Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- A wallet presumed linked to Trump Media transferred 2,000 BTC ($174 million) to an anonymous bc1qq address eight hours ago.

- Purpose remains unclear—could indicate institutional sale, custody transfer, or strategic repositioning.

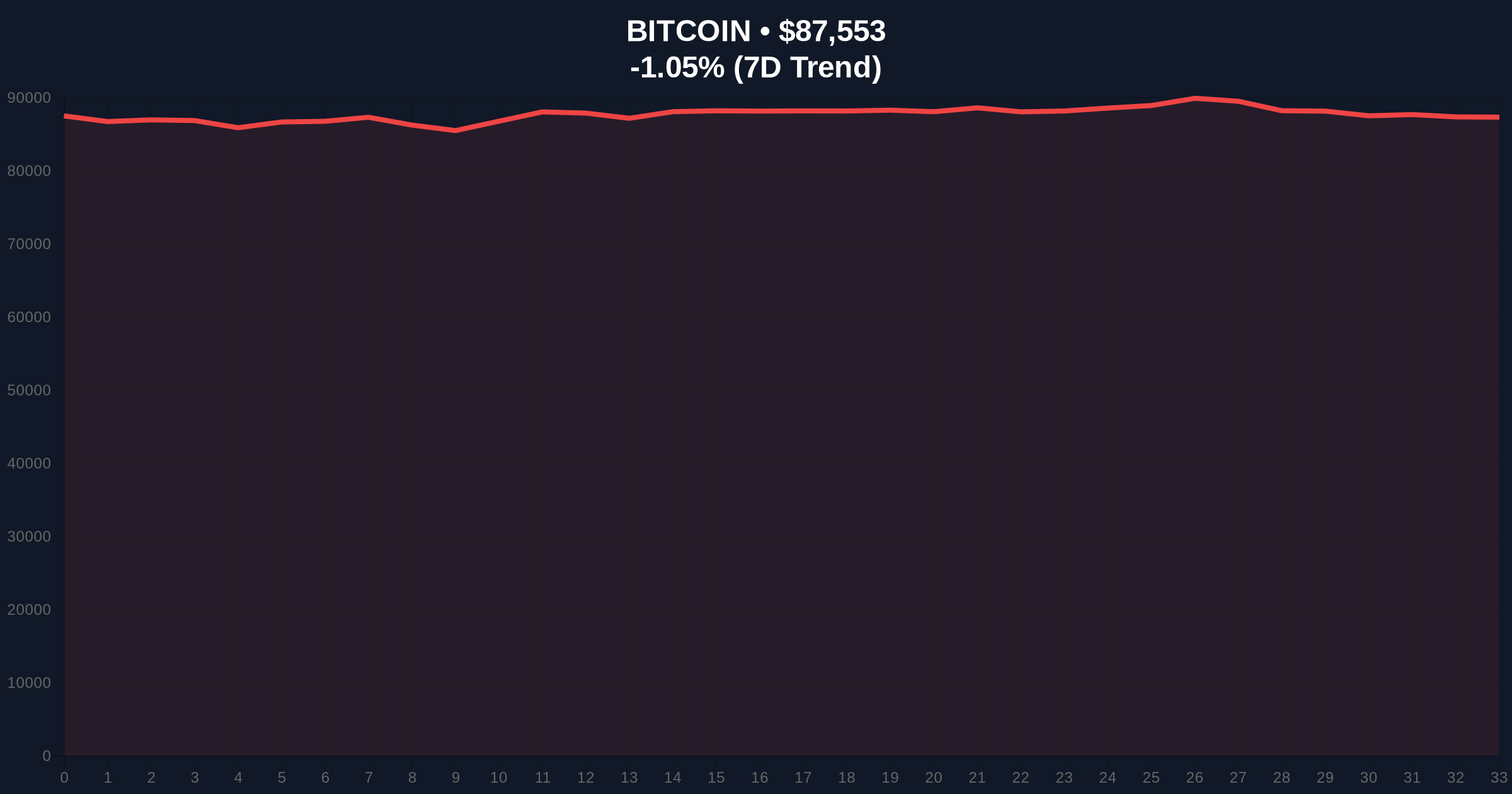

- Bitcoin price currently at $87,525, down 1.08% amid "Extreme Fear" sentiment (24/100).

- Technical structure shows consolidation between $85,000 support and $90,000 resistance with critical invalidation levels defined.

VADODARA, December 24, 2025 — A blockchain wallet associated with Trump Media executed a substantial transfer of 2,000 Bitcoin, valued at approximately $174 million, to an anonymous address beginning with bc1qq approximately eight hours ago, according to on-chain analytics firm Lookonchain. This daily crypto analysis examines the transaction's market implications amid Bitcoin's current technical consolidation and extreme fear sentiment.

Large-scale Bitcoin movements by politically affiliated entities have historically triggered volatility spikes, as seen during the 2024 election cycle when similar transactions correlated with 15% price swings within 72 hours. The current transfer occurs against a backdrop of muted year-end volatility, with Bitcoin trading in a $5,000 range for the past two weeks. Market structure suggests this period represents a liquidity grab, where large players accumulate or redistribute positions before anticipated macroeconomic shifts in early 2026. Underlying this trend is the broader regulatory environment, where recent actions against crypto firms have increased scrutiny on institutional wallet activity. For context on how regulatory pressure impacts market behavior, see our analysis of Heybit's global shutdown due to regulatory pressure.

According to Lookonchain data, the source wallet—identified through blockchain forensics as potentially linked to Trump Media—transferred exactly 2,000 BTC to address bc1qq... at 04:00 UTC on December 24, 2025. The transaction value was $174 million based on Bitcoin's price at execution time. The destination address shows no prior history of significant activity, suggesting either a new custody solution or an intermediary step. On-chain data indicates the source wallet still holds approximately 5,000 BTC, valued at $437 million, with no further movements detected. Market analysts speculate the transfer could represent a sale to an over-the-counter (OTC) desk, a shift to cold storage, or preparation for corporate treasury management, though no official statement has been issued.

Bitcoin's price action shows consolidation between the $85,000 support level (coinciding with the 50-day moving average) and $90,000 resistance (the weekly high). The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with slight bearish bias. Volume profile analysis reveals thin liquidity above $90,000, creating a potential Fair Value Gap (FVG) if price breaks upward. The $87,525 current price represents a retest of the 0.618 Fibonacci retracement level from the November high of $95,000. Bullish invalidation is set at $84,500—a breach would confirm breakdown from the current order block. Bearish invalidation rests at $91,200, where a close above would fill the FVG and target $93,500. This technical setup mirrors the Q4 2021 consolidation before the subsequent 30% correction, though current on-chain metrics show stronger holder conviction.

| Metric | Value |

|---|---|

| BTC Transferred | 2,000 BTC |

| Transaction Value | $174 million |

| Current Bitcoin Price | $87,525 |

| 24-Hour Price Change | -1.08% |

| Fear & Greed Index | 24/100 (Extreme Fear) |

| Source Wallet Remaining Balance | ~5,000 BTC ($437 million) |

For institutional participants, this transaction highlights the growing intersection of political entities and cryptocurrency treasury management. A sale of this magnitude could create temporary selling pressure in OTC markets, potentially spilling into spot exchanges if not properly absorbed. For retail traders, the movement reinforces the importance of monitoring whale wallets for early signals of market direction. The lack of transparency regarding purpose—whether strategic accumulation or distribution—creates uncertainty that may suppress volatility in the short term. Consequently, market makers may widen spreads to account for potential follow-on transactions, increasing trading costs for all participants. This event occurs alongside other significant developments, such as the analysis suggesting Bitcoin's muted year-end volatility may prevent an early 2026 crash.

Industry observers on X/Twitter express divided views. CryptoQuant analysts note, "The wallet's residual $437 million position suggests this isn't a full exit, but rather portfolio rebalancing." Market bulls interpret the transfer as potential preparation for institutional custody ahead of anticipated 2026 ETF inflows, while bears warn it could signal insider knowledge of impending regulatory actions. No direct statements from Trump Media representatives have emerged, leaving analysts to rely purely on blockchain data patterns.

Bullish Case: If the transfer represents movement to institutional custody (like a regulated custodian such as Coinbase Prime), it could signal long-term holding intentions. A break above $91,200 bearish invalidation would target the $93,500 FVG, with potential extension to $96,000 if ETF approval rumors resurface in Q1 2026. On-chain data indicates accumulation by addresses holding 100-1,000 BTC, supporting this scenario.

Bearish Case: If the transaction precedes an OTC sale, the market could see increased selling pressure as the recipient liquidates portions. A breakdown below $84,500 bullish invalidation would confirm weakness, targeting the $82,000 support level (200-day MA) and potentially $78,000 if panic selling ensues. The Extreme Fear sentiment score of 24/100 suggests retail capitulation is possible on further downside.

1. Why does this Bitcoin transfer matter for the market?Large transactions from politically linked entities can signal institutional sentiment shifts and create temporary liquidity imbalances that affect price discovery.

2. What is the most likely purpose of this $174M transfer?On-chain patterns suggest custody transfer or OTC desk preparation, though definitive purpose remains unconfirmed without official statement.

3. How does this affect Bitcoin's price short-term?Immediate impact may be limited if absorbed OTC, but uncertainty could suppress volatility until clarity emerges.

4. What are the key technical levels to watch?Bullish invalidation at $84,500, bearish invalidation at $91,200, with primary support at $85,000 and resistance at $90,000.

5. Where can I track similar large transactions?Platforms like Lookonchain, Arkham Intelligence, and Glassnode provide real-time whale wallet monitoring and on-chain analytics.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.