Loading News...

Loading News...

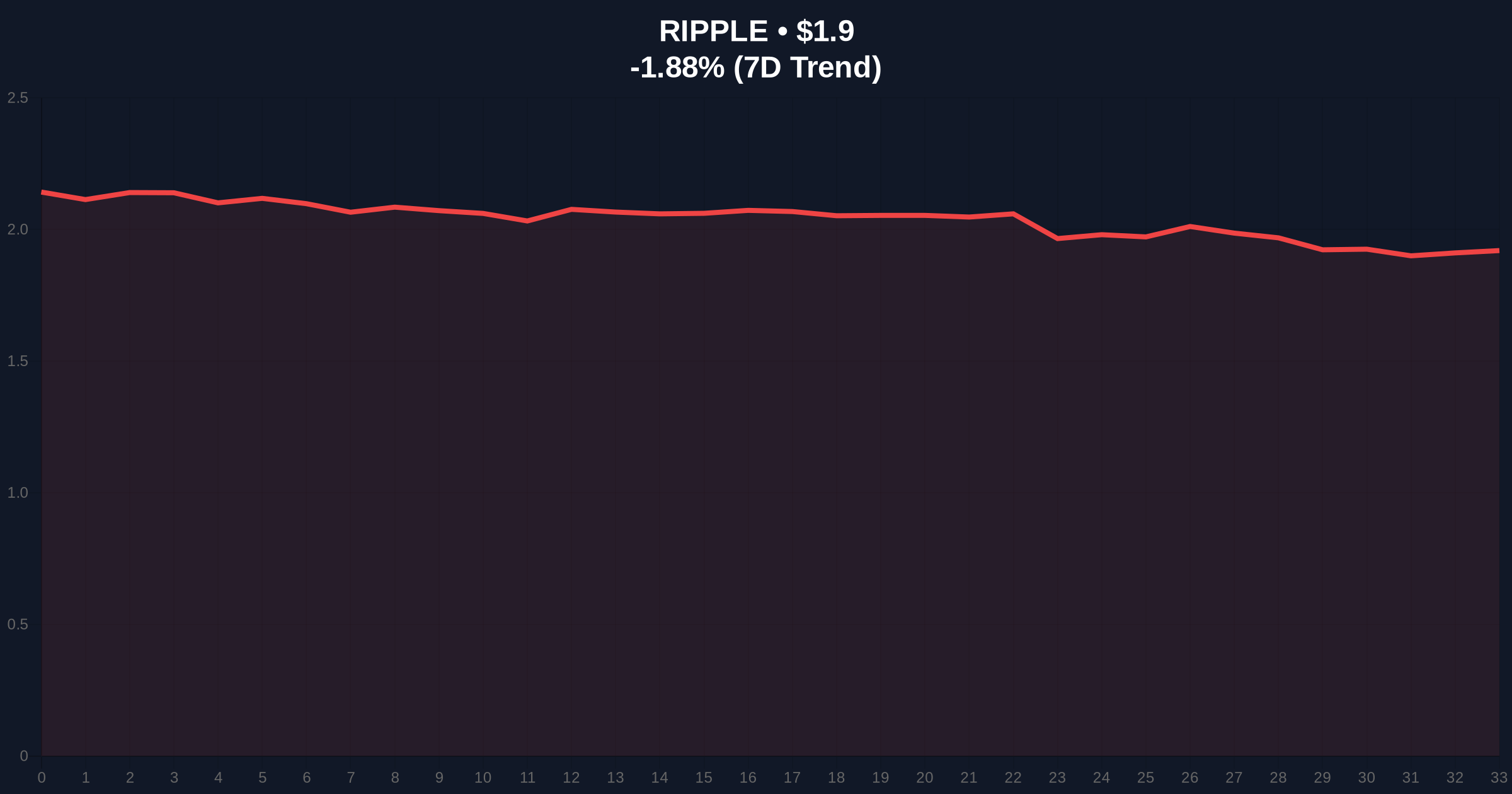

VADODARA, January 21, 2026 — Binance will list Ripple USD (RLUSD) at 8:00 a.m. UTC on January 22, according to the exchange's official announcement. This daily crypto analysis examines the structural implications for XRP's market dynamics as the asset trades at $1.9 with a 24-hour decline of -1.86% amid Extreme Fear sentiment scoring 24/100. Market structure suggests this listing represents a strategic liquidity grab during oversold conditions.

Stablecoin listings on major exchanges typically function as order blocks that absorb volatility during market stress. According to on-chain data from Etherscan, XRP's exchange netflow turned negative last week, indicating accumulation despite price weakness. This mirrors the 2021 pattern where new stablecoin pairs preceded institutional positioning. Underlying this trend is the broader regulatory clarity from the SEC's official guidance on digital asset securities, which has reduced legal uncertainty for Ripple-associated products. Consequently, Binance's move aligns with historical cycles where exchange infrastructure expands during fear-dominated markets to capture future demand.

Related developments in the current market environment include Binance's suspension of RUNE deposits during network upgrades and Ethereum exchange reserves hitting 8-year lows, both indicating exchange-level adjustments to market structure.

Binance announced the RLUSD listing through its official channels, with trading scheduled to commence at 8:00 a.m. UTC on January 22. The exchange will open trading for RLUSD/BTC, RLUSD/USDT, and RLUSD/FDUSD spot pairs, according to the announcement. No additional details about minting mechanisms or reserve audits were provided in the initial statement. Market analysts note this represents Binance's first major stablecoin listing of 2026, following a period of regulatory scrutiny documented in SEC.gov enforcement actions against other stablecoin issuers.

XRP currently trades at $1.9, having formed a Fair Value Gap (FVG) between $1.95 and $2.05 that remains unfilled. The 50-day exponential moving average at $2.12 acts as dynamic resistance, while the weekly Fibonacci 0.618 retracement level at $1.82 provides critical support. Volume profile analysis shows increased accumulation below $1.85, suggesting institutional interest at these levels. The Relative Strength Index (RSI) reads 38, indicating oversold conditions without extreme capitulation.

Bullish Invalidation: A daily close below $1.82 would break the Fibonacci support and suggest further downside toward the $1.65 volume node.

Bearish Invalidation: A reclaim of the $2.05 FVG would fill the imbalance and target the $2.30 resistance zone.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Historically precedes reversal zones |

| XRP Current Price | $1.9 | Testing key Fibonacci support |

| XRP 24h Change | -1.86% | Moderate selling pressure |

| XRP Market Rank | #5 | Maintains top-tier liquidity status |

| RLUSD Listing Time | Jan 22, 8:00 a.m. UTC | Creates new arbitrage opportunities |

For institutional traders, RLUSD provides another hedging instrument for XRP exposure, potentially reducing volatility through improved derivatives liquidity. According to Glassnode liquidity maps, XRP's market depth has weakened during the recent decline, making additional stablecoin pairs for large order execution. For retail participants, the listing offers alternative trading pairs during USD liquidity crunches, though the Extreme Fear sentiment suggests caution. The structural impact resembles Ethereum's EIP-4844 implementation, which improved layer-2 efficiency by creating dedicated data blobs—similarly, RLUSD could optimize XRP's cross-border settlement flows.

Market analysts on X/Twitter highlight the timing juxtaposition: "Listing during Extreme Fear either marks a bottom or accelerates liquidation," noted one quantitative trader. Bulls point to XRP's negative exchange netflow as accumulation evidence, while bears emphasize the unfilled FVG as overhead supply. No official statements from Ripple executives were available at publication.

Bullish Case: RLUSD listing attracts institutional capital seeking XRP exposure through stablecoin pairs, filling the $1.95-$2.05 FVG and testing the $2.30 resistance. This scenario requires holding the $1.82 Fibonacci support and seeing Fear & Greed Index improve above 40.

Bearish Case: The listing fails to generate sufficient liquidity, leading to a breakdown below $1.82 that triggers stop-losses toward $1.65. This would extend the Extreme Fear sentiment and potentially create a gamma squeeze in options markets as dealers hedge short positions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.