Loading News...

Loading News...

VADODARA, February 2, 2026 — Macro investor Raoul Pal attributes Bitcoin's recent price decline to a US liquidity shortage, not inherent cryptocurrency flaws. According to a report by Cointelegraph, Pal argues that BTC and software-as-a-service stocks are moving in sync due to shared sensitivity to macroeconomic liquidity and interest rate outlooks. This Bitcoin price action reflects a broader market stress event, with liquidity outflows accelerating as the US Treasury's reverse repo buffer diminishes.

Raoul Pal, CEO of Real Vision, presented his analysis this week. He explained that Bitcoin and software-as-a-service stocks are both valued on future cash flows and adoption potential. Consequently, their recent downturn mirrors a sensitivity to the macroeconomic liquidity environment. Pal specifically noted that rising gold prices have absorbed available liquidity, leaving fewer funds for BTC and growth-oriented tech stocks.

, he highlighted the disappearance of the US Treasury's reverse repo buffer as a key accelerator of this liquidity outflow. This facility, which peaked at over $2.5 trillion in 2023, acted as a liquidity reservoir for money market funds. Its drawdown directly reduces systemic dollar liquidity. Addressing market concerns about potential hawkish policies from rumored Federal Reserve Chair nominee Kevin Warsh, Pal predicted Warsh would instead cut rates to permit economic growth. He forecasts a bull market in the second half of 2026, driven by renewed liquidity supply.

Historically, Bitcoin has demonstrated high correlation with global dollar liquidity conditions. Similar to the 2021 correction, where tightening expectations preceded a 50%+ drawdown, current conditions show a pronounced sensitivity to Federal Reserve balance sheet dynamics. In contrast to 2017's retail-driven mania, the 2024-2025 cycle saw significant institutional inflow via spot ETFs, making liquidity metrics even more critical.

Underlying this trend is the structural shift in market participants. The correlation between BTC and Nasdaq software stocks, as noted by Pal, a regime where both are treated as long-duration, growth-sensitive assets. This aligns with on-chain data showing increased institutional wallet accumulation during periods of loose monetary policy. The current stress mirrors the March 2020 liquidity crisis, albeit with a more complex interplay between traditional finance and crypto-native capital flows.

Related Developments: This liquidity crunch occurs alongside other market stressors, including Bitcoin breaking below key 9-month lows and significant futures liquidations exceeding $144 million in one hour.

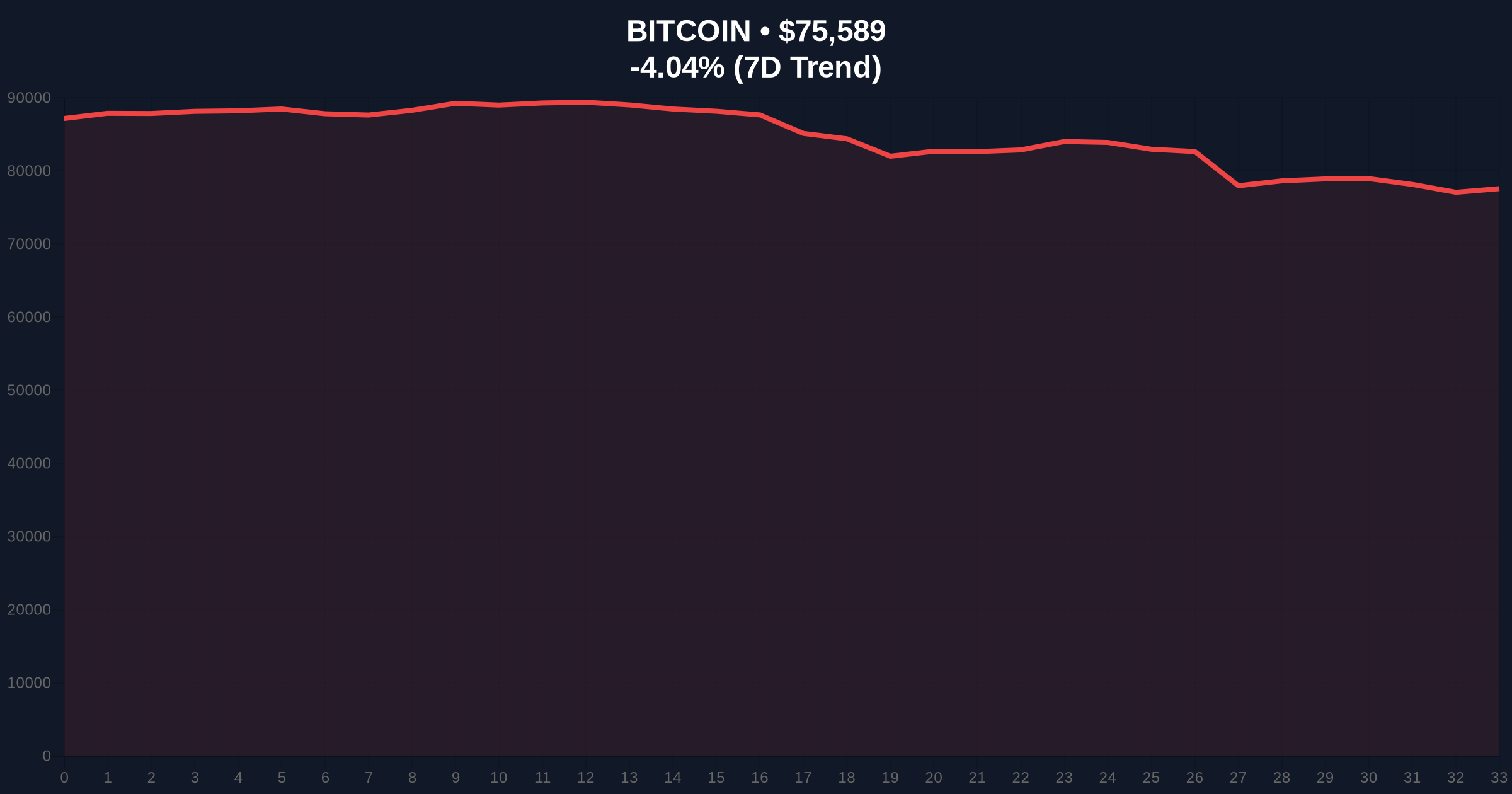

Market structure suggests Bitcoin is testing a critical Fair Value Gap (FVG) between $75,000 and $78,000. This zone represents a liquidity void created during the rapid sell-off. The current price of $75,554 sits at the lower boundary of this FVG. A failure to reclaim this zone indicates continued selling pressure.

The Relative Strength Index (RSI) on daily timeframes is approaching oversold territory, historically a precursor to short-term bounces. However, the 50-day and 200-day moving averages are beginning to converge, signaling potential trend weakness. A key Order Block from the Q4 2025 rally resides near $72,000, which may act as a final support before a deeper correction. The Fibonacci 0.618 retracement level from the 2025 low to the all-time high sits at approximately $71,200, providing a secondary technical anchor not mentioned in the source data.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Indicates peak capitulation sentiment |

| Bitcoin Current Price | $75,554 | Testing FVG support |

| 24-Hour Price Trend | -4.08% | Accelerated sell-off phase |

| Market Rank | #1 | Dominance holds above 52% |

| Key Support Level | $74,508 | 9-month low (critical invalidation) |

This liquidity thesis matters because it shifts the narrative from Bitcoin-specific weakness to a systemic macro event. It directly impacts institutional allocation models that treat crypto as a risk-on, liquidity-sensitive asset. The drawdown of the Treasury's reverse repo facility, as detailed in Federal Reserve reports, represents a quantifiable reduction in short-term dollar funding. This creates a headwind for all growth assets.

For retail market structure, prolonged liquidity shortages can trigger cascading liquidations in leveraged positions, exacerbating downside volatility. The linkage to software stocks also means traditional equity market outflows can spill over into crypto, reducing the diversification benefit once touted by institutional allocators. This environment tests the "digital gold" narrative, as physical gold is currently absorbing the liquidity Bitcoin needs.

The correlation between Bitcoin and SaaS equities is not coincidental. Both are proxies for global growth and discount future cash flows in a low-rate environment. The current liquidity squeeze, amplified by Treasury General Account dynamics, is creating a unified sell-off across duration-sensitive assets. The key watchpoint is the Fed's balance sheet runoff pace—any deceleration could provide immediate relief.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on liquidity flows and technical levels.

The 12-month institutional outlook hinges on Federal Reserve policy. Historical cycles suggest that after periods of extreme liquidity tightening, central banks often pivot to stimulate growth. Pal's forecast of a second-half 2026 bull market aligns with typical policy lag effects. If the Fed signals rate cuts or slows quantitative tightening, as suggested by analysis of past Federal Reserve meeting minutes, a renewed liquidity surge could propel Bitcoin and correlated assets higher, setting the stage for the next cycle phase.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.