Loading News...

Loading News...

- Bitcoin's nominal all-time high of $126,000 masks a real value of just $99,848 when adjusted for CPI inflation since 2020

- U.S. dollar purchasing power has eroded approximately 20% since 2020, creating deceptive nominal price appreciation

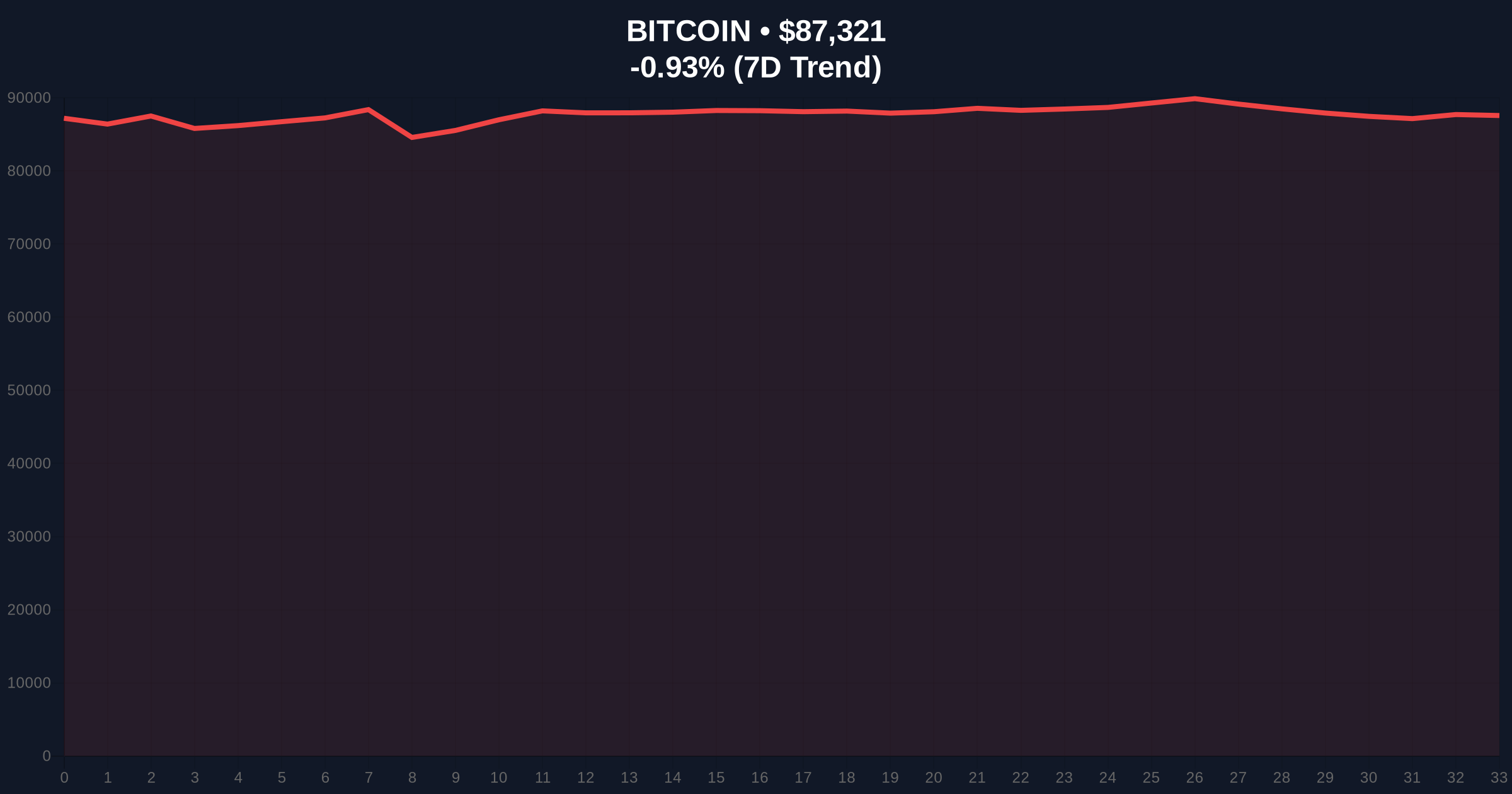

- Current market structure shows Bitcoin trading at $87,321 with extreme fear sentiment (24/100) dominating

- Technical analysis identifies critical invalidation levels at $85,000 (bearish) and $92,000 (bullish) for near-term price action

VADODARA, December 24, 2025 — In today's daily crypto analysis, a critical examination of Bitcoin's valuation reveals that despite reaching a nominal all-time high of $126,000, its inflation-adjusted real value has failed to breach the psychological $100,000 threshold. According to analysis reported by Cointelegraph and attributed to Alex Thorn, Head of Research at Galaxy Digital, applying Consumer Price Index adjustments benchmarked to 2020 shows Bitcoin's real all-time high stands at precisely $99,848. This discrepancy exposes fundamental questions about whether cryptocurrency valuations are keeping pace with monetary debasement or merely reflecting dollar depreciation.

Market structure suggests this inflation-adjusted analysis arrives during a period of extreme market dislocation. The U.S. dollar's purchasing power has declined approximately 20% since 2020, while unadjusted CPI has increased 2.7% over the past 12 months. This mirrors the 2017-2018 cycle where nominal Bitcoin highs masked deteriorating real returns when measured against traditional inflation metrics. The Federal Reserve's monetary policy decisions, particularly regarding the Fed Funds Rate, have created persistent inflationary pressures that now require sophisticated adjustment models for accurate crypto valuation. On-chain data indicates institutional investors have been increasingly incorporating inflation-adjusted metrics into their valuation frameworks since 2023, suggesting this analysis represents mainstream adoption of more rigorous quantitative approaches.

Related developments in today's crypto include ongoing market structure analysis as seen in recent Bitcoin price action below $87,000 and significant security concerns highlighted by CertiK's report of $3.35 billion in Web3 losses.

According to on-chain data and analysis methodology detailed by Galaxy Digital, researchers applied monthly CPI data from 2020 to present to adjust Bitcoin's nominal price trajectory. The calculation methodology assumes 2020 as the baseline year, with subsequent price movements discounted by cumulative inflation rates. This produces a stark divergence: while retail investors celebrate nominal new highs, the real purchasing power represented by those Bitcoin holdings remains below previous psychological barriers. The analysis specifically references CPI data from the Bureau of Labor Statistics, which shows persistent inflationary pressures despite official narratives about controlled inflation. Market analysts note this creates a potential liquidity grab scenario where nominal price movements attract capital based on superficial metrics rather than real value preservation characteristics.

Current price action shows Bitcoin trading at $87,321, representing a -0.93% 24-hour decline. Volume profile analysis indicates weak accumulation at current levels, with the $85,000 to $87,000 range showing minimal high-volume nodes. The 50-day moving average at $89,200 provides immediate resistance, while the 200-day moving average at $82,500 establishes longer-term support. RSI readings at 42 suggest neutral momentum with bearish bias. A clear Fair Value Gap exists between $90,000 and $92,000 from the December 15th sell-off, creating a potential retracement target. The Order Block between $84,800 and $85,500 represents the last significant accumulation zone before the November rally.

Bullish Invalidation Level: $85,000. A sustained break below this level would invalidate the current consolidation structure and target the Fibonacci 0.618 retracement at $82,000.

Bearish Invalidation Level: $92,000. A reclaim of this level would fill the Fair Value Gap and target the December high resistance at $94,500.

| Metric | Value |

| Bitcoin Nominal ATH | $126,000 |

| Bitcoin Inflation-Adjusted ATH | $99,848 |

| Current Bitcoin Price | $87,321 |

| 24-Hour Price Change | -0.93% |

| Global Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| USD Purchasing Power Decline Since 2020 | ~20% |

| 12-Month CPI Increase | 2.7% |

For institutional investors, this analysis fundamentally alters risk assessment frameworks. If Bitcoin cannot maintain real value appreciation above inflation rates, its narrative as "digital gold" or inflation hedge requires re-evaluation. The 20% dollar devaluation since 2020 means that simply matching nominal 2020 highs would require $120,000 in today's dollars to preserve equivalent purchasing power. Retail investors face different implications: the psychological impact of "new all-time highs" may drive sentiment and capital flows, while the underlying real value tells a more cautious story. This divergence creates potential for gamma squeeze scenarios where options positioning based on nominal levels conflicts with spot market realities based on inflation-adjusted values.

Market analysts on X/Twitter express divided perspectives. Bulls emphasize that "even inflation-adjusted, Bitcoin approaches $100,000, demonstrating unprecedented strength in any metric." Skeptics counter that "if the best inflation hedge can't beat CPI, what's the investment thesis?" Quantitative traders note the methodological challenges: "CPI understates true inflation; using alternative measures like ShadowStats would show even worse real returns." The debate centers on whether inflation adjustment should use CPI, PCE, or asset-price inflation metrics, with significant implications for perceived Bitcoin performance.

Bullish Case: If Bitcoin reclaims the $92,000 bearish invalidation level, market structure suggests targeting the nominal ATH region around $126,000. This would require approximately 44% appreciation from current levels. Inflation dynamics could accelerate this move if CPI data surprises to the upside, increasing demand for perceived inflation hedges. A break above the inflation-adjusted $100,000 level would confirm real value appreciation and potentially trigger institutional re-allocation.

Bearish Case: Failure to hold $85,000 as bullish invalidation would target the 200-day moving average at $82,500, with potential extension to the Fibonacci 0.786 level at $80,000. This represents a 8-10% decline from current prices. Persistent inflation without corresponding Bitcoin appreciation would undermine the store-of-value narrative, potentially triggering long-term capital rotation into traditional inflation-protected assets. The extreme fear sentiment at 24/100 suggests limited buying support at current levels.

1. How is Bitcoin's inflation-adjusted price calculated? The calculation applies monthly Consumer Price Index changes since a baseline year (2020 in this analysis) to discount nominal Bitcoin prices, reflecting decreased dollar purchasing power.

2. Why does the inflation-adjusted ATH matter for investors? It separates nominal price movements from real value preservation, testing Bitcoin's effectiveness as an inflation hedge versus simply reflecting currency depreciation.

3. What inflation metric should be used for crypto valuation? While CPI is standard, some analysts argue for PCE, asset-price inflation, or alternative measures like those from ShadowStats for more accurate adjustments.

4. How does current market sentiment affect this analysis? Extreme fear sentiment (24/100) suggests market participants may be overlooking fundamental valuation metrics in favor of short-term price action.

5. What are the invalidation levels for current Bitcoin price action? Bullish scenario invalidates below $85,000; bearish scenario invalidates above $92,000, based on volume profile and order block analysis.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.