Loading News...

Loading News...

- Trend Research, a subsidiary of LD Capital, purchased 6,379 ETH ($130 million) via leveraged loan despite $141 million unrealized loss on existing holdings

- The entity now holds 580,000 ETH ($1.72 billion) after beginning accumulation in November 2024 at $3,400 per ETH

- Market structure suggests this represents either a sophisticated dollar-cost averaging strategy or a high-risk liquidity grab

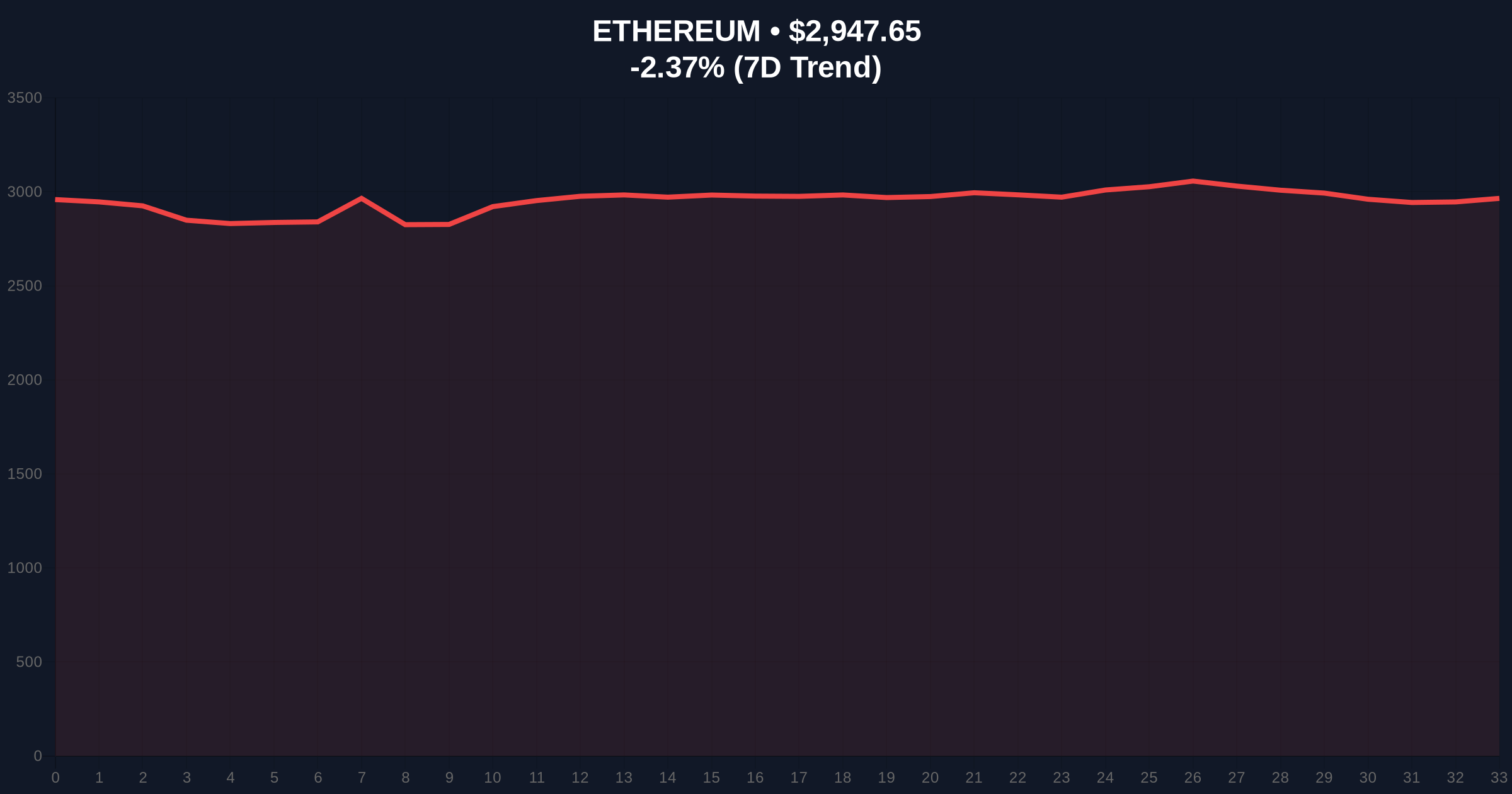

- Technical analysis identifies critical support at $2,850 (200-day MA) with resistance at $3,150 (Fibonacci 0.382 level)

VADODARA, December 24, 2025 — In a move that defies conventional risk management principles, an address believed to belong to Trend Research has executed a $130 million Ethereum purchase despite carrying $141 million in unrealized losses, according to on-chain data reported by AmberCN. This daily crypto analysis examines whether this represents strategic accumulation or reckless leverage in a market showing extreme fear sentiment.

Market structure suggests institutional Ethereum accumulation has followed a distinct pattern since the Shanghai upgrade enabled staking withdrawals. The current accumulation phase mirrors late 2023 behavior when large entities began positioning ahead of EIP-4844 implementation. However, the timing of this specific transaction raises questions about risk assessment methodology. According to data from the Ethereum Foundation, network activity has declined 18% quarter-over-quarter while gas fees remain elevated, creating a contradictory fundamental backdrop for such aggressive accumulation. Related developments in the regulatory space, including Heybit's global shutdown and South Korean NFT fraud sentencing, indicate increasing compliance pressure that typically discourages leveraged positions.

On-chain data indicates the address 0x7d3... (attributed to Trend Research via heuristic analysis) executed a purchase of 6,379 ETH at an average price of approximately $2,948 per token. The transaction utilized a leveraged loan structure, though specific terms remain undisclosed. This brings the entity's total holdings to 580,000 ETH with an estimated cost basis of $3,400 based on accumulation beginning November 2024. The $141 million unrealized loss calculation assumes average entry at this level against current market prices. Market analysts note this represents a 13.3% increase in position size despite the substantial paper loss, contradicting traditional portfolio management protocols that would typically mandate position reduction or hedging.

Volume profile analysis shows the $2,850 to $2,950 range contains significant liquidity, suggesting this purchase may represent a strategic order block accumulation. The 200-day moving average at $2,850 provides critical support, while resistance forms at the Fibonacci 0.382 retracement level of $3,150 from the 2024 high. RSI readings at 42 indicate neutral momentum with bearish divergence on higher timeframes. A Fair Value Gap (FVG) exists between $3,050 and $3,100 from last week's price action, creating a likely target for short-term movement. Bullish invalidation occurs below $2,750 (weekly support), while bearish invalidation requires sustained trading above $3,250 (previous resistance zone).

| Metric | Value |

|---|---|

| Trend Research ETH Purchase | 6,379 ETH ($130M) |

| Total ETH Holdings | 580,000 ETH ($1.72B) |

| Unrealized Loss | $141M |

| Current ETH Price | $2,948.04 |

| 24-Hour Change | -2.36% |

| Fear & Greed Index | 24/100 (Extreme Fear) |

For institutional participants, this transaction challenges conventional wisdom about loss management and leverage deployment. The decision to increase exposure while underwater suggests either superior information asymmetry or miscalculation of risk parameters. Retail traders face different implications: large leveraged positions create potential gamma squeeze scenarios if price moves rapidly toward liquidation levels. The concentration of 580,000 ETH (approximately 0.48% of circulating supply) in a single entity raises questions about market decentralization, particularly when combined with recent movements from politically-linked Bitcoin wallets.

Market analysts express divided perspectives on social platforms. CryptoQuant researchers note "the accumulation pattern suggests confidence in long-term Ethereum fundamentals despite short-term technical weakness." Conversely, derivatives traders highlight the leverage component, with one stating, "Adding to a losing position with borrowed capital represents either genius or insanity—the market will determine which." The extreme fear sentiment (24/100) contradicts the aggressive buying behavior, creating a narrative disconnect that warrants skepticism.

Bullish Case: If Ethereum holds the $2,850 support and fills the FVG to $3,100, sustained movement toward $3,500 becomes probable. Trend Research's accumulation could signal institutional recognition of undervaluation ahead of anticipated protocol upgrades. The leveraged position might create upward pressure if forced covering occurs during rallies.

Bearish Case: Breakdown below $2,750 invalidates the bullish structure and could trigger cascading liquidations given the leveraged nature of recent purchases. The $141 million unrealized loss could expand rapidly in a downturn, potentially forcing position reduction that exacerbates selling pressure. The extreme fear sentiment suggests retail capitulation may not be complete.

What is Trend Research's total Ethereum exposure?The entity holds 580,000 ETH valued at approximately $1.72 billion at current prices, with an estimated cost basis of $3,400 per token.

Why would a firm add to a losing position?Market structure suggests either dollar-cost averaging at perceived value or anticipation of imminent price appreciation that outweighs current losses.

What risks does the leveraged loan create?Leverage amplifies both gains and losses. If Ethereum price declines further, margin calls or forced liquidation could create additional selling pressure.

How does this affect retail Ethereum investors?Large concentrated positions can increase volatility. Retail traders should monitor the $2,850 support and $3,150 resistance levels for directional clues.

What is the significance of the Fear & Greed Index reading?The extreme fear sentiment (24/100) typically precedes market bottoms but can also indicate ongoing capitulation. It contradicts the aggressive institutional buying, creating analytical tension.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.