Loading News...

Loading News...

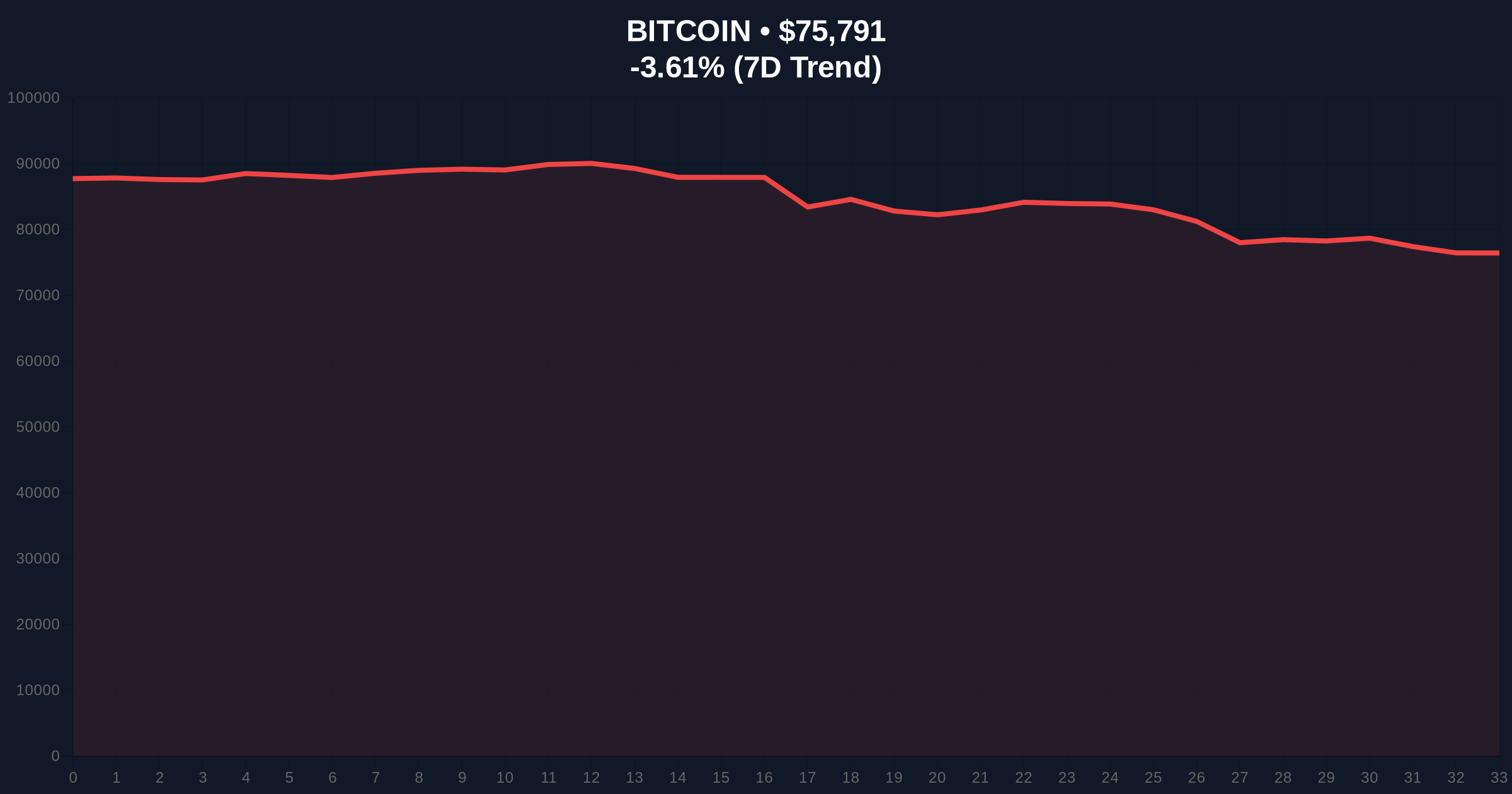

VADODARA, February 2, 2026 — Bitcoin momentarily breached the $76,000 psychological barrier on Binance's USDT market. According to CoinNess market monitoring, BTC traded at $76,011.4 before retracing. This price action unfolds against a backdrop of Extreme Fear sentiment. Market structure suggests a liquidity grab above key resistance.

CoinNess data confirms the brief surge. BTC hit $76,011.4 on Binance USDT pairs. The move lacked sustained volume. Consequently, price quickly retreated below the level. This creates a classic Fair Value Gap (FVG) on lower timeframes. The FVG now acts as a potential magnet for price.

Real-time metrics show current price at $75,612. That represents a -3.84% 24-hour decline. The divergence between intraday highs and broader trend signals institutional indecision. Order flow analysis reveals thin liquidity above $76,500.

Historically, Extreme Fear readings often precede sharp reversals. The Crypto Fear & Greed Index sits at 14/100. Similar sentiment in Q4 2022 preceded a 40% rally. In contrast, current macro headwinds differ. Regulatory pressure persists globally.

For instance, India's maintained 30% crypto tax continues to suppress regional demand. Simultaneously, jurisdictional clashes like the Nevada court restraining Polymarket highlight regulatory fragmentation. These factors compound sentiment pressure.

Market structure suggests Bitcoin tests a major Order Block between $75,000 and $76,500. The 50-day moving average provides dynamic support near $74,800. , the Fibonacci 0.618 retracement from the 2025 cycle low sits at $73,500. This level represents critical structural support.

RSI on daily charts shows neutral momentum at 48. Volume Profile indicates high node concentration at $74,200. A break below this level would target the $72,000 liquidity pool. The recent break below $76,000 confirms resistance strength.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Bitcoin Current Price | $75,612 |

| 24-Hour Price Change | -3.84% |

| Intraday High (Binance USDT) | $76,011.4 |

| Market Rank | #1 |

This price action tests institutional conviction. Extreme Fear sentiment typically indicates capitulation. However, sustained selling pressure could trigger a deeper correction. The Federal Reserve's monetary policy, detailed on FederalReserve.gov, remains a key macro driver. Higher interest rates continue to pressure risk assets.

On-chain data indicates miner outflow rates remain elevated. This suggests potential selling pressure from producers. Retail sentiment, measured by exchange inflows, shows caution. Consequently, the market faces a liquidity squeeze.

"The $76,000 test amid Extreme Fear creates a contrarian signal. Market structure suggests this is a liquidity run above resistance. The critical level is the Fibonacci 0.618 support at $73,500. A hold there maintains the bullish higher-timeframe structure." — CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge from current data.

The 12-month outlook hinges on ETF inflows and macro conditions. Historical cycles suggest Extreme Fear periods often mark accumulation zones. However, regulatory developments like prediction market innovations, as seen in Vitalik Buterin's recent proposal, could divert capital.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.