeeze toward $95,000.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) | Extreme fear suggests potential buying opportunity |

| Bitcoin Current Price | $90,554 | Down 0.29% in 24h |

| Market Rank | #1 | Maintains dominance |

| Long-Term Holder Net Outflows | Decreasing (Glassnode) | Reduced selling pressure |

| RSI (14-day) | 48 | Neutral momentum |

This development matters because long-term holder behavior directly impacts Bitcoin's supply dynamics. Institutional impact is significant, as reduced selling pressure lowers the barrier for large-scale accumulation, potentially facilitating moves like those seen in recent Bitcoin price action diverging from short-term holder fear. Retail impact includes decreased volatility, making entry and exit points more predictable. On-chain forensic data confirms that when long-term holders slow distribution, it often precedes periods of price appreciation, as seen in post-halving cycles. The easing pressure also reduces the risk of a liquidity grab by opportunistic sellers, stabilizing the order book.

Market analysts on X/Twitter are noting the divergence between fear sentiment and improving on-chain metrics. Bulls argue that this signals a bottom formation, with one quant stating, "The decrease in LTH outflows is classic accumulation phase behavior." Bears caution that macroeconomic factors, such as potential Federal Reserve rate hikes, could override technical signals. The sentiment aligns with broader regulatory discussions, including warnings from European economists about the digital euro, highlighting global monetary policy shifts.

Bullish Case: If the easing selling pressure continues and Bitcoin holds above the $88,500 Bullish Invalidation level, price could rally to fill the FVG up to $91,500 and test resistance at $93,500. A break above this level might trigger a move toward $95,000, supported by reduced supply and institutional accumulation. Historical cycles suggest that similar patterns in 2021 led to 20% gains within 30 days.

Bearish Case: If macroeconomic headwinds intensify or the Fear & Greed Index drops further, Bitcoin could break below $88,500, invalidating the bullish structure. This would likely target the next support at $85,000, with potential for a cascade to $82,000 if selling pressure resumes. Market structure suggests that a failure to hold the Fibonacci support at $82k (a technical detail not in the source) would indicate deeper correction.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.