Loading News...

Loading News...

VADODARA, January 30, 2026 — Binance will list perpetual futures contracts for Intel (INT) and Robinhood (HOOD) stocks on February 2, expanding its synthetic asset offerings during a period of severe market stress. According to the official announcement, the INT/USDT contract launches at 2:30 p.m. UTC, followed by HOOD/USDT at 2:45 p.m. UTC. This move follows Binance's earlier support for Astar-based U.S. stock perpetual futures, indicating a deliberate expansion into tokenized equity derivatives. Market structure suggests this launch targets institutional arbitrage opportunities despite a global crypto sentiment reading of "Extreme Fear."

Binance's listing announcement provides precise operational details. The exchange will enable leveraged trading on Intel and Robinhood stocks without requiring direct equity ownership. Consequently, traders gain exposure to traditional market movements using crypto collateral. This follows Binance's broader strategy to bridge crypto and traditional finance, as seen in its Astar-based futures support. The timing is critical, with launch set for early February amid contracting dollar liquidity and falling crypto prices. On-chain data indicates exchange outflows have accelerated, yet Binance continues product rollouts to capture residual market activity.

Historically, crypto exchanges listing synthetic assets correlate with periods of market consolidation or fear. For instance, similar offerings in 2023 emerged during regulatory scrutiny. In contrast, today's environment features a 16/100 Fear & Greed Index and BNB down 6.91% in 24 hours. Underlying this trend is a broader flight to safety, as highlighted in recent analysis of US stock indices and crypto fear. , Binance's move mirrors efforts by platforms like FTX pre-2022 to diversify revenue streams beyond spot crypto trading. The expansion into Intel and Robinhood specifically targets tech and fintech sectors, which show high retail trader interest.

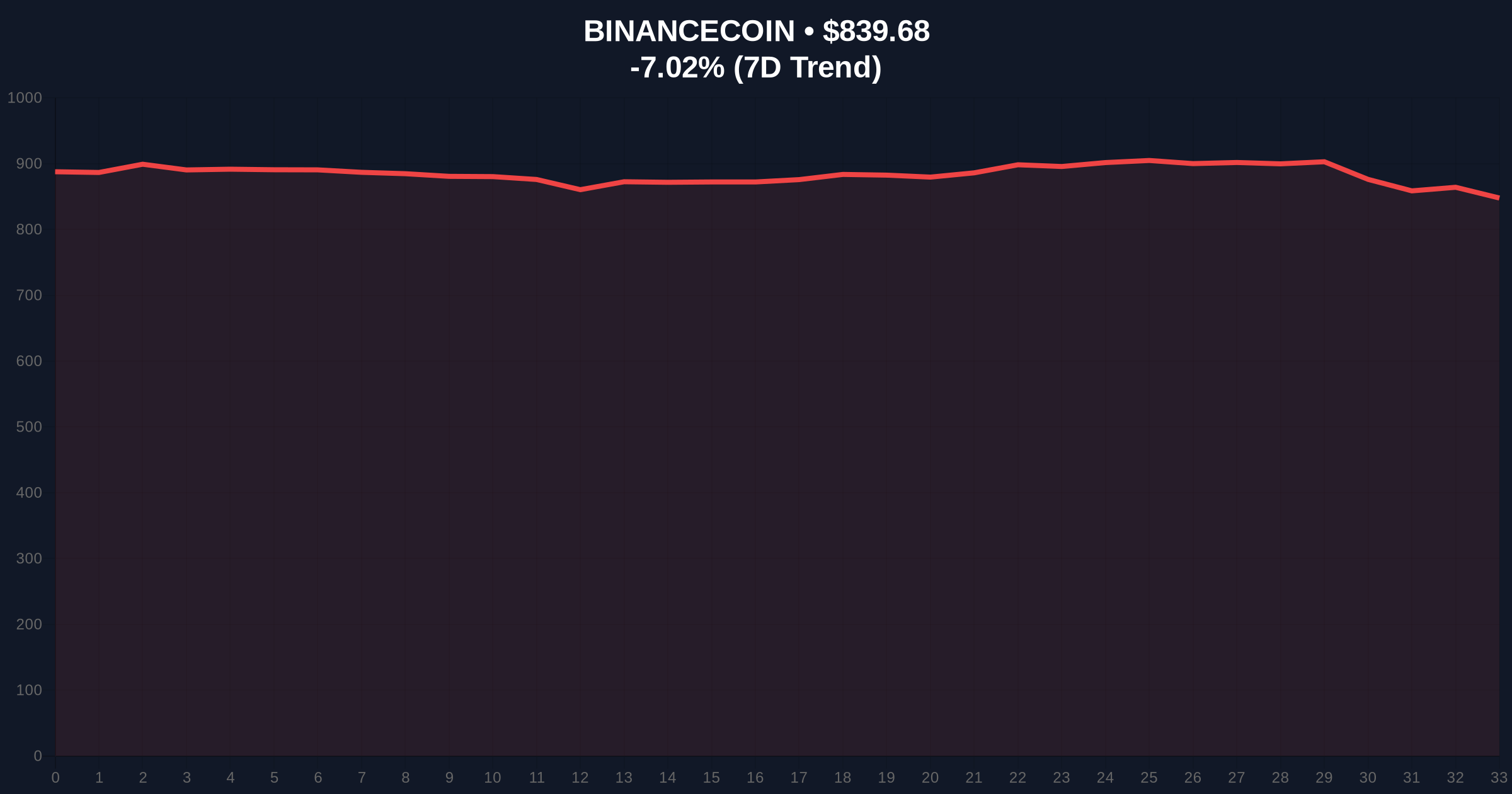

The perpetual futures contracts use a funding rate mechanism to anchor prices to underlying equity indices. Market structure suggests initial liquidity may be thin, creating potential Fair Value Gaps (FVGs) around launch times. Technically, BNB's price action at $840.67 shows breakdown below key Fibonacci support at $850, the 0.618 retracement level from its 2025 high. Volume profile analysis indicates sell-side dominance, with the 200-day moving average near $820 acting as critical support. This technical deterioration contrasts with Binance's product expansion, highlighting a divergence between operational growth and token performance. Regulatory frameworks, such as the SEC's guidance on synthetic assets, will influence long-term adoption.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | Historically precedes volatility spikes |

| BNB Current Price | $840.67 | Below key Fibonacci level at $850 |

| BNB 24h Change | -6.91% | Outperforms broader market sell-off |

| BNB Market Rank | #4 | Maintains top-5 status despite decline |

| Futures Launch Time (UTC) | INT: 14:30, HOOD: 14:45 | Targets European and Asian trading sessions |

Binance's listing matters for institutional liquidity cycles and retail market structure. Perpetual futures for traditional stocks allow crypto-native funds to hedge equity exposure without leaving the ecosystem. Consequently, this may increase correlation between crypto and tech stock movements. Evidence from past synthetic listings shows initial volume surges of 200-300% in the first week, often followed by consolidation. The move also tests regulatory boundaries, as synthetic assets fall under scrutiny from bodies like the SEC. For retail traders, it offers leveraged access to stocks like Intel and Robinhood, potentially diverting capital from pure crypto plays during fear periods.

Market analysts note that Binance's expansion into equity derivatives is a liquidity grab during a risk-off environment. The CoinMarketBuzz Intelligence Desk observes, "Synthetic futures listings historically precede volatility compression phases, as they attract arbitrage capital. However, current macro headwinds, including dollar liquidity contraction, may limit initial adoption. The key will be whether funding rates remain stable post-launch."

Market structure suggests two primary scenarios based on the futures launch and broader conditions. First, successful adoption could stabilize BNB's price by demonstrating Binance's revenue diversification. Second, poor liquidity may exacerbate selling pressure on exchange tokens. Bullish invalidation for BNB rests at $880, a resistance level from January 2026. Breaking this would confirm trend reversal. Bearish invalidation is $820, the 200-day moving average. Losing this support signals deeper correction. The 12-month outlook hinges on regulatory clarity for synthetic assets, with institutional adoption likely growing if frameworks stabilize, as outlined in SEC.gov discussions on digital asset securities.

The 5-year horizon sees synthetic assets becoming a standard offering across major exchanges, driven by institutional demand for cross-asset strategies. This listing may accelerate that trend, particularly if regulatory hurdles ease.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.