Loading News...

Loading News...

VADODARA, February 2, 2026 — Binance's Secure Asset Fund for Users (SAFU) received a test transfer of 64.811 USDT from a Binance hot wallet, according to on-chain analyst ai_9684xtpa. This daily crypto analysis examines the transaction's timing against extreme market fear and Binance's previously announced plan to convert $1 billion in stablecoin holdings to Bitcoin. Market structure suggests this move represents more than routine maintenance.

On-chain data from Etherscan confirms the test transfer occurred on February 2, 2026. The transaction involved moving 64.811 USDT from a known Binance hot wallet to the official SAFU address. According to the analyst's report, this follows Binance's September 2025 announcement about adjusting SAFU's asset structure. The exchange plans to gradually convert its existing $1 billion in stablecoin reserves to Bitcoin.

Market analysts question why Binance would conduct a test transfer during extreme market fear conditions. The Crypto Fear & Greed Index currently sits at 14/100, indicating maximum risk aversion. Typically, exchanges execute such operations during neutral or bullish sentiment periods. This timing creates a contradiction in the official narrative of routine fund management.

Historically, Binance has used SAFU as an insurance fund during market crises. The fund originated in 2018 following multiple exchange hacks. It currently holds approximately $1 billion in assets, according to Binance's transparency reports. The planned conversion to Bitcoin represents a significant shift in risk management strategy.

In contrast to previous cycles, this move occurs alongside broader institutional stress. For instance, MicroStrategy's recent $900 million Bitcoin unrealized loss demonstrates corporate treasury volatility. , regulatory developments like South Korea's crypto tax overhaul add compliance pressure. These factors create a complex backdrop for Binance's asset restructuring.

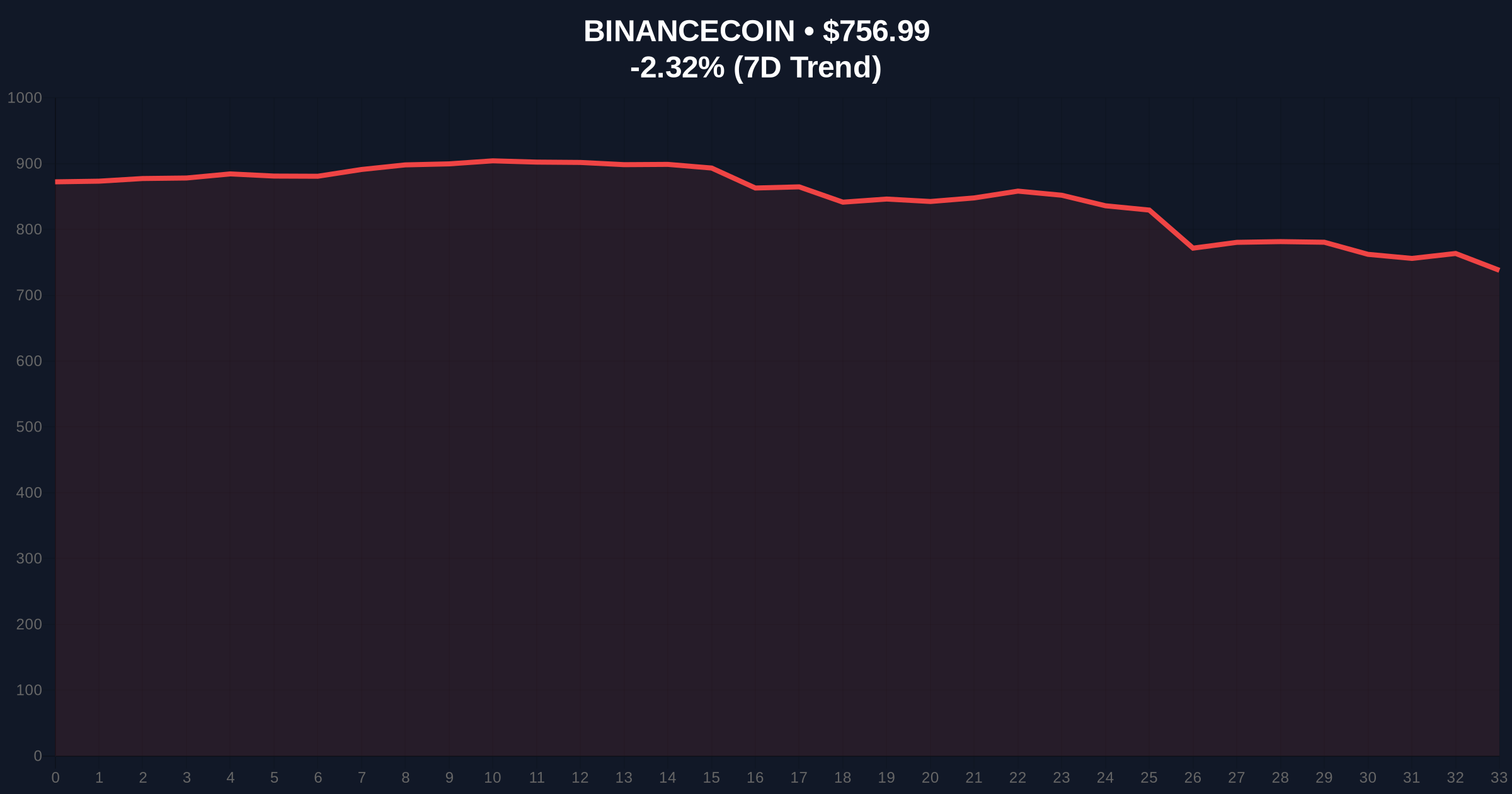

BNB's price action reveals critical technical levels. The asset currently trades at $757.01, down 2.32% in 24 hours. Volume profile analysis shows increased selling pressure around the $770 resistance zone. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias.

Market structure suggests BNB must defend the $740 Fibonacci 0.618 retracement level. This support aligns with the 50-day moving average. A break below would create a Fair Value Gap (FVG) targeting $720. On-chain data indicates reduced exchange inflows, suggesting accumulation at lower levels. The UTXO age distribution shows older coins remain dormant despite price volatility.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Maximum risk aversion environment |

| BNB Current Price | $757.01 | Testing key Fibonacci support |

| BNB 24h Change | -2.32% | Bearish momentum acceleration |

| SAFU Test Transfer Amount | 64.811 USDT | Small test before larger moves |

| SAFU Planned Conversion | $1 Billion to BTC | Major liquidity shift pending |

This test transfer matters because it signals impending liquidity movements during extreme fear. Binance controls approximately $1 billion in SAFU assets. Converting these to Bitcoin would represent a significant market order. Such large transactions typically create volatility and liquidity grabs.

Market structure suggests institutions monitor these moves for entry points. The extreme fear sentiment creates contrarian opportunities. However, the timing raises questions about Binance's internal risk assessment. Why test fund transfers when retail sentiment hits maximum panic? This contradiction warrants skeptical analysis.

"Test transfers during extreme fear periods typically precede larger operational moves. The small USDT amount suggests system verification before executing the billion-dollar conversion. Market participants should watch for corresponding Bitcoin accumulation patterns on-chain." — CoinMarketBuzz Intelligence Desk

Two technical scenarios emerge from current market structure. The first assumes successful defense of key support levels. The second anticipates breakdowns triggering further liquidation.

The 12-month institutional outlook depends on Bitcoin's performance post-SAFU conversion. If Binance executes its $1 billion conversion gradually, it could provide sustained buying pressure. However, a rapid conversion might create temporary selling pressure as market makers hedge exposure. The 5-year horizon suggests such institutional moves accelerate Bitcoin's maturation as a reserve asset, as detailed in Ethereum's official documentation on blockchain economic security.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.