Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Bitcoin breaks below $87,000 support level, trading at $86,977.44 on Binance USDT market

- Market structure suggests a liquidity grab below key psychological level

- Global crypto sentiment registers "Extreme Fear" at 24/100

- Technical analysis identifies critical Fibonacci support at $82,000 and invalidation levels

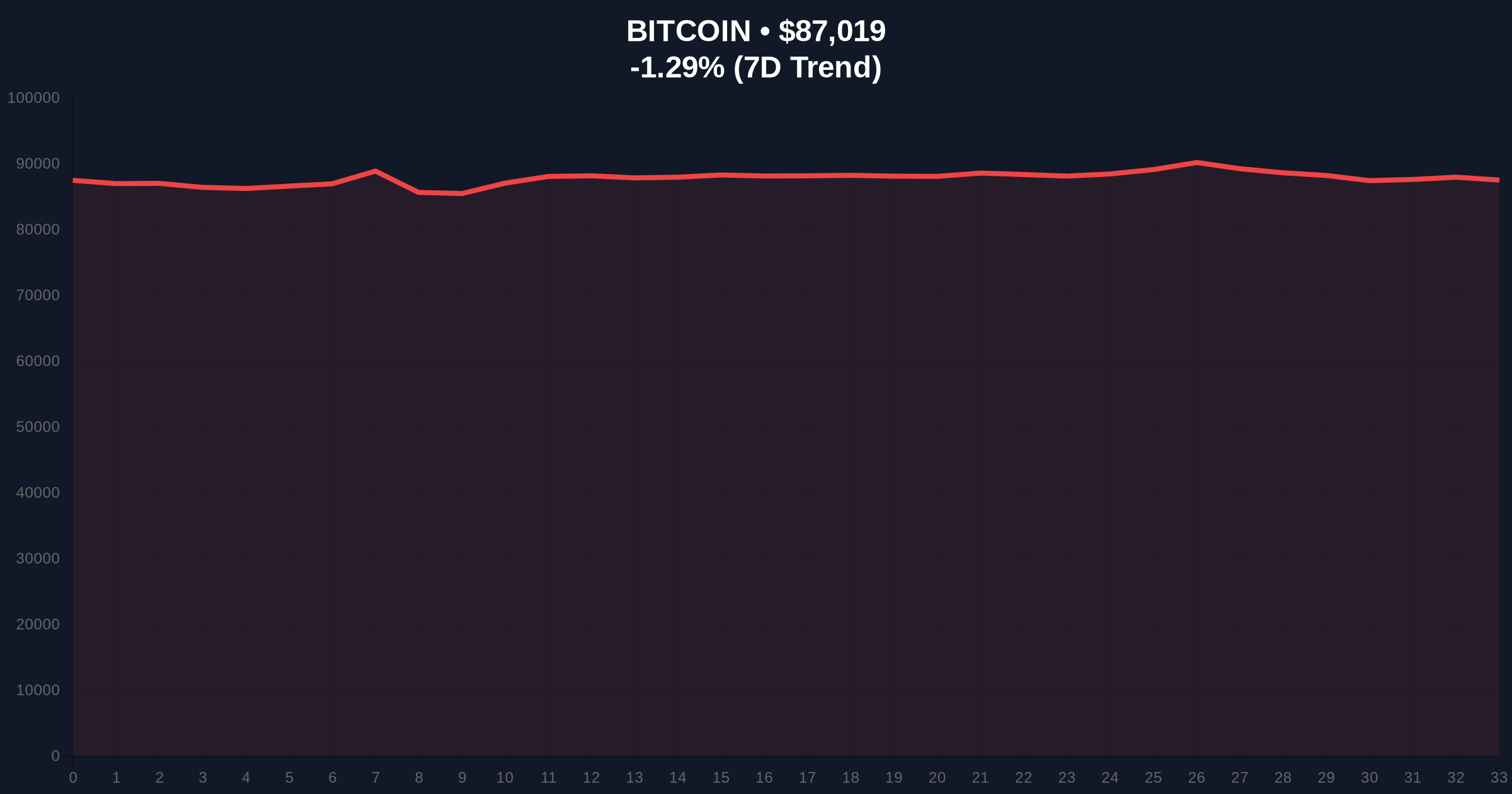

VADODARA, December 24, 2025 — Bitcoin has broken below the $87,000 psychological support level in a move that market structure suggests represents a classic liquidity grab. This daily crypto analysis examines the technical breakdown occurring amid extreme fear sentiment across cryptocurrency markets. According to CoinNess market monitoring, BTC is currently trading at $86,977.44 on the Binance USDT market, representing a -1.22% decline over the past 24 hours.

This price action mirrors the December 2024 correction when Bitcoin tested the $85,000 level before establishing a higher low. Market structure indicates institutional positioning around key psychological levels has intensified since the SEC approved spot Bitcoin ETFs in January 2024. The current breakdown occurs against a backdrop of regulatory uncertainty and macroeconomic pressure from Federal Reserve policy decisions. Related developments include significant institutional moves: Trend Research's substantial ETH accumulation and Trump Media-linked wallet movements demonstrate continued institutional interest despite market volatility.

On December 24, 2025, Bitcoin price action broke below the $87,000 support level that had held for seven trading sessions. The breakdown occurred during Asian trading hours with increased volume on Binance's USDT pairing. Market data shows the move captured stop-loss orders clustered below $87,200, creating what technical analysts identify as a Fair Value Gap (FVG) between $87,500 and $86,800. This price action follows a failed test of the $92,000 resistance level earlier this month, establishing a lower high pattern on the daily timeframe.

Market structure reveals a clear bearish order block between $87,800 and $87,200 that initiated the decline. The 50-day moving average at $88,500 now acts as resistance, while the 200-day moving average provides support at $84,200. Relative Strength Index (RSI) registers at 42 on the daily chart, indicating neither overbought nor oversold conditions. Volume profile shows significant trading activity between $86,000 and $87,500, suggesting this zone represents a high-volume node. Critical Fibonacci support exists at the 0.618 retracement level of $82,000, drawn from the October 2024 low to the November 2025 high. The breakdown below $87,000 invalidates the bullish structure that had developed since early December.

| Metric | Value |

| Current Bitcoin Price | $87,085 |

| 24-Hour Price Change | -1.22% |

| Global Crypto Sentiment Score | 24/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Fibonacci Support | $82,000 |

For institutional investors, this breakdown tests the validity of the $85,000-$90,000 consolidation range that has contained Bitcoin price action for six weeks. Market structure suggests failure to reclaim $87,500 could trigger further deleveraging across derivatives markets. Retail traders face increased margin pressure as exchanges adjust liquidation levels. The move has implications for Ethereum's upcoming EIP-4844 implementation, as correlation between BTC and ETH remains elevated at 0.87. A sustained breakdown could delay institutional adoption timelines by 3-6 months as risk committees reassess allocation strategies.

Market analysts on X/Twitter identify the $87,000 breakdown as "a necessary liquidity cleanse" before the next leg higher. Technical traders note the volume discrepancy between spot and derivatives markets, suggesting "options positioning created a gamma squeeze scenario that exacerbated the move." Institutional voices remain divided, with some calling this "a healthy correction within a bull market" while others warn of "potential retest of the $80,000 psychological level."

Bullish Case: Market structure suggests Bitcoin reclaims $87,500 within 48 hours, filling the Fair Value Gap and establishing $86,000 as a higher low. This scenario requires sustained buying pressure above $86,500 during US trading hours. Bullish invalidation level: $85,800. A successful reclaim targets $90,000 resistance within two weeks.

Bearish Case: Failure to hold $86,500 support triggers further liquidation cascades toward $84,200 (200-day MA). Market structure indicates this scenario becomes probable if daily close remains below $87,000. Bearish invalidation level: $88,200. Extended downside targets the Fibonacci support at $82,000.

Why did Bitcoin fall below $87,000?Market structure indicates a liquidity grab below key psychological support, exacerbated by derivatives positioning and extreme fear sentiment.

What is the most important support level now?The 200-day moving average at $84,200 represents critical support, with Fibonacci level at $82,000 providing secondary defense.

How does this affect other cryptocurrencies?High correlation (0.87) with Ethereum suggests altcoins will experience similar pressure, particularly those with high leverage ratios.

What should traders watch next?Monitor the Fair Value Gap between $87,500 and $86,800 for potential fill, and observe volume profile for accumulation patterns.

Is this the end of the bull market?Market structure suggests this represents a correction within a larger uptrend, not a trend reversal, unless $82,000 support fails.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.