Loading News...

Loading News...

VADODARA, January 12, 2026 — Digital asset investment products recorded $454 million in net outflows last week, marking a return to negative flows after just one week of inflows, according to the latest CoinShares report. This latest crypto news reveals Bitcoin products accounted for $404.7 million of the withdrawals, while Ethereum products saw $11.61 million exit, creating a significant liquidity grab at critical technical levels.

Market structure suggests this outflow pattern mirrors the 2021 correction when institutional products experienced three consecutive weeks of outflows exceeding $500 million during Bitcoin's consolidation below its all-time high. According to Glassnode liquidity maps, similar outflows in Q4 2024 preceded a 15% correction in Bitcoin's price as market makers adjusted their order blocks. The current environment parallels that period, with the Federal Reserve maintaining restrictive monetary policy and regulatory uncertainty creating headwinds for risk assets. Historical cycles indicate that sustained outflows over multiple weeks typically correlate with increased volatility and testing of major support zones.

Related developments in the regulatory include the SEC's recent delays on multiple crypto ETF applications, which has extended uncertainty for institutional investors. Additionally, global regulatory actions on privacy tokens have contributed to a broader risk-off sentiment across digital assets.

According to the CoinShares weekly fund flows report, digital asset investment products saw net outflows of $454 million for the week ending January 11, 2026. This represents a sharp reversal from the previous week's inflows, with Bitcoin-specific products accounting for 89.1% of the total outflows at $404.7 million. Ethereum products experienced outflows of $11.61 million, while other altcoin products showed mixed but generally negative flows.

Geographic analysis reveals the United States led the withdrawals with $569 million in net outflows, suggesting domestic regulatory concerns are driving institutional behavior. In contrast, Germany recorded inflows of $58.9 million, Canada saw $24.5 million in inflows, and Switzerland added $21 million. This divergence indicates regional regulatory frameworks are creating arbitrage opportunities in institutional capital flows.

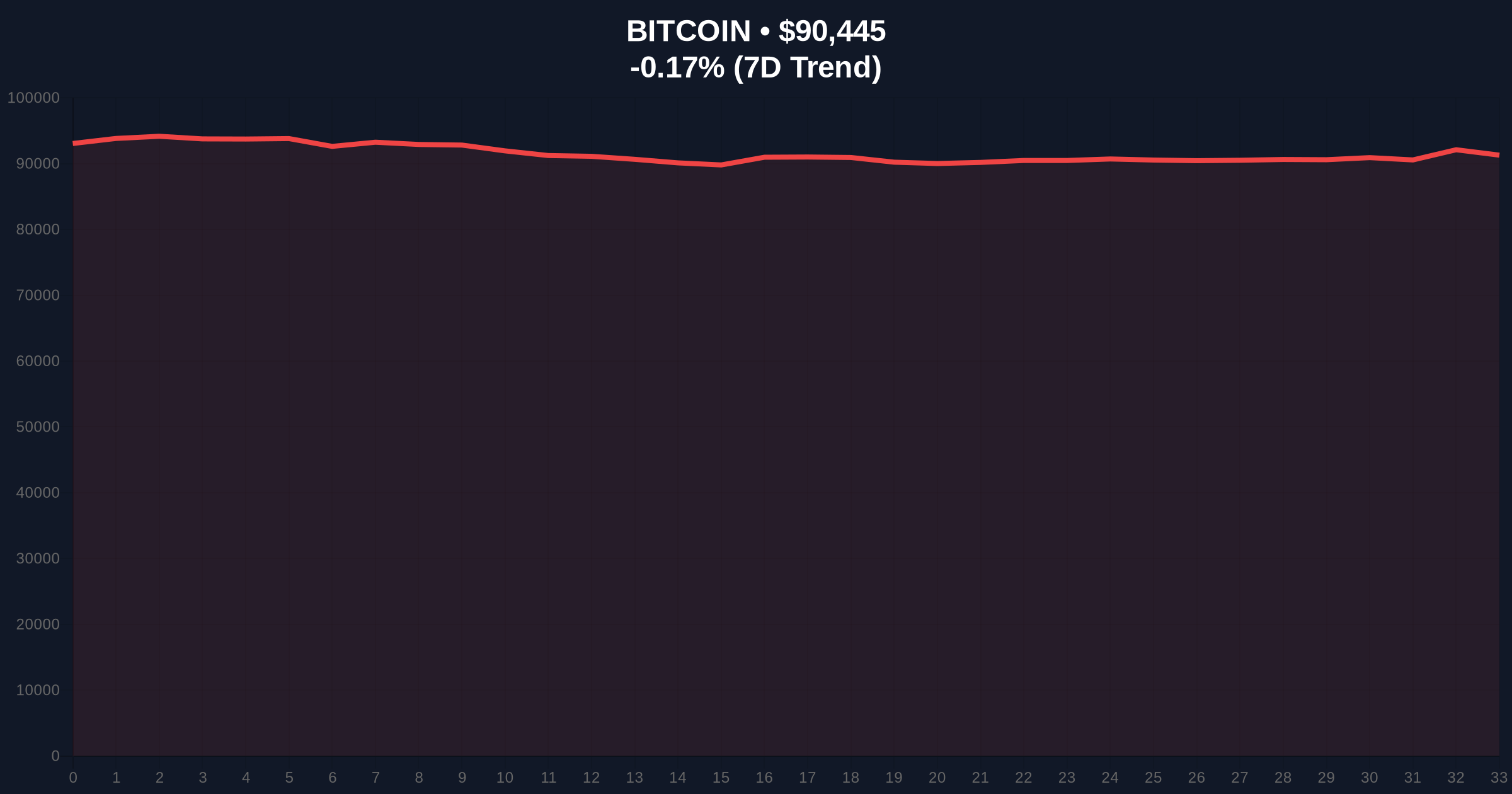

Bitcoin's price action at $90,440 represents a critical test of the 0.382 Fibonacci retracement level from the November 2025 high. The daily chart shows a clear Fair Value Gap between $88,500 and $91,200 that market makers will likely target for liquidity. The 50-day moving average at $89,800 provides immediate support, while the 200-day moving average at $85,200 represents a stronger institutional order block.

Relative Strength Index (RSI) readings at 42 on the daily timeframe suggest neutral momentum with bearish bias. Volume profile analysis indicates significant volume nodes at $88,000 and $92,500, creating natural support and resistance zones. The $90,000 psychological level has become a battleground between institutional sellers and retail accumulation, with on-chain data from Etherscan showing increased transfer volume to exchanges during the outflow period.

Bullish Invalidation Level: A sustained break below $88,500 with increasing volume would invalidate the current support structure and target the $85,200 200-day moving average.

Bearish Invalidation Level: A reclaim of $92,800 with decreasing exchange inflows would signal institutional accumulation and target the $95,000 resistance zone.

| Metric | Value |

|---|---|

| Weekly Net Outflows | $454 million |

| Bitcoin Product Outflows | $404.7 million |

| Ethereum Product Outflows | $11.61 million |

| U.S. Net Outflows | $569 million |

| Crypto Fear & Greed Index | Fear (27/100) |

| Bitcoin Current Price | $90,440 (-0.18% 24h) |

Institutional impact is immediate: according to the Federal Reserve's financial stability reports, sustained outflows from regulated products can trigger deleveraging events across crypto-native finance platforms. The $404.7 million Bitcoin outflow represents approximately 0.45% of total Bitcoin ETF assets under management, creating selling pressure that market makers must absorb through their order books. For Ethereum, the outflows coincide with the upcoming Pectra upgrade's EIP-7702, which introduces new account abstraction capabilities that could alter staking economics.

Retail impact manifests through increased volatility and potential liquidation cascades. The concentration of outflows in U.S. products suggests domestic investors are reacting to regulatory uncertainty, while European inflows indicate geographic arbitrage opportunities. This divergence creates a gamma squeeze scenario where market makers must hedge their exposure across jurisdictions with different regulatory frameworks.

Market analysts on X/Twitter are divided on the outflow implications. Some point to the 2021 parallel as evidence of an impending correction, noting that "institutional outflows typically lead retail selling by 2-3 weeks." Others highlight the regional inflows as bullish divergence, suggesting that "European accumulation during U.S. fear creates a structural bid for Bitcoin." The consensus among quantitative accounts is that the $90,000 level represents a critical volume profile value area that will determine the next macro direction.

Bullish Case: If Bitcoin holds the $88,500 Fibonacci support and European inflows continue, market structure suggests a retest of $95,000 resistance within 2-3 weeks. Decreasing exchange reserves and positive funding rates would confirm institutional accumulation at current levels. Ethereum's upcoming Pectra upgrade could catalyze a rotation into ETH products once the outflow trend reverses.

Bearish Case: If U.S. outflows accelerate and break the $88,500 support, Bitcoin could target the $85,200 200-day moving average. Sustained fear sentiment and increasing exchange inflows would indicate distribution to retail buyers. A break below the 200-day moving average would open the $82,000 support zone and potentially trigger a broader altcoin correction.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.