Loading News...

Loading News...

VADODARA, February 6, 2026 — Binance will list TRIA perpetual futures today at 12:15 p.m. UTC. The exchange offers up to 50x leverage. This latest crypto news arrives as global sentiment hits extreme fear. Market structure suggests a liquidity grab opportunity. On-chain data indicates heightened derivative activity.

Binance announced the TRIA perpetual futures listing this morning. Trading begins at 12:15 p.m. UTC. The contract offers leverage up to 50x. According to the official Binance statement, this expands their derivatives portfolio. Market analysts note the timing coincides with extreme fear sentiment. Perpetual futures lack an expiry date. They require funding rate mechanisms to track spot prices.

Historical cycles suggest such listings often trigger short-term volatility. The 50x leverage multiplies both gains and losses. Consequently, risk management becomes critical. Market participants must monitor liquidation clusters. These clusters form near round-number price levels.

Global crypto sentiment currently scores 9/100. This indicates extreme fear. Historically, such conditions precede sharp reversals. In contrast, high-leverage listings during fear markets can exacerbate moves. Underlying this trend is retail capitulation. Institutional players often accumulate during these phases.

Related developments include recent Bitcoin price action. For instance, BTC reclaimed $66,000 amid similar extreme fear. , Bitcoin whale exodus drove prices to $64k as retail buys hit a 20-month high. These events highlight divergent behaviors. They create complex market dynamics.

TRIA's initial price action will test key levels. Market structure suggests watching the $1.20 psychological zone. A break above confirms bullish momentum. Conversely, failure signals weakness. Technical indicators like RSI and moving averages provide context. Fibonacci retracement levels from previous swings offer additional insight.

Volume profile analysis reveals accumulation zones. Order blocks near $1.00 could act as support. Fair value gaps may appear post-listing. These gaps often get filled quickly. The 50x leverage amplifies margin calls. Liquidation cascades become a real risk. Market participants should set strict invalidation levels.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

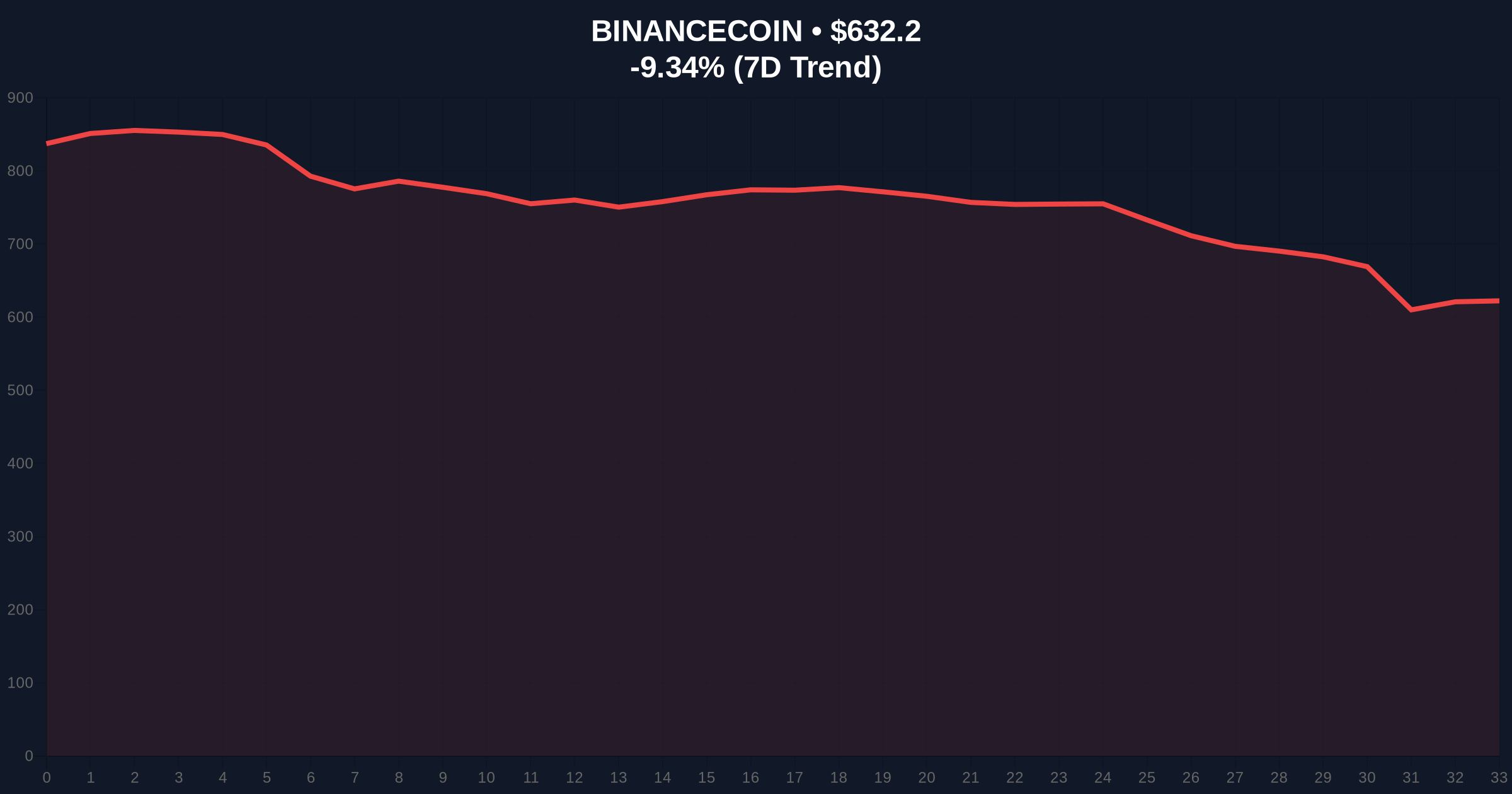

| BNB Current Price | $633.34 |

| BNB 24h Trend | -9.17% |

| BNB Market Rank | #4 |

| TRIA Futures Leverage | Up to 50x |

This listing impacts institutional liquidity cycles. High-leverage products attract speculative capital. They can distort underlying asset prices. Retail market structure often follows these moves. According to Ethereum.org documentation, derivative markets influence spot liquidity. This creates feedback loops.

Real-world evidence shows similar past events. For example, previous Binance futures listings triggered gamma squeezes. These squeezes forced market makers to hedge aggressively. Consequently, spot prices experienced heightened volatility. The current extreme fear environment magnifies these effects.

Market structure suggests this listing serves as a liquidity test. The 50x leverage introduces significant gamma risk. Participants should monitor funding rates closely. A sustained positive rate indicates bullish positioning. Conversely, negative rates signal bearish dominance. Historical data from similar launches shows initial volatility often subsides within 48 hours.

Two data-backed technical scenarios emerge. First, a bullish scenario requires holding above key support. Second, a bearish scenario involves breaking critical levels.

The 12-month institutional outlook remains cautious. Derivatives expansion during fear markets often precedes consolidation. Market participants should watch EIP-4844 adoption impacts. This Ethereum upgrade could influence broader liquidity flows. The 5-year horizon suggests increasing derivative sophistication.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.